China Recovery, U.S. Recession?

2023.04.13 07:07

While the upcoming US recession is capturing the headlines, this downturn may look very different than previous ones. Our conversations with over 50 CEOs and CFOs over the past several weeks paint a different picture. Several companies are noting upside surprises to their expectations driven by the recovery in China.

Contents

- China to the rescue? The inflection in hyperscaler capex

- Commodities () next in line for a potential upturn

- Our take on the overly anticipated US recession – datapoints from the field

Inflection in hyperscaler capex in China

Despite a relatively muted economic recovery in China this year, we are starting to hear datapoints from several companies across many end markets that are noting upside surprises to their original expectations.

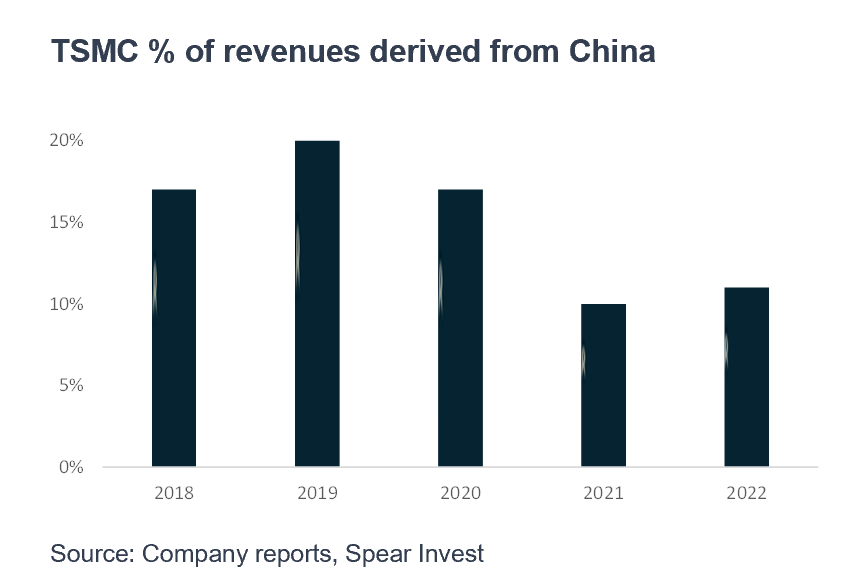

While we do not expect gangbusters recovery, China is now coming from a very low base after 2+ years of subdued demand. As an example, if we look at Taiwan Semiconductor Manufacturing (NYSE:) sales, China represented only 11% of revenues in 2022, down from ~20% in 2019. We expect demand from China can easily double over a 2 year timeframe in an economic recovery. For context, TSM is often used as proxy for global trends as it is the largest manufacturer of semiconductors with 57% foundry market share.

TSMC % of Revenues Derived from China

TSMC % of Revenues Derived from China

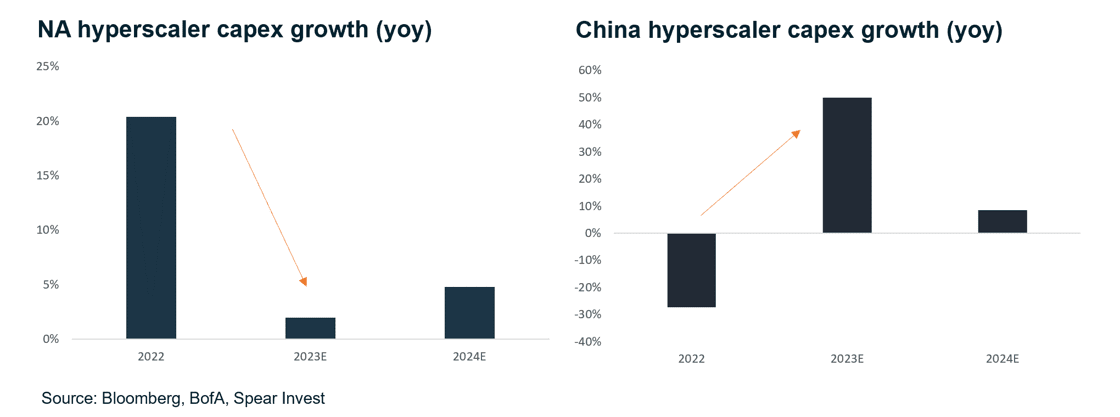

This recovery is already starting to get reflected in capex plans from hyperscalers. Alibaba (NYSE:) is expected to grow capex by 40% in 2023 and Tencent is expected to grow capex by 80% in the same time-frame. These capex expectations were recently revised upwards resulting in global capex growth expectations for the hyperscalers to increase from ~3% to 5% for 2023.

