Could US Stocks Continue to Outperform This Year?

2025.01.02 03:06

This is the time of year when we all wish one another a healthy, happy, and prosperous new year. The past two years were certainly prosperous ones for equities investors, as the rose 23.3% following a 24.2% gain in 2023.

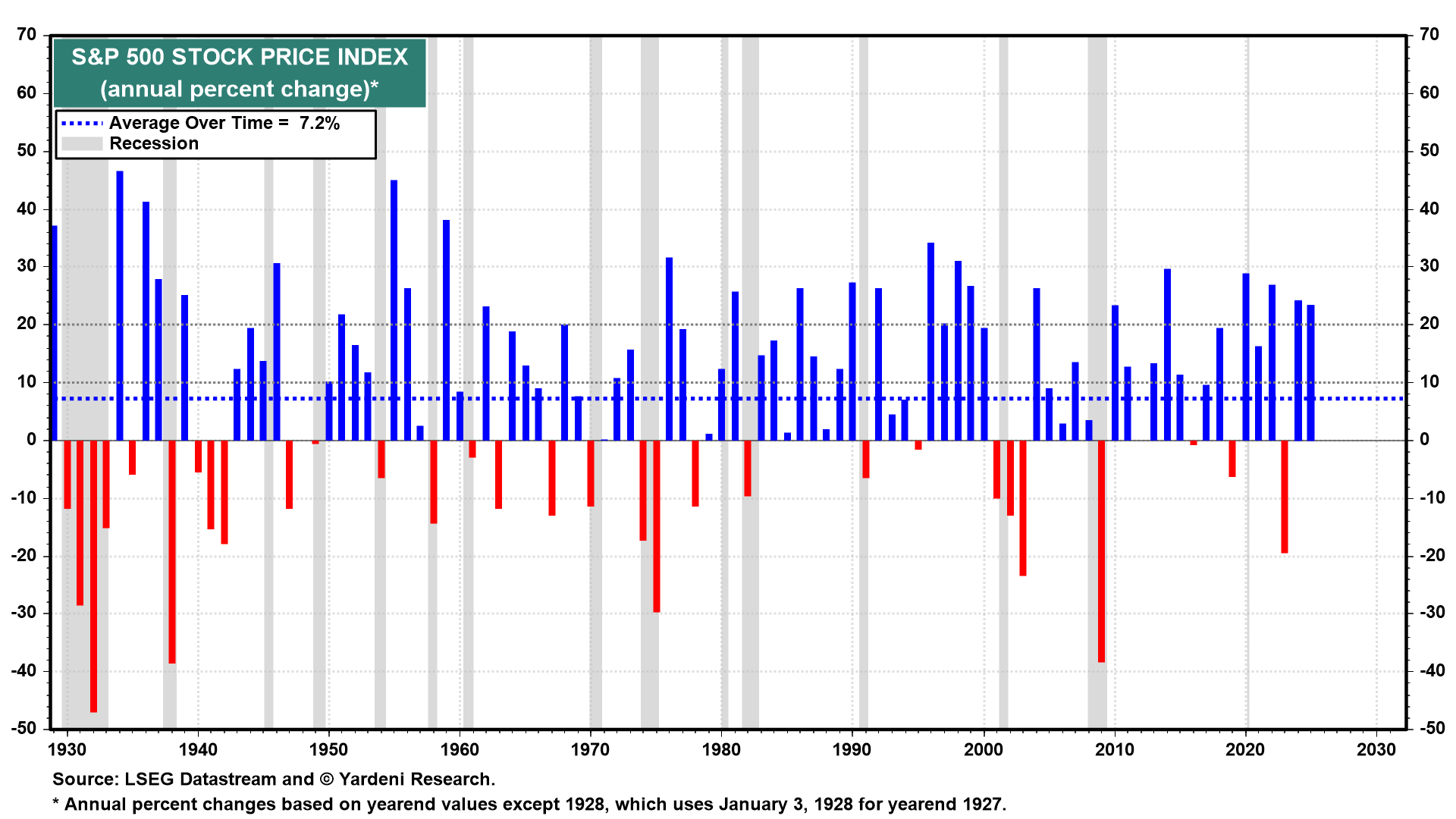

Those gains more than offset the 19.4% loss during 2022. On average, the S&P 500 is up 9.4% per year over the past three years, consistent with its long-run average growth rate of 7.2% (chart). Of course, in the case of dividends, returns are even higher than performance suggests.

