Cryptocurrency Helped Bypass U.S. Sanctions, Claims A Report By Chainalysis

2022.08.01 13:57

Mainstream crypto payments are traceable but seemingly not sanctionable.

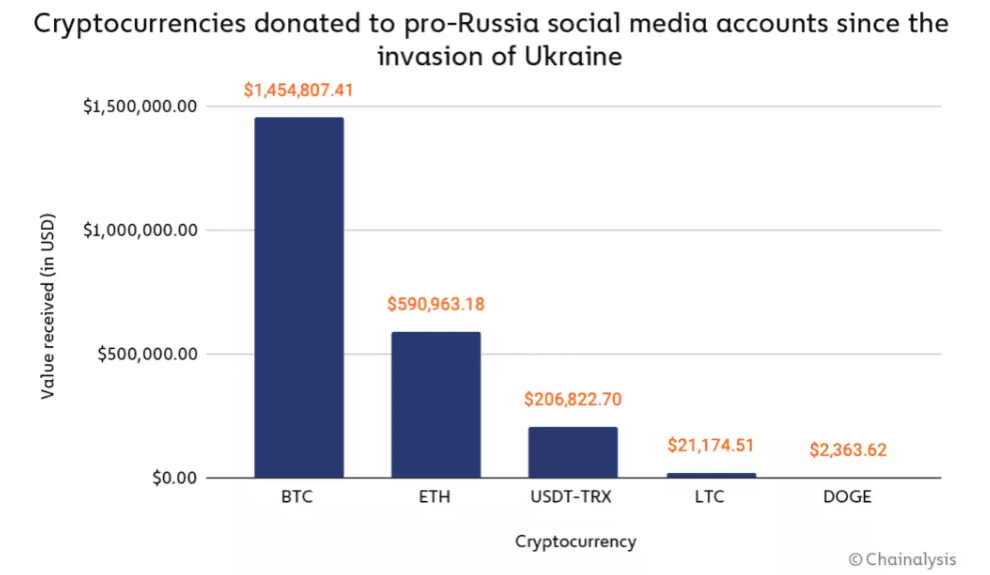

A recent Chainalysis report found that pro-Russian social media accounts received $2.2 million in cryptocurrency since the conflict started. As one would expect, cryptocurrencies with the largest market caps, Bitcoin and Ethereum, made up 93% of that number. Interestingly, stablecoin USDT on the Tron network, known for its low transfer fees, made it third place.

This was to be expected, as the Fed interest rate hikes brought down the value of cryptocurrencies into double-digit negative territory well into the conflict.

Cryptocurrencies Donated To Pro-Russia Social Media Accounts

Cryptocurrencies Donated To Pro-Russia Social Media Accounts

The Regional Focus of the Report

The Chainalysis report focuses on two Ukrainian regions, Donetsk and Luhansk, predominantly inhabited by a Russian-speaking population and pro-Russian voters. The map below largely correlates with Ukraine’s language division, with bluer regions being more pro-Russian.

Pre-crisis Divisions In Ukraine

Pre-crisis Divisions In Ukraine

The Ukrainian language itself is a mix of Russian and Polish. In turn, there is 50% mutual intelligibility between Russians and Ukrainians. This is the threshold at which speakers understand each other without having to take the effort to learn either language.

Where Did the Crypto Money Go?

By connecting social media accounts/blogs to wallet addresses, Chainalysis could track 10 accounts that received the biggest share of funds. The division was quite lopsided, as one account received over $1 million while five others received under $100k.

The pro-Russian accounts made it easy to see how the money was spent to aid in war efforts, either offensively or defensively. Some took to the meticulous itemization of all purchased items to instill confidence in donators that funds would not go to frivolous waste.

The exceptionally performing ruble further boosted their purchasing power. Year-to-date (YTD), the Russian ruble appreciated by +20%. Simultaneously, the euro dropped like a rock, resetting to EUR/USD parity since its launch 20 years ago. This was expected, given that Russia holds the natural resources card.

Can Crypto Transactions be Anonymized?

To prevent sanction evasion, the Office of Foreign Assets Control (OFAC) keeps a detailed list of all detected individual or corporate entities that should not receive funds. If that happens, OFAC would then be able to sanction the mediators themselves, such as international cryptocurrency exchanges, plunging them out of business.

However, that doesn’t work for companies that do not care for such listings. Case in point, Moscow-based exchange Bitzlato facilitated around $1 billion in crypto-fiat conversions since 2019. While crypto users can take advantage of inherently private cryptocurrencies like Monero (XMR), mixers are another prominent tool in use.

As the name implies, platforms like Tornado Cash try to anonymize public coins by running them (mixing) with other coins and then outputting the same value:

- User deposits $1,000 worth of crypto in a mixer pool.

- The pool consists of many cryptocurrencies processed from different sources.

- The outgoing (withdraw) transfer has the same value, but the coins differ from the deposited ones.

Chainalysis developed a wide range of tools and techniques to remove obfuscation to counter mixers, spearheaded by Chief Scientist Jacob Illum. Of course, like privacy-oriented Monero is legal, so are mixers.

After all, the right to privacy applies to communication as to money transfers. For instance, a messenger app like Meta’s WhatsApp is more open to scrutiny than encrypted P2P apps like Signal or the recently launched Keet.

In the end, even mixer platforms sometimes block malicious actors. In the case of Tornado Cash, it banned the Lazarus group, affiliated with North Korea and involved with Axie Infinity’s Ronin Bridge hack.

About Chainalysis

Founded by Michael Gronager and Jonathan Levin in 2014, the New York-based blockchain startup has come a long way in its intelligence work. The company’s original goal was to take advantage of the public blockchain’s transparency and break the media narrative on cryptos as underground money.

After receiving total funding of $536.6 million, Chainalysis became an education portal and expertise provider for governmental agencies.