Could Wednesday’s CPI report change the Fed’s rate outlook?

2024.05.13 10:56

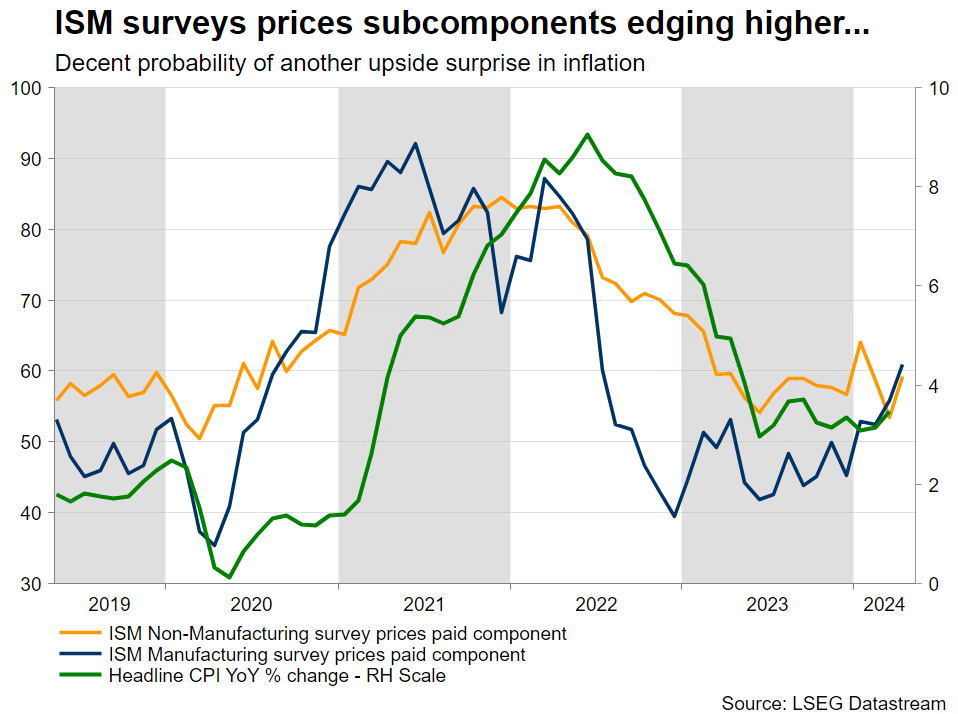

The aggressive deceleration in US inflation seen during 2022 has paused over the past few months with CPI proving stickier than widely expected. As a result, the market is now expecting just 42bps of monetary policy easing by the Fed during 2024 with the CPI dataset continuing to have a significant market impact.

What has happened since the last CPI report?

Last month, both the headline and core CPI components for March managed to surprise the market by printing above expectations. The US dollar enjoyed a boost across the board, but US stocks suffered as the probability of a June rate cut by the Fed dropped aggressively.

Since then, the data flow has been mostly on the weak side. Except for retail sales, the economy appears to be slowing down as made evident by the various business surveys, the preliminary GDP print of the first quarter of 2024 and the recent labour market report. However, various inflation indicators point to continued price pressures.

This is the main reason why the May 1 Fed meeting was relatively balanced. Fed members understand the need for patience as the economy progresses. Cutting rates at this juncture might further fuel the strong domestic demand, partly responsible for the current inflation stickiness, and potentially cause a heated reaction from the Republican Presidential candidate, Donald Trump.

The April CPI report will be released on Wednesday

The market is expecting a small deceleration across the board as the headline figure is seen rising by 3.4% year-on-year with the core indicator, which excludes food and energy prices, edging lower to 3.6% yoy. With both the food and energy price pressures remaining weak, the focus will be on shelter.

Considering this sector’s weight to the overall CPI figure, a further deceleration in shelter costs appears vital to opening the door to Fed rate cuts. House prices turned the corner about a year ago and are currently recording steady yearly growth. Assuming that there is a 12-18 months lag between house prices and shelter costs, there is an increasing possibility of the latter continuing its recent slowdown.

Will the Fed react to the CPI report?

There are two inflation reports until the June 12 Fed meeting. The market is currently assigning only a 5% probability for a June rate cut, with this percentage rising considerably for the September meeting. This market pricing matches the updated Fed expectations by certain key investment houses looking for just two rate cuts in 2024.

