Coca-Cola Earnings Preview: Will Q3 Report Help Sustain Stock’s Bullish Momentum?

2023.10.23 08:25

- Coca-Cola stock has declined since late July, but it has shown signs of recovery in recent weeks

- Analysts expect Coca-Cola to report earnings per share of $0.69 and revenue of $11.4 billion for the third quarter of 2023

- Given the company’s strong fundamentals and market presence, could the decline be an opportunity to buy?

Coca-Cola (NYSE:), the world’s most recognizable beverage brand, is poised to release its 3rd-quarter 2023 earnings on October 24th, just before the market open. As the financial results draw near, investors are eager to see if the numbers will turn out to be the catalyst needed for KO stock to recover from its +15% decline since the last week of July.

Recent signs of hope emerged as the stock experienced a 3% uptick in value last week. Investors appear to have found value at levels comparable to those seen at the same time last year, hovering around the $52 range just before the earnings announcement. This indicates that with the release of the last quarter’s results, shares may experience increased volatility.

Now, let’s delve into what investors can anticipate in this upcoming report and whether the stock presents an enticing buying opportunity at current levels.

Coca-Cola Revenues Face Headwinds

The stock’s previous steep and swift decline began shortly after the disclosure of Q2 . During that quarter, Coca-Cola earnings per share (EPS) of $0.78, surpassing InvestingPro’s expectations by an impressive 8%. Additionally, the company’s revenue for that period stood at $11.96 billion, exceeding expectations by 1.8%.

Despite the continued growth in revenue and profitability, the beverage titan has faced challenges, with most analysts attributing the decline to the growing popularity of weight loss drugs in the United States. The expectation that these drugs, equipped with appetite-suppressing properties, could reduce demand for food and beverages has cast a shadow over KO stock.

Source: InvestingPro

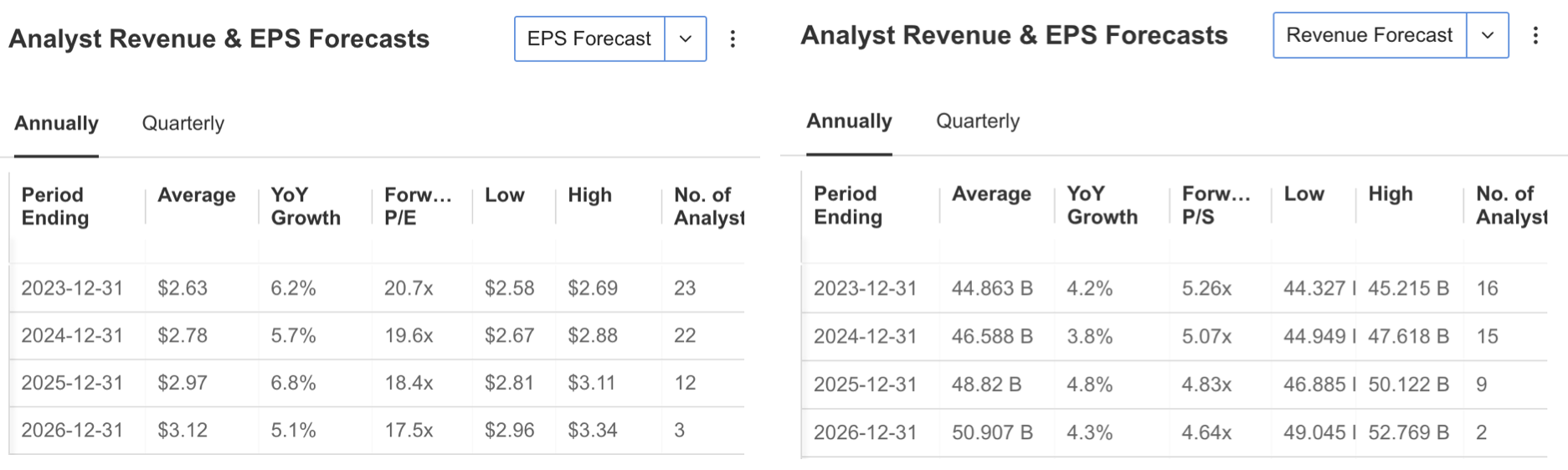

If we look at the 3rd quarter estimates; While 12 analysts revised their estimates downwards, there is a consensus estimate of $0.69 for EPS and $11.4 billion for the company’s quarterly revenue in the last quarter.