Three consecutive years of double-digit gains don’t happen too often. Nevertheless, that’s what we are expecting: We see the S&P 500 increasing 19.0% this year to 7000. However, we think it could be a bumpier ascent than in recent years, especially during the next couple of months. Fed officials are likely to be less dovish in the coming weeks. In addition, uncertainty about fiscal, trade, and immigration policies might continue to put upward pressure on bond yields.

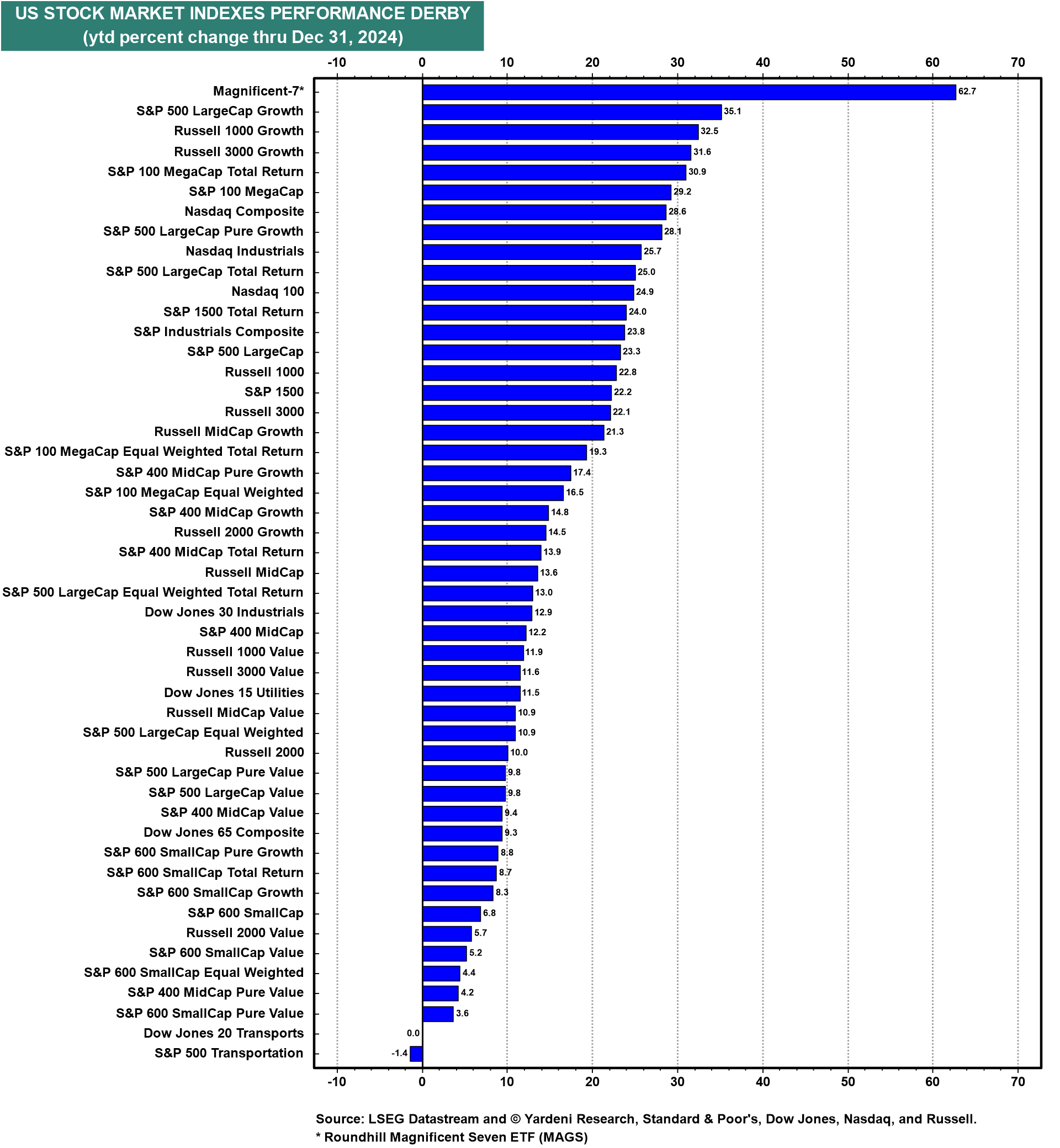

Let’s have a closer look at the performance derbies:

