Chinese property developer Country Garden slides after Moody’s downgrade

2023.08.07 01:32

© Reuters.

Investing.com — Shares of Country Garden Holdings, one of China’s biggest property developers, tumbled on Monday after ratings agency Moody’s downgraded the firm further into junk territory, amid a brewing real estate crisis in China.

Hong Kong shares of Country Garden (HK:) slid nearly 7% to a two-week low, and were trading close to record lows hit in November 2022.

Moody’s on Friday downgraded Country Garden’s rating to B1 from Ba3, putting the company further in junk territory after it recently canceled a $300 million share sale and capital raising.

The ratings agency said that the downgrade reflected growing concerns over weakening property sales, limited funding access, and a large amount of expiring debt over the next 12-18 months, which could dent the firm’s credit position and liquidity.

Moody’s had in 2022 downgraded Country Garden to junk, amid a growing downturn in the Chinese property market.

“The negative outlook reflects uncertainties over the company’s ability to stabilize its declining contracted sales and to recover its funding access over the next 6-12 months due to the weak operating environment in low-tier cities and volatile capital markets,” Moody’s analysts said in a note.

The ratings agency also expects the property developer’s contracted sales to drop to 210 billion yuan ($1 = 7.19 yuan) from 357B yuan in 2022, which in turn will further constrict the company’s cash flow and profitability.

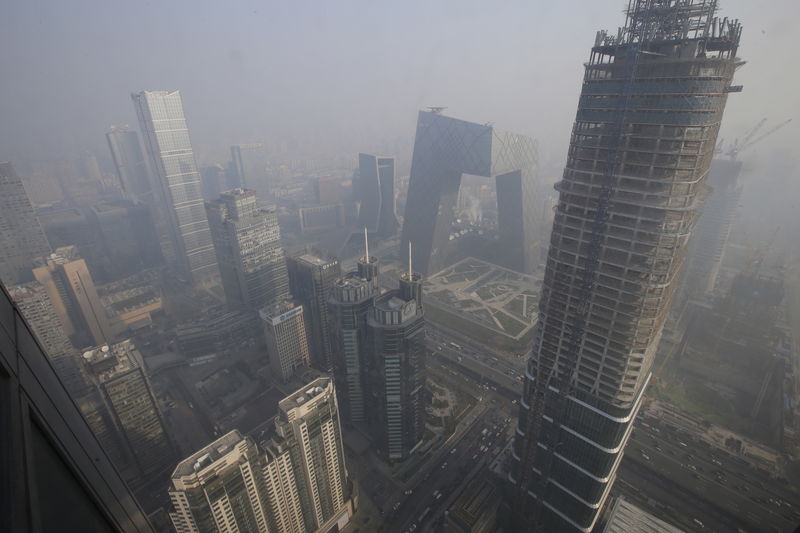

Country Garden was seen as among the few Chinese property developers to have somewhat weathered a severe downturn in the market over the past three years, amid dwindling sales and increased regulatory scrutiny towards capital raises. China’s property market, once a key economic engine, was hit by a mix of COVID restrictions and worsening liquidity conditions, which triggered a drastic slowdown in sales.

Country Garden, in addition to its recently-canceled capital raise, has also flagged a potential loss in the first half of 2023, while a slew of upcoming bond maturities saw traders positioning for a potential default. Country Garden’s bonds were trading at record lows this year.

Concerns over Country Garden spilled over into other property stocks, with peers Sunac China Holdings Ltd (HK:) and Longfor Properties Co Ltd (HK:) sinking more than 3% each in Hong Kong trade.

Country Garden Services Holdings (HK:), a listed unit, sank 6.6%.