Source: InvestingPro

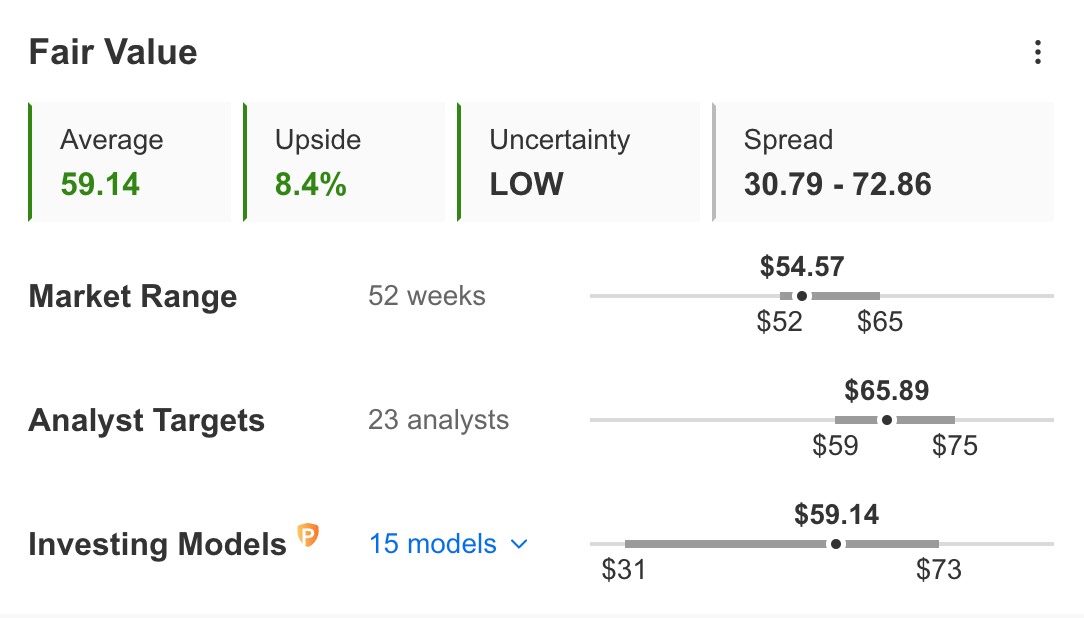

According to the latest financial results, the share price in the fair value analysis is calculated as $59 according to 15 ratios. While 23 analysts’ estimates remain more optimistic, the average estimate of analysts is that KO shares could reach $ 65 within a year. This means that the share, which is currently in the $54 band, is estimated to move at a discount of 8% according to the fair value analysis and close to 20% according to the opinion of analysts.

Company’s Fundamentals Remain Strong

Looking at the company’s fundamentals, Coca-Cola boasts one of the strongest brands in the beverage industry. Its robust economic structure provides a competitive edge, instilling confidence in its investors. Notably, Coca-Cola generates a healthy cash flow, enabling consistent dividend increases and share buybacks over the years.

Furthermore, Coca-Cola’s well-managed approach is evident in its recent acquisitions diversifying its non-alcoholic beverage portfolio, including forays into coffee and alcoholic beverages. This strategic expansion solidifies Coca-Cola’s position, setting it apart from its industry counterparts.