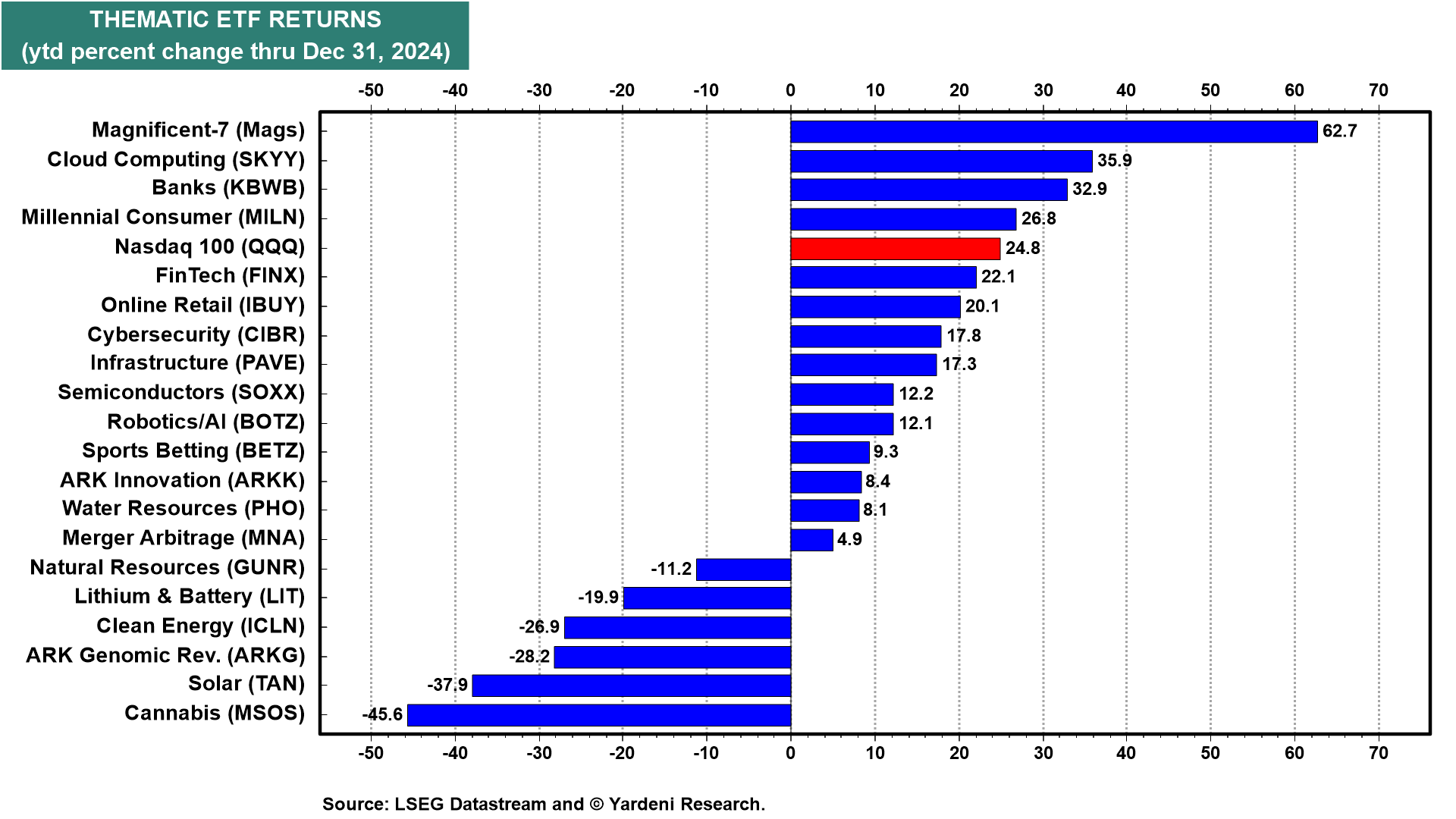

Last year’s advance was heavily skewed by the Magnificent-7 stocks, which collectively soared 62.7% and currently account for a whopping 32% of the market cap of the S&P 500 (chart). They will probably continue to outperform at the start of the year. We also think that the will outperform in 2025. While we believe a significant stock market pullback is likely at the start of the new year, we expect the bull market to broaden again starting in the spring, once monetary and fiscal policies become clearer.

