Chinese house prices fall most in 7 years in October

2022.11.15 21:09

[ad_1]

Chinese house prices fall most in 7 years in October

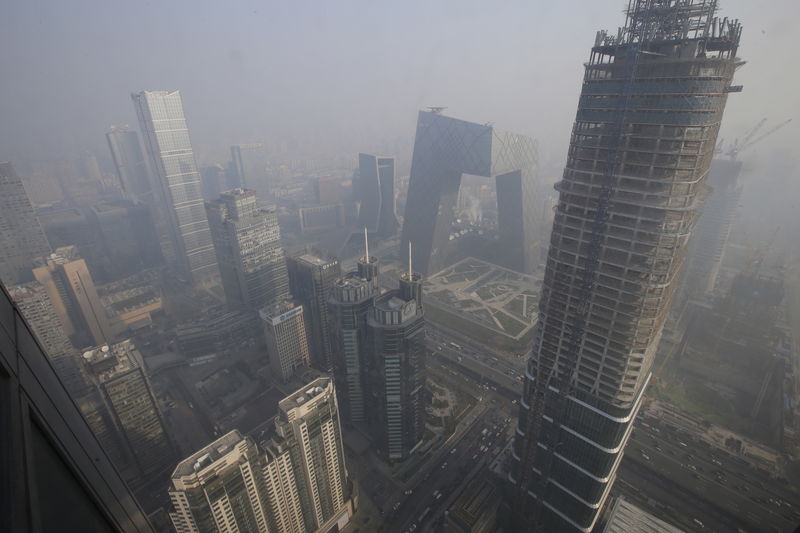

Budrigannews.com – Chinese house prices fell by their biggest margin in seven years in October, data showed on Wednesday, as a property sector slump and continued disruptions from COVID-19 lockdowns soured sentiment towards investing in real estate.

fell 1.6% in October from the prior year, data from the National Bureau of Statistics showed. The fall was also steeper than September’s drop of 1.5%.

China’s property sector has been steadily contracting since the government cracked down on excessive borrowing in 2020, cutting developers off from cash supplies. This saw real estate developers unable to meet bond repayments and left them unable to complete several projects, which drew the ire of civilians who had invested in the projects.

Homebuyers enacted a strike on mortgage payments this year, further pressuring debt-strapped developers and cooling the real estate market.

This saw Beijing roll out several stimulus measures to support the sector, with the government most recently unveiling a 16-point plan for financial firms to support the property market.

China had clamped down on the property market in 2020 to stem a housing bubble that was spurring extreme gains in house prices. The country reiterated its “housing is for living, but not for speculation” stance at a recent congress of the Communist Party.

A series of COVID lockdowns this year also further stifled construction activity, delaying project completion for several developers and adding to their liquidity woes.

With China now grappling with its worst outbreak in six months, investors are positioning for more headwinds to the property sector.

Slowing retail sales, which sank for the first time in six months in October, also indicate that Chinese consumers are facing headwinds from slowing economic growth.

While the country recently relaxed some quarantine and movement restrictions under its strict zero-COVID policy, rising infections are likely to spur a delay in the complete lifting of the policy.

China’s zero-COVID policy is at the heart of its economic woes this year, as business activity was ground to a halt by repeated lockdown measures.

[ad_2]

Source link