NA-China Hyperscaler Capex Growth

NA-China Hyperscaler Capex Growth

Investors may wonder why is this such a big deal, if US capex is already slowing from ~20% growth to single digits. We would point to 3 things:

- China hypersclaers are smaller than the US counterparts, muting the impact of the strong growth, but China has a larger number of consumer companies that are at the forefront of AI that will likely face similar growth dynamic.

- US estimates are based on very muted macro expectations and are not factoring just yet the impact of incremental investments in AI related infrastructure.

- Inflections are always notable for stocks as downward trend gets priced in (3% -> 5% growth can signal a change in trajectory).

We expect that these capex increases will positively impact semiconductor hardware companies, but over time will boost demand for other data infrastructure.

Expect China to drive the next leg up for commodities

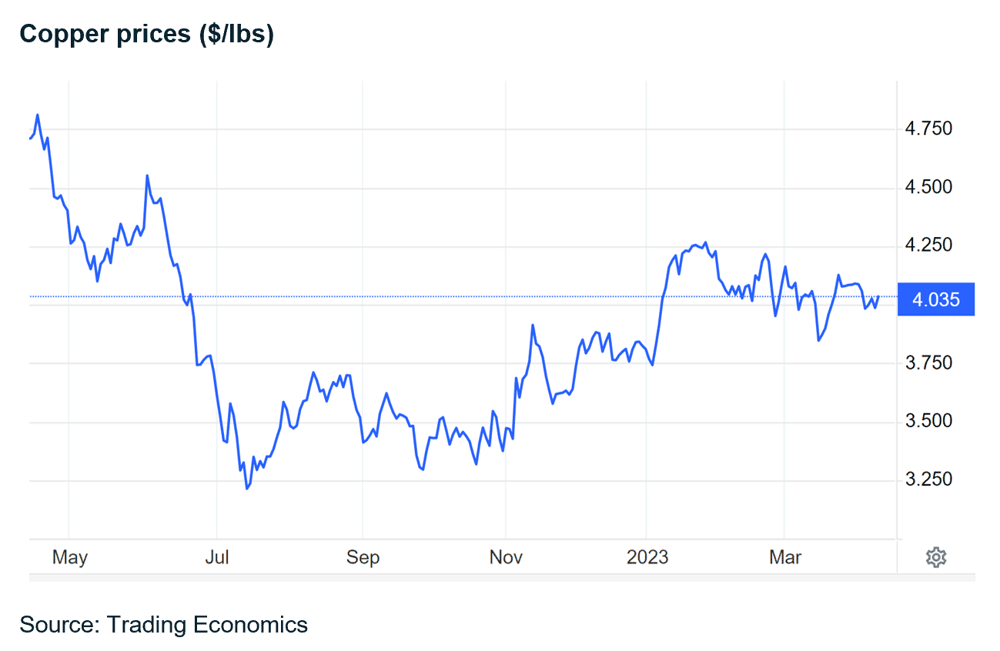

While commodities have broadly pulled back since the beginning of the year on recession worries driven by the US banking crisis, we are getting to a point where inventories are reaching critical lows for commodities with strong secular demand drivers (such as copper). We believe that this is creating a similar set up to Oct/Nov. 2022, where demand may be bad, but sentiment is even worse. If the China recovery is in fact surprising to the upside, this could provide significant boost to copper demand.

While more electric vehicles (EVs) doesn’t mean more pricing power for the EV manufacturers, it does mean more demand for copper. In addition to electric vehicles, broader electrical infrastructure and focus on renewables provides long-term support for copper demand.

- More than 65% of the worlds copper is used in applications to deliver electricity.

- Electric vehicles use up to 4x more copper than internal combustion engines.

- Renewable energy technologies use 4-5 times more copper than fossil fuel power generation.