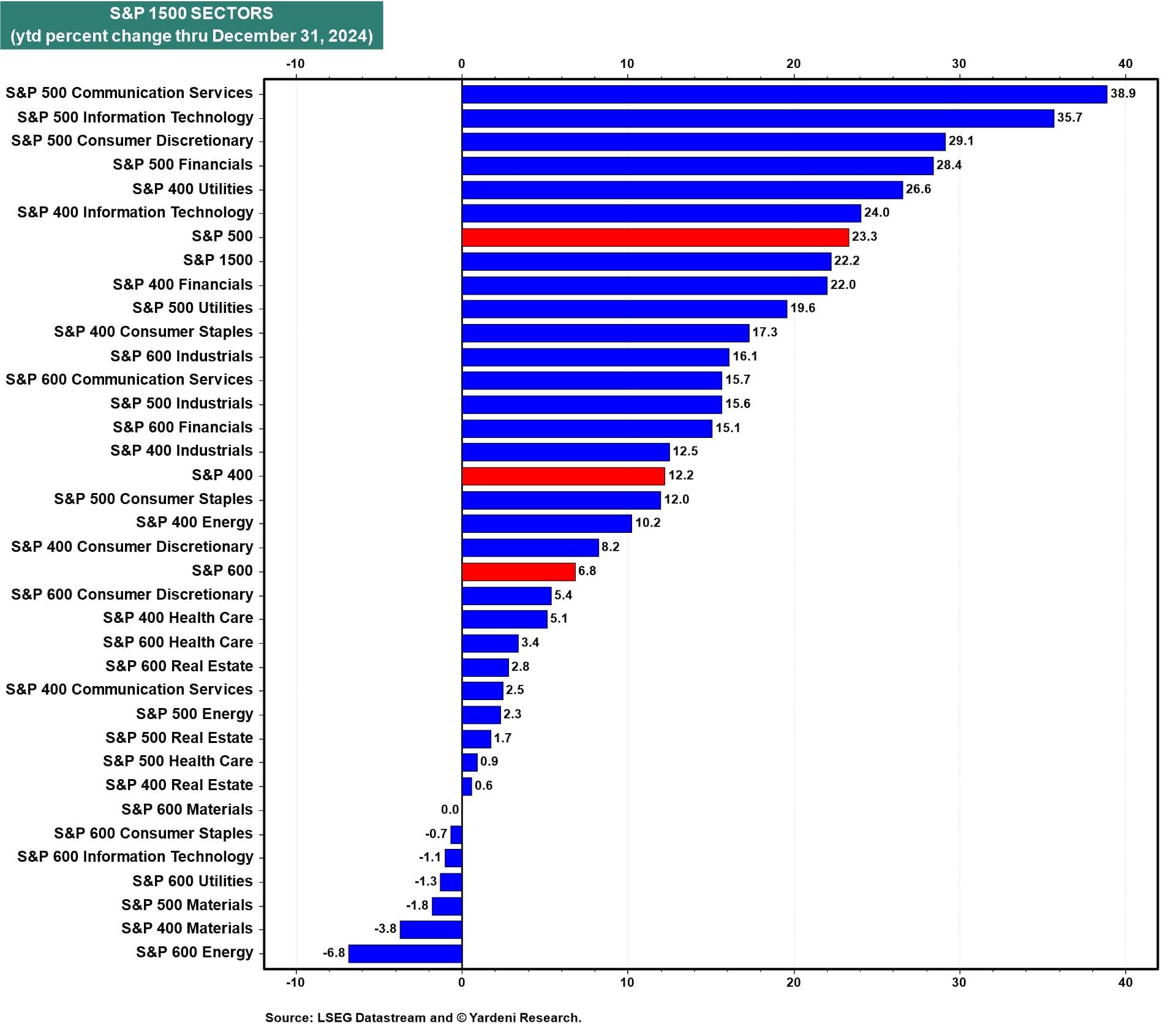

In 2024, the S&P 1500’s outperforming stock sectors were dominated by large-cap growth stocks, particularly the Mag-7 (chart). However, the S&P 500 and S&P 400 managed to beat the S&P 500. We aren’t keen on small caps, which have been disappointing underperformers for several years now. The problem is that the best of the bunch get acquired before they can grow into the next Microsoft (NASDAQ:). Furthermore, the forward earnings of the S&P 400 and S&P 600 have been flat-lining since 2022.

