Could Large-Cap Growth Stocks Continue to Dominate Gains Throughout 2024?

2024.08.28 11:25

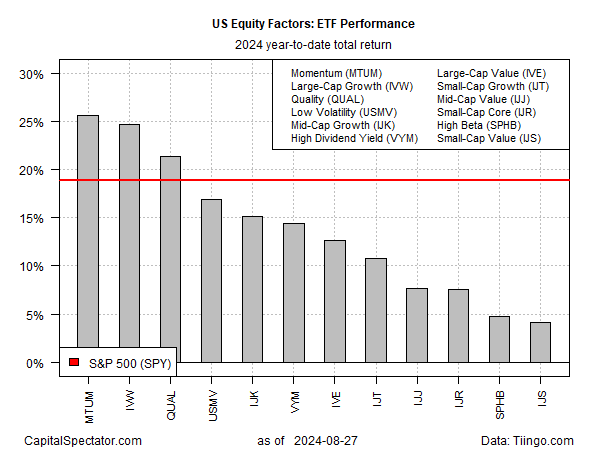

Betting against the hottest equity risk factors this year has been a painful strategy, if only in relative terms. But no matter how you slice the numbers, momentum and large-cap growth continue to outperform in 2024, based on a set of ETFs through yesterday’s close.

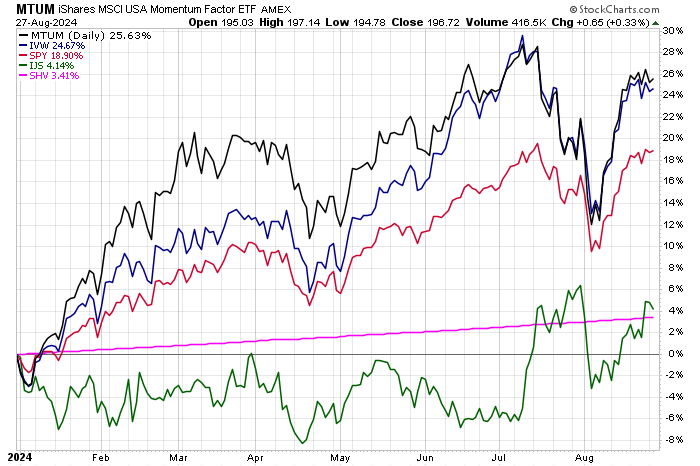

The iShares MSCI USA Momentum Factor ETF (NYSE:) is posting the strongest gain for the opportunity set year to date via a sizzling 25.6% surge. Large-cap growth () is a strong second-place winner with a 24.7% rise.

Not only are those gains well ahead of the rest of the factor field, but the returns also reflect solid premiums over the broad market’s 18.9% advance, based on SPDR S&P 500 (NYSE:).

Notably, risk factors across the board are posting gains this year. That’s a sign that the market rally in 2024 has been wide and deep.

But it’s also true that the deepest laggards are suffering by way of relative comparison. The weakest factor this year: small-cap value (), which is up just 4.1%, barely outperforming an ETF for proxy for cash ().

By some accounts, the leadership in momentum and large-cap growth has room to run, in part because strength begets strength for a period of time.

There are limits, of course, but until there’s a catalyst that jolts the crowd into a state of deep attitude adjustment, the default assumption is that recent history remains the best near-term guide to the future.

“Many investors who were previously cautious have found themselves underinvested in this rising market. This has led to a scramble to buy stocks and avoid missing out on further gains,” says Nigel Green, CEO of the deVere Group.

“This FOMO – fear of missing out – has been a powerful driver of stock prices in recent weeks. At the same time, sellers seem to be running out of steam. Fewer investors are willing to bet against the market in the face of such strong momentum.”

Some analysts thought the late July market correction was the beginning of the end for the usual suspects that have been dominating performances this year. So far, however, that forecast has given way to a rebound led by – you guessed it – momentum and large-cap growth.

Small Caps – Smart Contrarian Bet?

But the contrarians don’t give up easily. Brian Armour, an analyst at Morningstar, has been beating the contrarian drum this month.

In early August he wrote:

“Now’s the Time to Diversify Beyond the ‘Magnificent Seven’ Stocks,” followed by his latest piece that advises: “In a concentrated market, opportunities still exist for investors to cash in while reducing risk.”

Global market allocations have shifted heavily to the US, especially its largest companies. While we know it’s not normal, it could be valid. But the world’s biggest companies tend to fall or fade away over time.

The reasons are often unknowable ahead of time: We can’t write the obituary for another top company until after we see it happen.

Value and small-cap shares, he reasons, are the poster children for out-of-favor factors. “Why would value and small-cap companies make a comeback? Because investors have given up hope through a decade of underperformance.”

Some readers may roll their eyes and complain that contrarians have been touting the downtrodden for several years, with little to show for their efforts to date.

But for some investors, the gap between the leaders and laggards is too wide to ignore. Eager to latch on to hints of green shoots, small-cap optimists note that the sector has rallied sharply in recent days while the broad market has meandered. A thin reed, but beggars can’t be choosers.

The crowd, meantime, has become conditioned to dismiss any strength that threatens the momentum and large-cap dominion.

Barron’s on Monday wrote: “Small-Caps Have Popped—but Don’t Expect It to Last.”

For true believers in contrarianism, this is an encouraging sign. When strength in the laggards is dismissed as noise, it’s interpreted as an indication that maximum pessimism for a contrarian strategy is ripe for the taking.

The future, of course, remains as unclear as ever. But this much is probably true: gloominess pervades the crowd’s outlook for small-cap value and other lagging corners of the market.

That alone doesn’t ensure outperformance is finally at hand, but it does suggest that taking a fresh look at the downtrodden is timely… again.