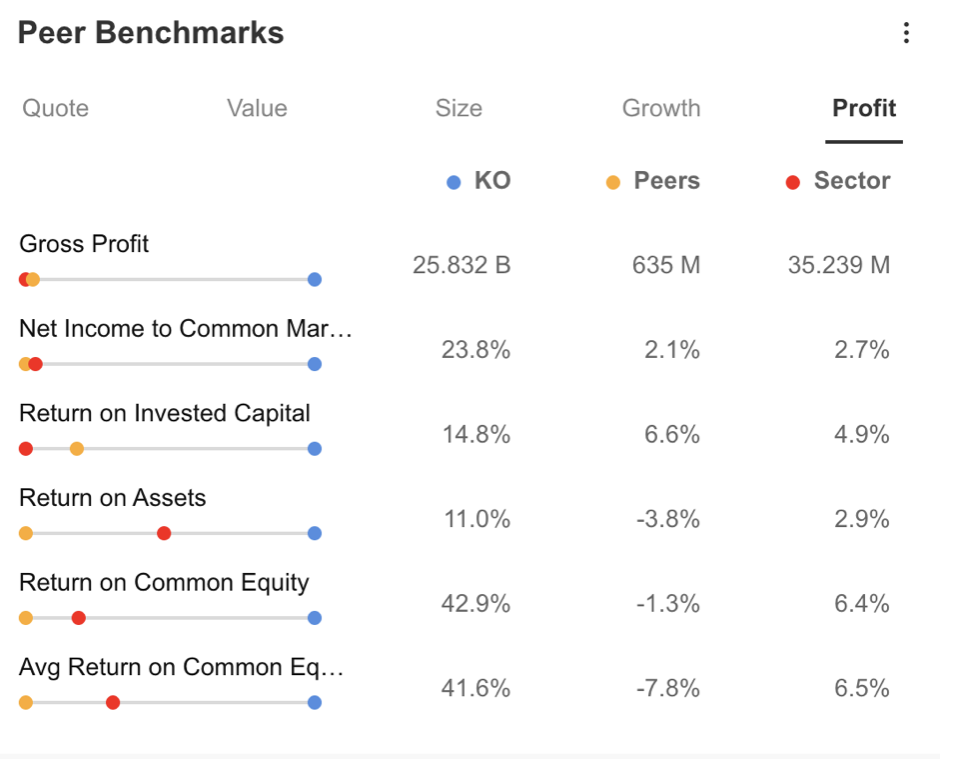

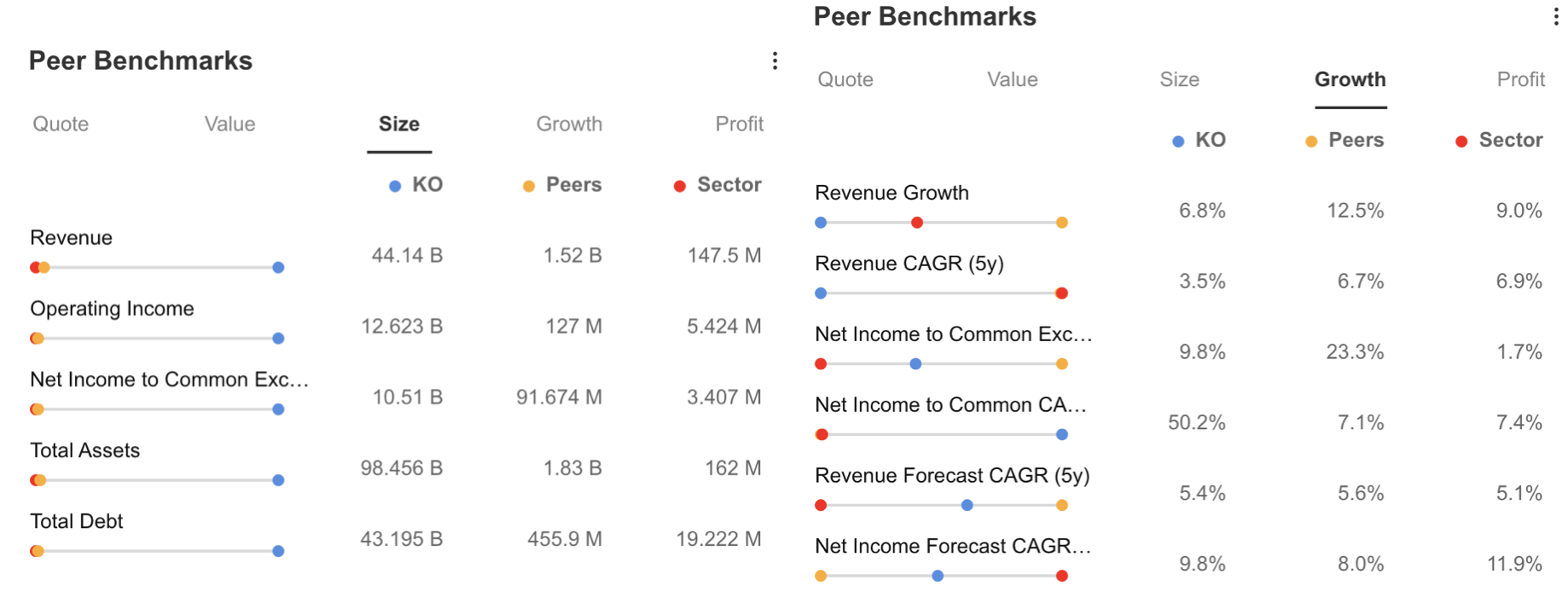

In terms of profitability margins, Coca-Cola maintains a distinct advantage over its peers and the sector. However, considering its size relative to peers, there may be limitations in terms of growth. While the past year’s revenue growth slightly lags behind peers, the 5-year revenue forecast aligns closely with peer companies, with only a marginal variance.

The consistently strong profitability indicates that long-term investors may find merit in retaining Coca-Cola stock in their portfolios, despite some growth constraints.

Source: InvestingPro

Peer Benchmarks – Growth, Size

Peer Benchmarks – Growth, Size

Source: InvestingPro