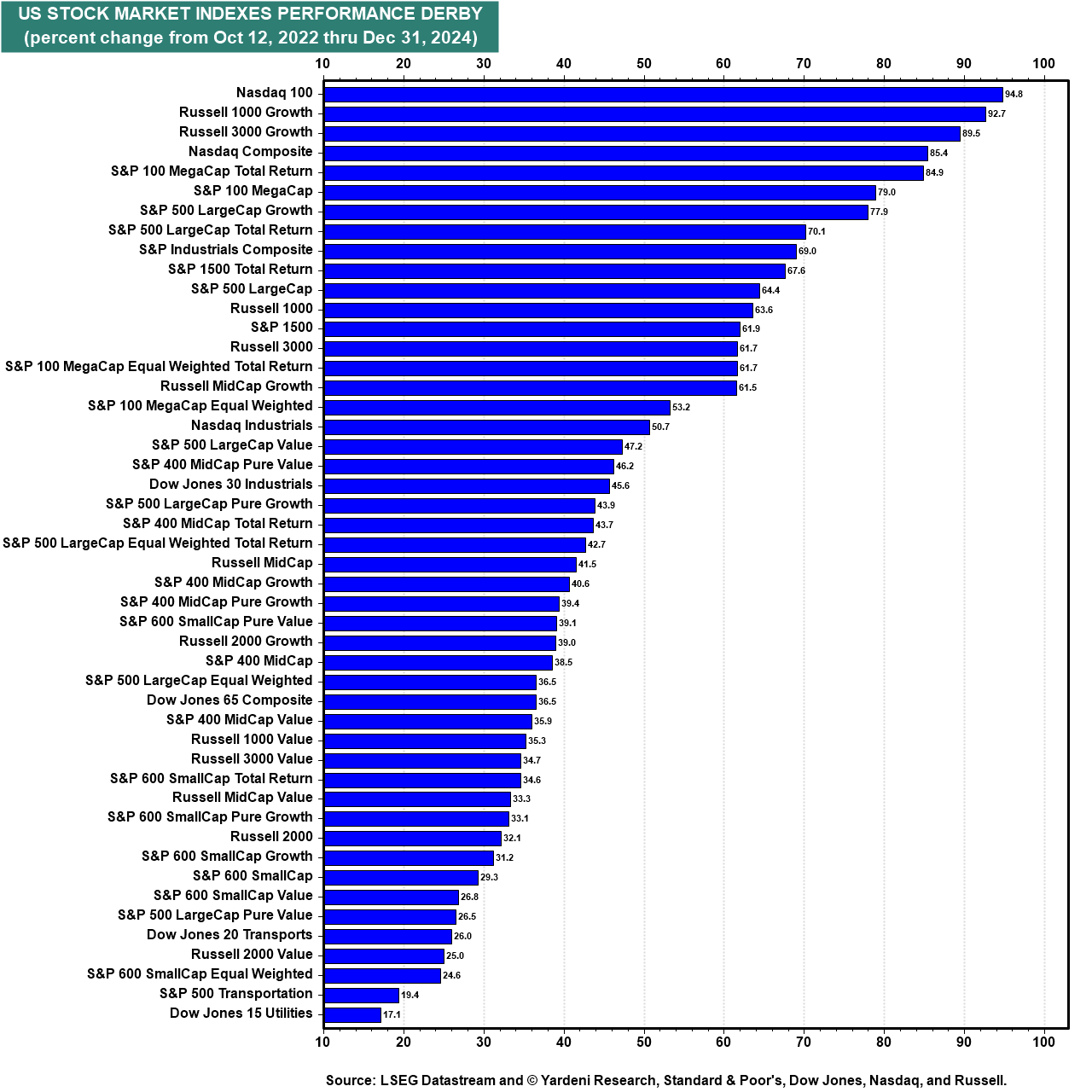

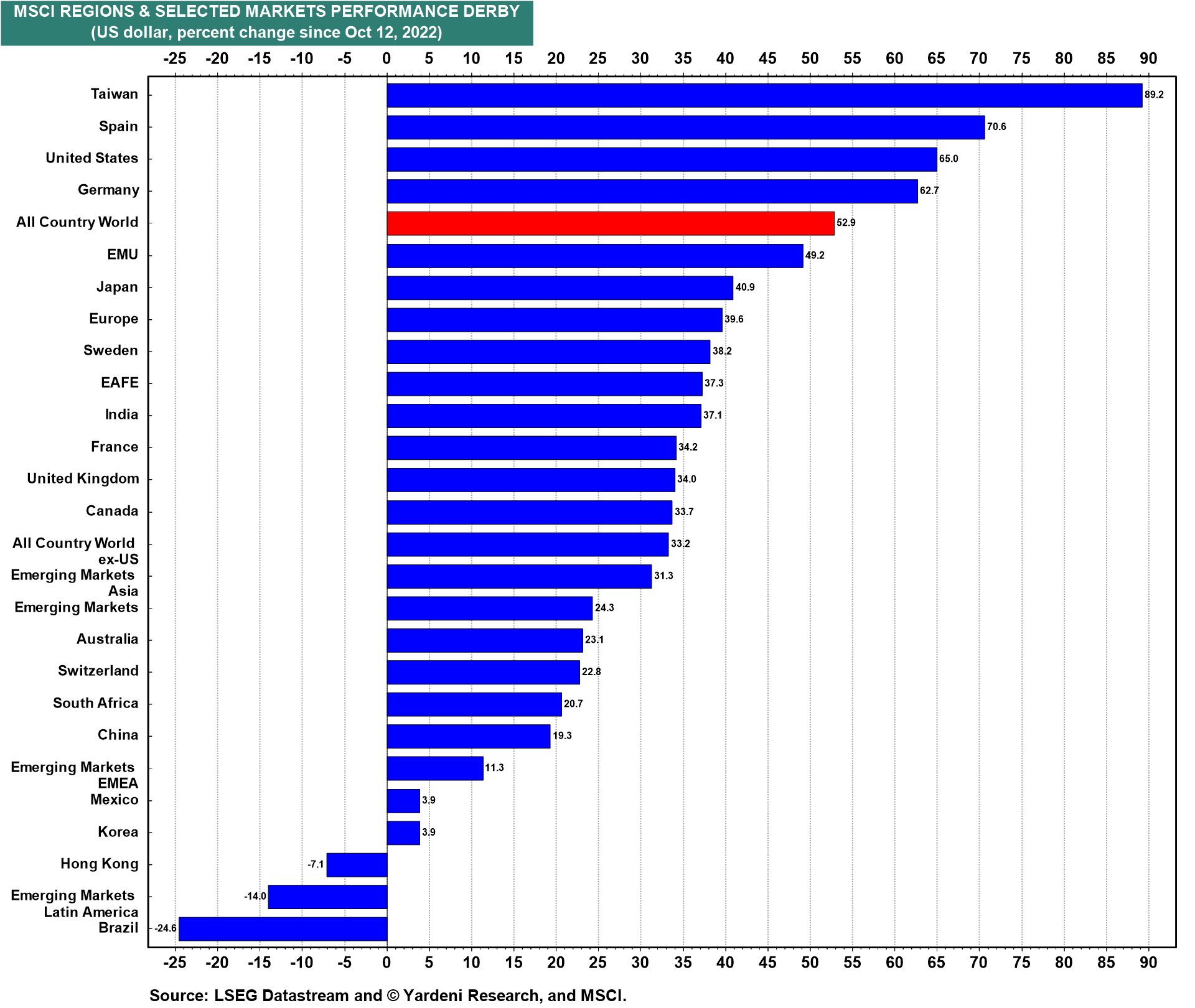

The bull market since October 12, 2022 has been a broad one, with plenty of stock market indexes up by more than 25% (chart). It only seems narrow because of the significant outperformance of a handful of large-cap stocks.

The US MSCI stock price index has been among the few to beat the (in ) since the start of the bull market on October 12, 2022 (chart). We expect it will continue to outperform in 2025. We also expect that the {{505|Emerging Markets MSCI}) will continue to underperform.

