China Stimulus-Fueled Gains in EM Stocks May Be Short-Lived

2024.10.07 12:32

As rebounds go, the current revival in the fortunes of stocks in emerging markets surely ranks as one of the more impressive feats in recent history.

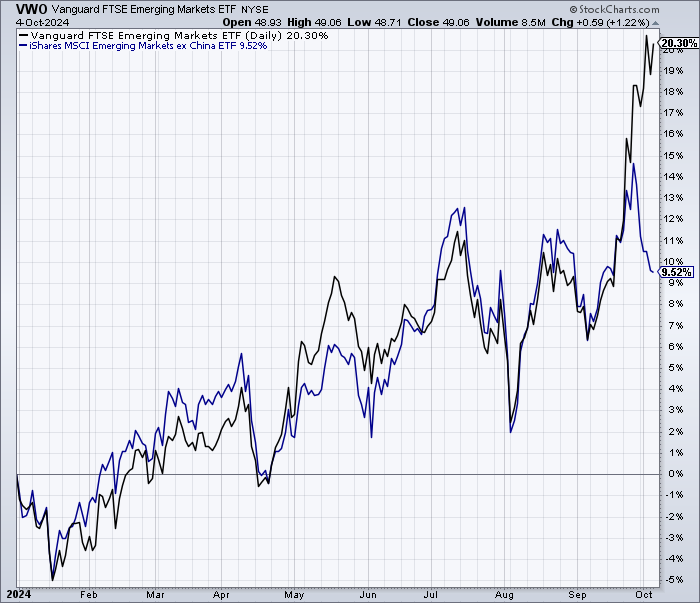

The caveat: The turnaround is primarily due to surging share prices in China. Exclude China and broadly defined EM stocks are posting substantially softer results, based on a set of ETFs through Friday’s close (Oct. 4).

For perspective, let’s start with an update of all the year to date. US shares () are effectively neck and next with EM () so far in 2024: 20.4% vs. 20.3%, respectively.

The comparable year-to-date results are striking in a year that, until recently, was dominated by US equities performance over EM—often by a wide margin.

That all started to change a month ago when China announced relatively aggressive stimulus policies to support its slowing economy.

The news lit a fire under EM shares generally, although the spillover effect outside of China started to fade in late September.

Comparing EM that includes China (VWO), with a roughly 26% weighting, vs. an EM fund that excludes China () reflects a stark performance difference lately.

VWO is up 20%-plus this year vs. EMXC’s 9.5% rise. As recently as Sep. 23 the two ETFs had been posting virtually identical year-to-date results.

Gains May Not Last

The question is whether China’s dramatic revival will endure. Lynn Song, chief economist of Greater China at ING, predicts that for the near term the optimism-fueled rally could roll on “albeit at a less furious pace.”

Much depends on previously announced policies and “how soon and aggressively” the stimulus plans are implemented, Song advises. “If any of these things fall short, the optimism could falter.”

Economists at Nikko Asset Management point out that “Mainland China’s economy is in bad shape.

Elevated youth unemployment is contributing to flagging domestic consumption, while households see the bulk of their savings, predominantly invested in real estate, dwindle as property prices spiral downwards.”

Nikko’s economists add that “the elephant in the room seems to be a lack of consumer confidence.

It is hard to feel optimistic about the future when job security is tenuous, salaries remain stagnant and as investors see the value of their real estate and equity holdings depreciate by the day.”

Raymond Ma, Invesco’s chief investment officer for Hong Kong and Mainland China, is also cautious, explaining:

“In the short term, sentiment could overshoot but people will go back to fundamentals. Because of this rally, some stocks have become really overvalued.”