Clock is ticking for US recession, return of Fed’s QE, says black swan fund

2024.09.27 11:43

By Davide Barbuscia and Carolina Mandl

NEW YORK (Reuters) – The first interest rate cut by the Federal Reserve signals a U.S. recession is imminent and a dramatic drop in financial markets could once again force the U.S. central bank to come to the rescue by buying bonds, said tail-risk hedge fund Universa.

The Fed said last week it started cutting rates to recalibrate monetary policy and to maintain strength in the labor market. With inflation declining, and the economy still on relatively solid footing, many see the beginning of the easing cycle as a precursor to a so-called economic soft landing.

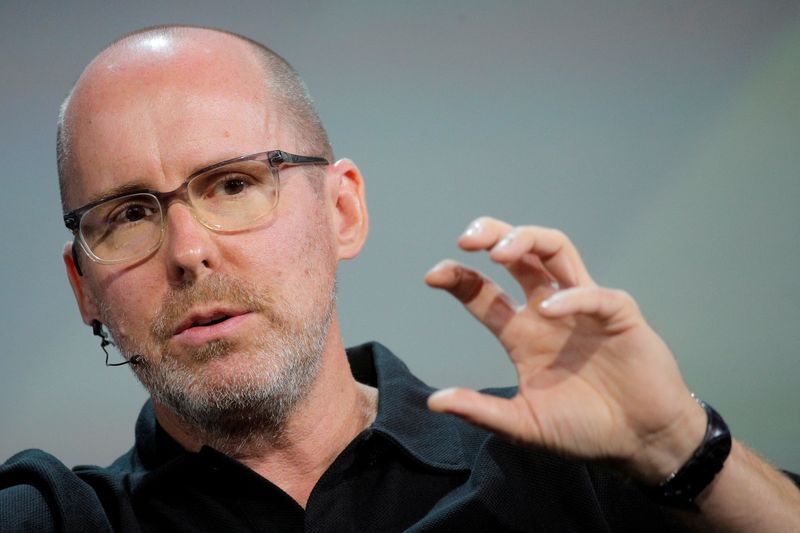

But for Mark Spitznagel, chief investment officer and founder of Universa, this was the start of an aggressive reduction in interest rates, as a highly indebted U.S. economy, which has so far defied expectations, will soon crack under the weight of interest rates still at historical highs.

“The clock is ticking and we are in black swan territory,” he told Reuters this week.

Universa is a $16 billion hedge fund specializing in risk mitigation against “black swan” events – unpredictable and high-impact drivers of market volatility. It uses credit default swaps, stock options and other derivatives to profit from severe market dislocations.

Tail-risk funds are generally cheap bets for a big, long-shot payoff that otherwise are a drag on the portfolio, similarly to monthly insurance policy payments. Universa was one of the big winners during the extreme volatility that rocked markets in the early days of the Covid-19 pandemic in 2020.

Spitznagel said the recent “disinversion” of a closely watched part of the U.S. Treasury yield curve, a key bond market indicator of an upcoming recession, signals that a sharp downturn is imminent. “The clock really starts when the curve disinverts, and we’re here now,” he said.

The curve comparing two and 10-year yields has been inverted for about two years but turned back positive in recent weeks with short-term yields dropping faster than longer-dated ones on expectations the Fed will cut interest rates to support a weakening economy. In the past four recessions – 2020, 2007-2009, 2001 and 1990-1991 – that curve had turned positive a few months before the economy started contracting.

The magnitude of the next credit crunch could be similar to the “Great Crash” of 1929 that triggered a global recession, he said. “The Fed hiked rates into such a huge, unprecedented debt complex … That’s why I say I’m looking for a crash that we haven’t seen since 1929.”

A recession could occur as soon as this year, forcing the Fed to cut rates aggressively from the current level of 4.75%-5%, and eventually pushing the central bank back to quantitative easing (QE), or bond buying – a process that generally occurs amid unsettled markets and aims to bolster monetary policy when rates are near zero.

“I do think they’ll save the day again … I feel strongly that QE is coming back and rates are going to go back to something like zero again,” said Spitznagel.