Citi Says Chip Stocks Can Plunge Another 15%, Tells Clients When to Buy Again

2022.07.13 18:11

Citi Says Chip Stocks Can Plunge Another 15%, Tells Clients When to Buy Again

By Senad Karaahmetovic

Citi analyst Christopher Danely reiterated his negative stance on semi stocks as the situation is likely to get worse before it gets better.

Danely sees the SOX index – benchmark index for semi stocks – falling another 15% on the back of the consensus estimates cuts. The analyst reminds investors that the data is pointing toward weakening demand in PCs and smartphones, which combine for roughly 50% of the overall semi demand.

Danely also expects “a correction in the automotive and data center end markets over the next few quarters given lower demand and a buildup of inventory.”

The final leg is likely to be triggered by a roughly 25% decline in consensus estimates, similar to the 2011/2012 downturn.

“We expected 30% downside to the stocks when we downgraded the sector earlier this year and given the SOX has fallen 15% since, we expect at least another 15% downside driven by estimate cuts,” Danely told clients in a note.

On when to buy semi stocks again, Danely believes the right time to buy is “when stocks stop going down on bad news, and most of the downside is priced in.”

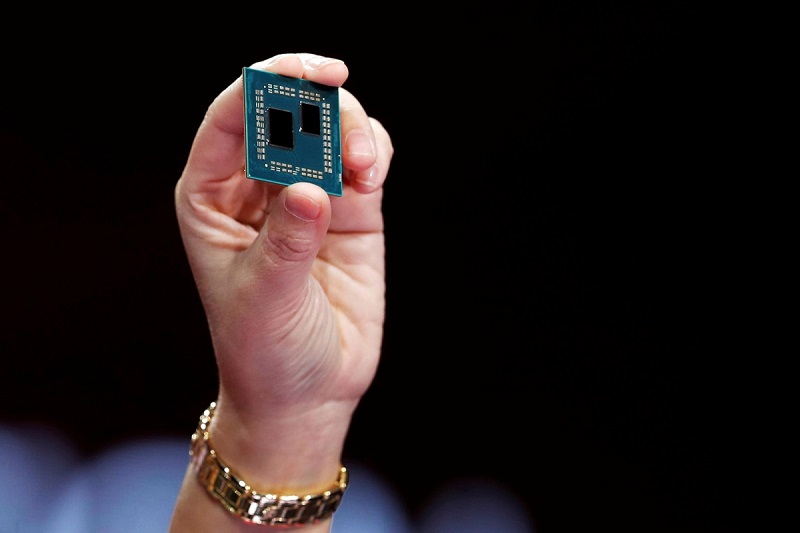

“ADI (NASDAQ:ADI) remains our top pick given our defensive stance. When the downturn ends, we prefer to own stocks with secularly increasing EPS such as Micron (NASDAQ:MU), ON (NASDAQ:ON), GlobalFoundries (NASDAQ:GFS), and AMD (NASDAQ:AMD) as they should offer the most upside,” Danely added.