When we examine the end-2023 and longer forecasts for Coca-Cola on the InvestingPro platform, an annual increase of 6.2% in EPS and an average increase of 6% in the next 3 years are predicted. Revenues are projected to increase by 4.2% y-o-y to 44.8 billion by year-end and continue at a similar pace over the next 3 years.

Revenue and EPS Forecasts

Revenue and EPS Forecasts

Source: InvestingPro

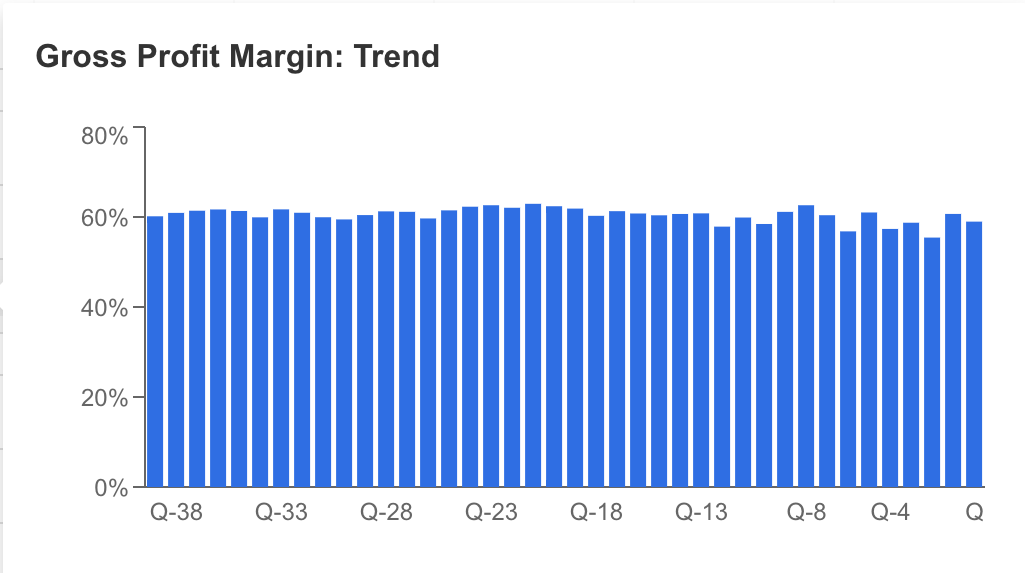

One of the most important features that keeps Coca-Cola ahead of its competitors is its ability to cut costs significantly. The company’s huge size and cash strength enable it to negotiate hard with its suppliers, giving it a cost advantage over its competitors. Coca-Cola continues to maintain brand awareness by using cost savings in marketing activities.

