Comcast Is An Asset Bonanza Priced Cheap

2022.09.28 01:45

[ad_1]

- Comcast is an asset bonanza with 51% broadband footprint in the U.S.

- Loses cable customers, but gains broadband, streaming and advertising

- Shares are trading at historic lows, 9X forward earnings, 3.33% dividend yield

Global media and communications company Comcast (NASDAQ:) stock is down (-37%) on the year and testing its pandemic lows. Despite the cord cutting trend that is killing its legacy cable video tv business losing (-521,000) customers in Q2 2022, the Company is still showing . It added 317,000 wireless lines in the quarter. It’s cable business achieved the higher adjusted EBITDA margin on record. It’s a leading broadband provider with a portfolio of top notch content brands including NBC, Universal, Peacock, Telemundo, and Sky Studios. The Company boasts 57 million customers between the U.S. and Europe and continues to show moderate growth. NBCUniversal is seeing strength in its theme parks and strong results from its studios business thanks to the success of Minions: The Rise of Gru, Jurassic World: Dominion, Nope and live events like Sunday Night Football and The World Cup. It faces tough competition on all fronts including AT&T (NYSE:) on fixed broadband, Verizon (NYSE: NYSE:) on wireless, Disney (NYSE:) on theme parks and Warner Brothers Discovery (NASDAQ:) on Paramount (NASDAQ:) on studios and streaming. Comcast is an asset bonanza that is still growing. It’s been losing cable TV customers that are switching to broadband and streaming content, which it still provides. In essence, they are seeing their customer downsize but finding other avenues to raise profits in addition to price hikes. Shares are trading near pandemic lows at 9X forward earnings with a 3.3% annual dividend yield suitable for long-term investors.

Comcast Broadband Moat

Comcast’s internet broadband footprint reaches 51% of the households in the U.S. through Xfinity, Comcast Business, and Sky Brands in the Europe. That is a very wide moat enabling it to mitigate the cord cutting trend as its streaming services have nearly 57 million customers. It’s media brands include NBC, Universal, Sky Studios, Peacock, and Telemundo. It has also moved into the wireless business as it added 317,000 customers for the best second quarter result on record. Wireless penetration of residential broadband customers grew to 7.9%. For the first six months of 2022, Comcast grew residential customers by 147,000 and business customers by 19,000. Total broadband customers grew 262,000, while it lost (-1 million) total video customers and (-262,000) total voice customers. Rumors even arose that it was intent on buying Roku (NASDAQ:) to gain access to its 60 million plus customer base. However, nothing came to fruition on the rumor.

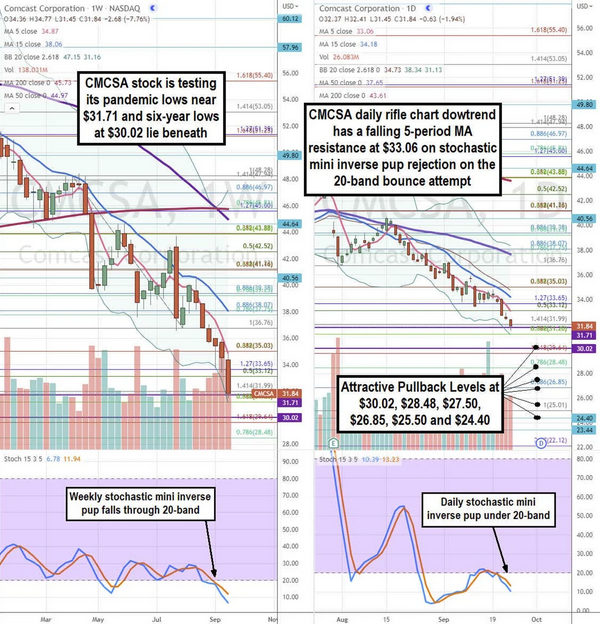

Comcast Corp. Chart

Comcast Here’s What the Charts Have to Say

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for CMCSA stock. The weekly rifle chart has had four straight inverse pup breakdowns back to back upon triggering the initial inverse pup breakdown on the breakout rejection off the $51.39 Fibonacci (fib) level. Shares would stage a multi-week rally only to lose it all in a single candle as shares cascade lower. The weekly lower Bollinger Bands (BBs) sit at $31.16 as the falling 5-period moving average (MA) resistance continues to fall at $34.67. The weekly market structure low (MSL) has yet to form as shares continue making lower low weekly candles going into a seventh consecutive week. The daily rifle chart has been downtrending with a falling daily 5-period MA resistance at $33.06 followed by the daily 15-period MA resistance at $34.18. The daily lower BBs sit near the $31.20 fib. The weekly stochastic rejected the 20-band stochastic mini pup bounce attempt to reverse it into a mini inverse pup down. Attractive pullback levels on this ugly stock sit at the $30.02 six year low, $28.48 fib, $27.50, $26.85 fib, and $24.40.

Comcast Still Churning Out Profits

On July 28, 2022, Comcast released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profit of $1.01 excluding non-recurring items versus consensus analyst estimates for $0.92, beating estimates by $0.09. Revenues rose 5.1% year-over-year (YoY) to $30.02 billion beating analyst estimates for $29.72 billion. Cable communications total customer relationships grew 1.7% to 34.4 million and broadband customers grew 2.5% to 32.2 million. Comcast CEO Brian Roberts commented, “Our financial results in the second quarter were very strong across the board, with Cable, NBCUniversal, and Sky each delivering solid growth in adjusted EBITDA, resulting in a double-digit increase in adjusted earnings per share and healthy free cash flow generation. Significantly we accomplished this while also continuing to invest in our businesses’ future growth, increasing our return of capital to our shareholders, and keeping our balance sheet in a great place. In Cable, we achieved our highest adjusted EBITDA margin on record even amid a unique and evolving macroeconomic environment that is temporarily putting pressure on the volume of our new customer connects.”

Death of Cable TV and Growth of Streaming

While Comcast is losing loads of cable TV (video) customers, they aren’t necessarily completely losing them. They are simply migrating. Most ex-cable TV customers are cutting the cord and keeping or boosting their internet broadband services. What Comcast they lose on the cable video TV side, they are also gaining on the broadband and streaming side along with the targeted advertising revenues. It’s a matter of evolution and Comcast seems to be adjusting favorably so far. Comcast is a part owner of Hulu as rumors swirl that Disney would like to buyout Comcast’s stake to combine its Disney+ and Hulu platforms into a single streaming package to take on the likes of streaming leader Netflix (NASDAQ:).

Original Post

[ad_2]

Source link