DAX stock Market Overview

2023.02.01 08:46

DAX stock Market Overview

As volatility decreases, the DAX 40 March is forming a sideways consolidation, which is typical of both bull and bear trends. Although the duration of this procedure is unknown, there is without a doubt no sell signal at this point.

Since we were stuck in a range of about 250 ticks the week before, there won’t be many good trading opportunities until we see some movement once more.

As we wait for a move, March maintained a 100-tick range last week, so the same levels apply today.

Keep in mind that when support is cut off, it usually becomes resistance and vice versa.

Analysis

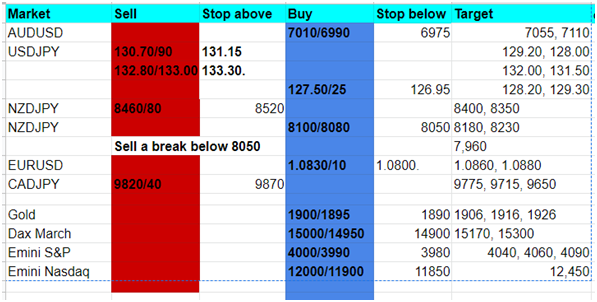

Dax March has a series of eight Dojis in a row, which is unusual but highlights the sideways trend with no clear path forward. The battle has lost the interest of the bears and bulls! So far this week, we are just above support at 15000/14950 (about 35 ticks above), with a bounce from here targeting minor resistance at 15170/200 before the January high of 15300/330. Stops above 15380 are needed by shorts. A buy signal initially targeting 15500 is a break higher.

At 15000/14950, the initial support returns. After strong support at 14770/720, a break lower aims for 14870/850.

Yesterday, our FTSE March longs at the initial support level of 7695/75 performed flawlessly once more, establishing a sideways trend and a straightforward 70-tick profit on the way to strong resistance at 7745/65. a high for the day once more here yesterday) – Stops above 7785 are required for short sellers. A buy signal for 7825 before a retest of 7850/60 is a break higher.

First, support at 7695/75 once more. Stops must be below 7865 for longs.

This time, March broke first support at 4045/35, but I missed a 7-point buying opportunity at 4000/3990 with March longs at 12000/11900 after a bounce from 11872.

March is clearly arranged in a two-month triangle on the sides. We’ll wait until the break.

My next target is 4075, and the Emini S&P March bounce from just above 4000 may have reached resistance at 4100/4110 this morning. The December high of 4140/45 could be retested with a move higher.

A chance to buy once more at 4000/3990. Longs require stops under 3980. For a lower break, target 3970/60 faces resistance at 3990/4010.

On the one-hour chart, the Nasdaq March bearish engulfing candle triggered a move down exactly as predicted to the first support at 12000/11950. Longs were successful as we remained above 11850. However, a break lower today could target 11730/700.

A rebound from initial support at 12000/11950 aims for 12300, 12460, and 12480 as of this writing.

After reaching my next target of 33800/750 yesterday, the Emini Dow Jones bounced back in the sideways trend to reach strong resistance at 34150/200 yesterday. Stops above 34300 are needed by shorts. The January high of 34450/490 can be retested with a break higher.

Support is sporadic at 33850/750, but below this point, targets can be 33500/450.