This also strengthens the company’s hand in pricing its products and generating revenue from its operations, while contributing to a stable gross profit margin at a high rate.

Gross Profit Margin Trend

Gross Profit Margin Trend

Source: InvestingPro

Another positive factor that should be evaluated for Coca-Cola is that the company’s sales have continued steadily, especially in the macro-level inflationary pressure environment for the last 2 years.

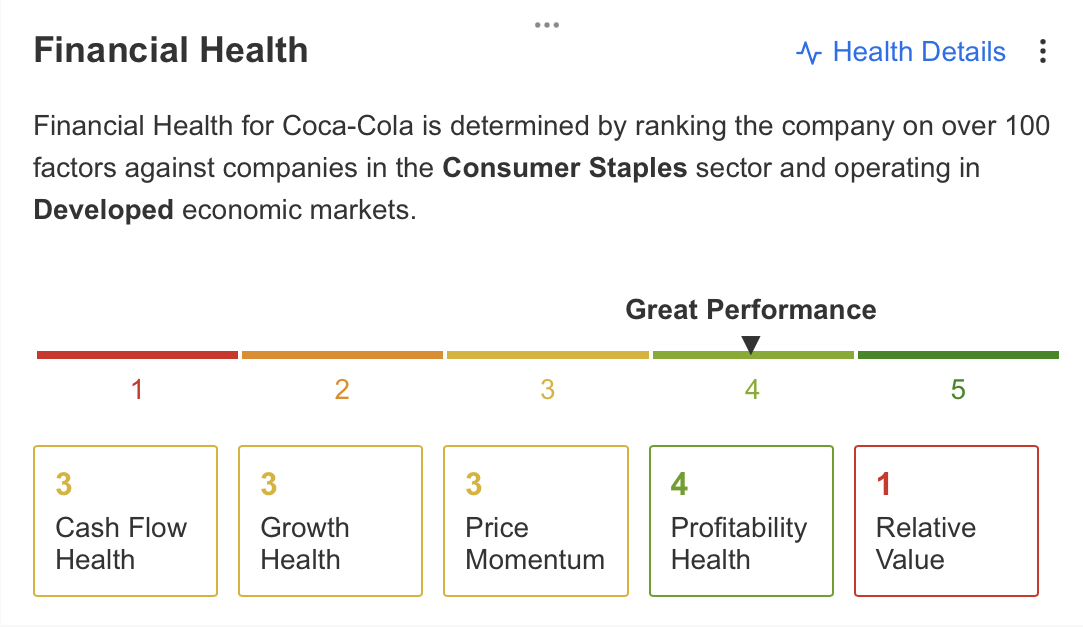

If we summarize the positive and negative aspects of the company through the theInvestingPro platform;

- Increased dividend payment for 53 years in a row

- Impressive gross profit margin

- Offering high returns to investors

- The stock continues to be low volatile with a beta of 0.6

are seen as positives.

Negative factors for Coca-Cola are;

- 6 analysts revised their earnings expectations for the 3rd quarter downwards

- The stock has a high F/S ratio despite short-term profitability growth

In addition, InvestingPro’s company summary cites Coca-Cola’s recent slowdown in revenue growth and average debt levels as a warning.

Conclusion

Coca-Cola stands as a company that gives confidence to its investors with its good management as well as many factors that it can outperform its competitors. The company also has an important advantage in terms of maintaining its market share and remaining resilient against economic difficulties with its healthy financial position and high profitability that stands out in the balance sheet.

Source: InvestingPro

On the other hand, the fact that Coca-Cola has a low beta indicates that it is less volatile than its peer company stocks, and since it is a dividend stock, it may continue to be preferred as a defensive asset in the portfolio of long-term investors.

***

Amazon Earnings on the Horizon: What to Expect?

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.