Considering the multiple Fed members’ appearances arranged for this week, one should expect a plethora of commentary on the inflation report. Rather conveniently, one of the arch hawks of the FOMC, Minneapolis President Kashkari, will be on the wires on Wednesday. He will most likely remain hawkish if CPI does not significantly surprise on the downside.

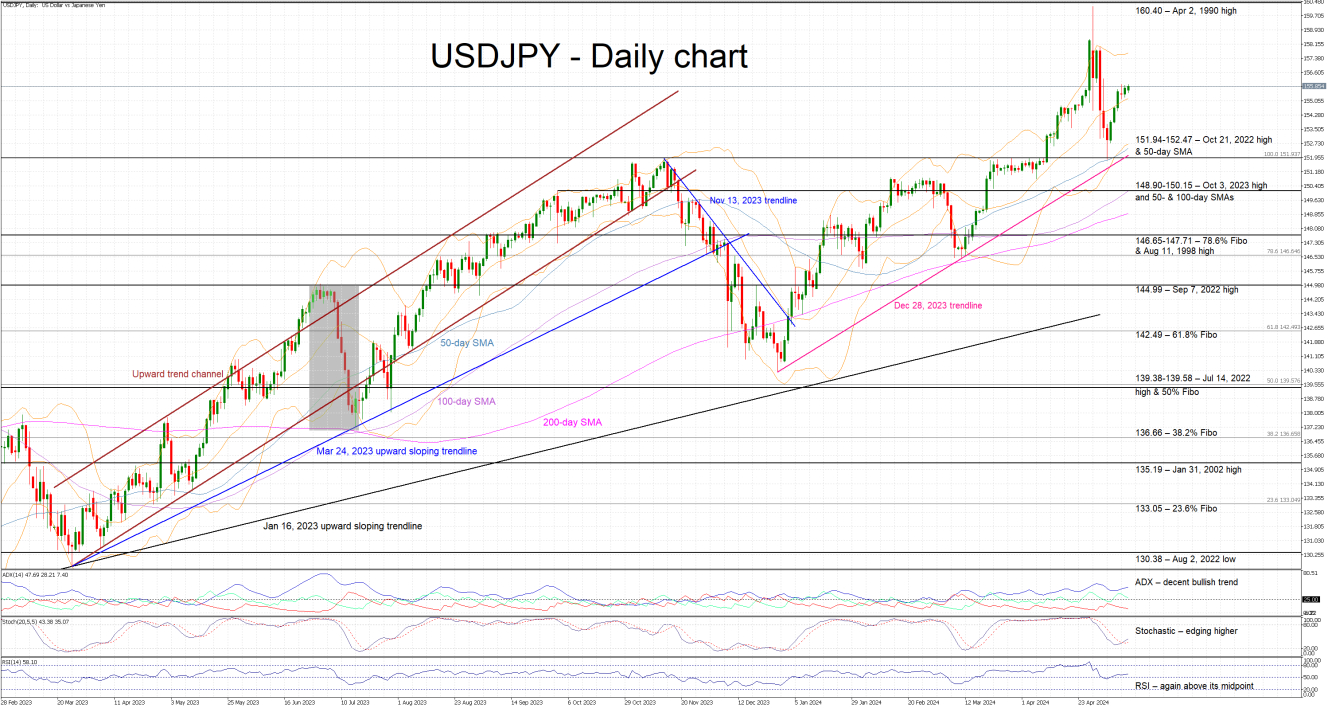

Strong market reaction upon another CPI shock

Should both the headline and core subcomponent surprise again to the upside, US equities stand to suffer, especially if retail sales released also on Wednesday point to an undying spending thirst from US consumers. The dollar could cancel out part of last week’s underperformance against the euro and fuel another rally in dollar/yen. More specifically, a move towards the recent 160.40 high could be on the cards, possibly forcing the BoJ to intervene again in the market.

On the flip side, a weaker inflation report could result in a significant upleg in US equities, especially if the headline CPI figure falls below the 3% threshold. The dollar might be under pressure with the euro/dollar pair finally managing to rally above the converging simple moving averages at the 1.0784-1.0821 range. Similarly, dollar/yen could reverse last week’s bullish move with the October 21, 2022 high of 151.94 looking like a plausible target.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Source link