Among thematic ETFs, the year’s outperformers were the Mag-7 and other ETFs that focus on technology. The big losers were ETFs that bet on clean energy and pot. We expect the same in 2025.

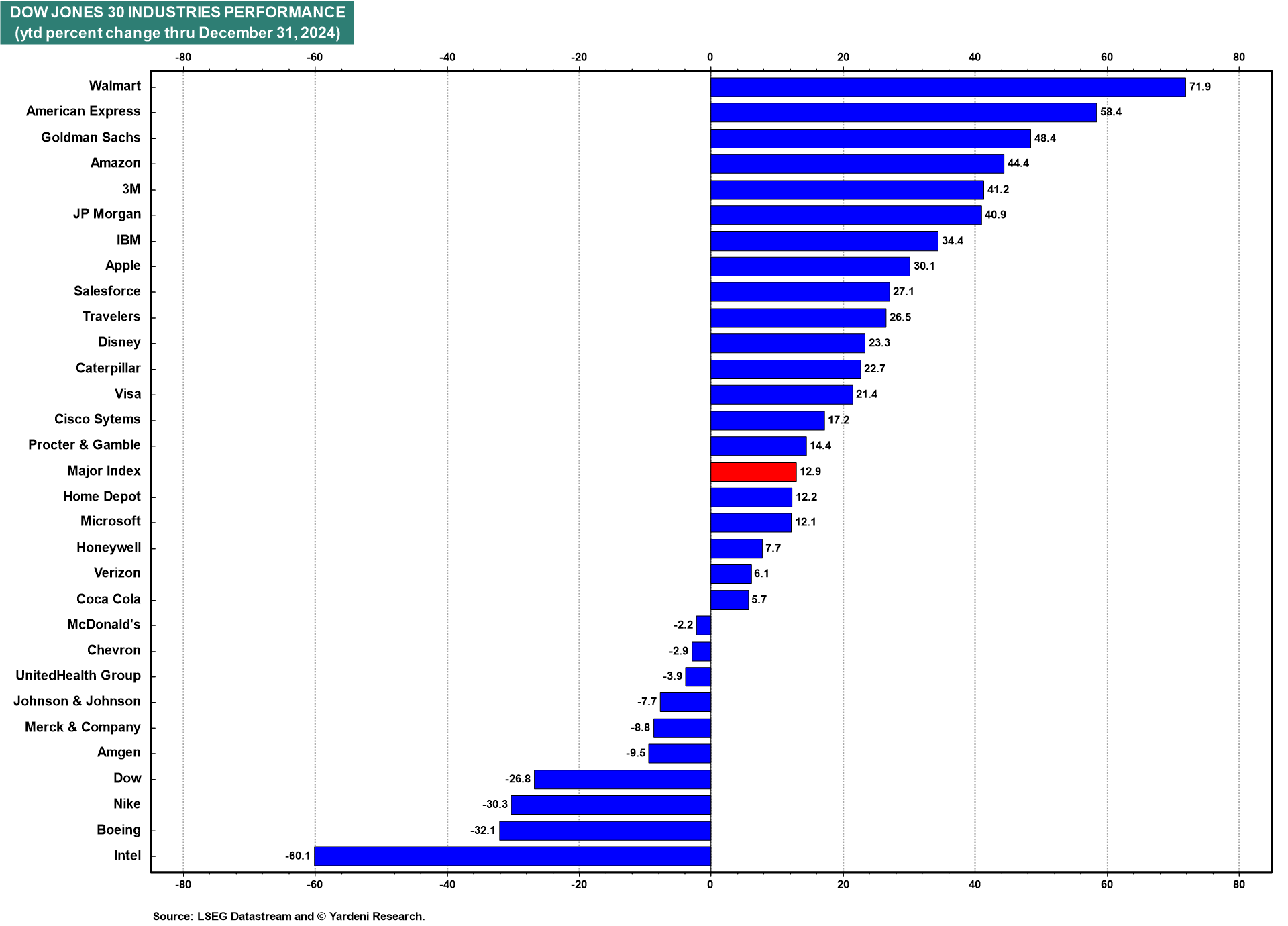

Finally, we wouldn’t be surprised if the Dogs of the in 2024 remain so in 2025, weighing on the relative performance of the index (chart).

Original Post