Economic news

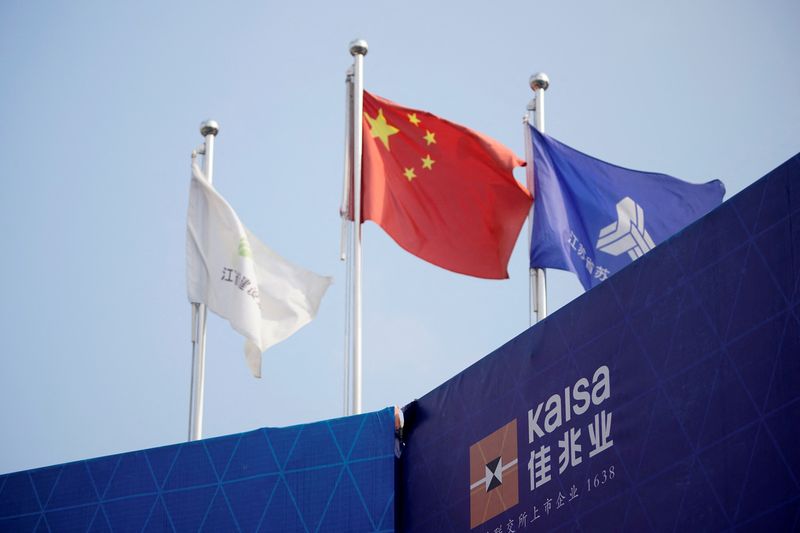

Chinese property developer Kaisa announces offshore debt restructuring agreement

2024.08.19 21:01

(Reuters) -China’s Kaisa Group announced on Tuesday an offshore debt restructuring agreement with a group of creditors via the issue of U.S. dollar-denominated senior bonds and mandatory convertible bonds.

Kaisa will issue senior notes worth an aggregate of $5 billion in five tranches and an aggregate of $4.8 billion worth of mandatory convertible bonds in seven tranches, the property developer said.

Maturities on the notes and bonds range from 2027 up to 2032. Cash interest on the senior notes will be between 5% and 6.25% per year, while convertible bonds will fetch shares in the company based on an allocation ratio.