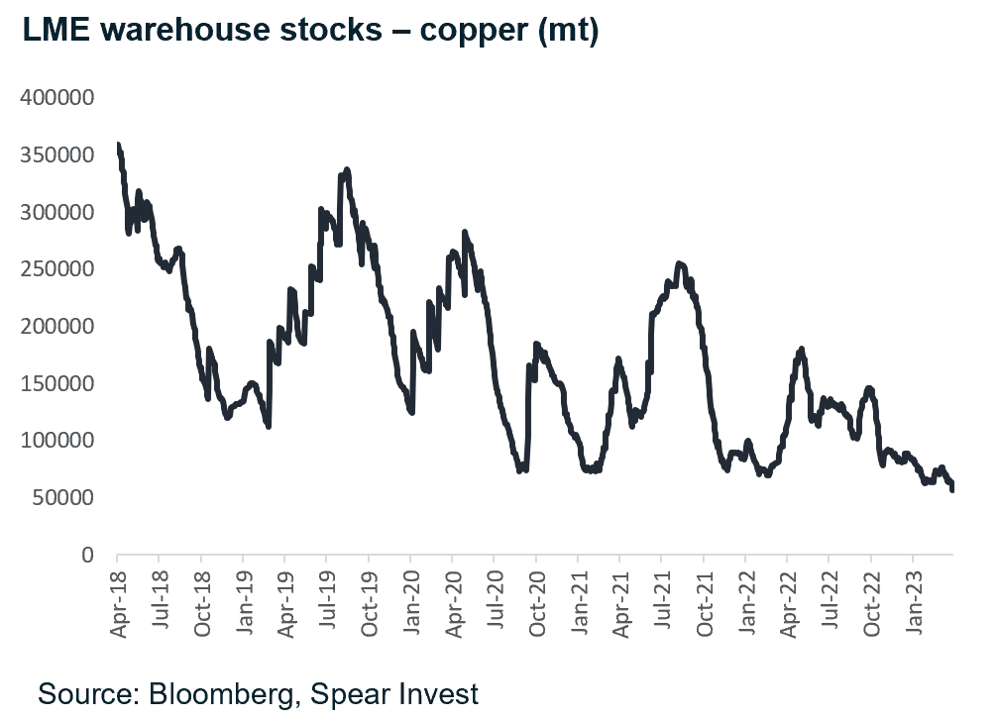

LME warehouse stocks for copper are at a 5-year low. Inventories at the Shanghai Futures Exchange have already fallen by over one-third since their peak in February. Generally, buyers de-stock when there are worries of economic slowdown/recession, but will than need to re-stock with any incremental inflection in demand.

LME Warehouse Stocks – Copper

LME Warehouse Stocks – Copper

The overly anticipated US recession

The markets have been calling for a 2H23 recession for over a year now, the Fed has now made those expectations official. The “unexpected” crisis in the banking sector is now expected to cause a “mild recession” by year-end, per the Fed minutes from March that were released yesterday.

But the current crisis is unlike a typical crisis and therefore different end markets are at different points in the downturn. The main difference is tight capacity and tight labor market caused by decline in productivity.

A typical crisis is pre-ceded by overcapacity – small change in demand causes an oversupply and market collapse. In this downturn, capacity is relatively tight, and the imbalances are caused by a unprecedented pace of of interest rate hikes i.e. going from “free money” to a relatively tight monetary policy.

We expect that each end-market will experience the downturn at a different time and magnitude and provide some thoughts below by sector:

- Technology was first to go into the downturn as a spike in the “risk-free” rate impacted technology valuations. This was followed by earnings estimate cuts caused by the expected recession. We are now at a point where estimates have re-set lower and some companies (especially early cycle semis) may experience an earnings inflection

- Industrials went through a recession in 2015-16. This is the reason why capacity is so tight and industrial companies are able to shrug-off recession worries. Re-shoring and need for automation are incremental long-term secular drivers that are providing further support. Parker Hannifin (NYSE:), Eaton (NYSE:), and several others pointed to these trends translating to orders. We expect to see a major industrial cycle – decades of globalization reversed over 3-5 year horizon

- Housing has been challenged for the past year, but we are starting to hear datapoints of very tight capacity. While we are not expecting a housing boom with interest rates higher for longer, the question is where is the incremental downside going to come from?

- Commercial real estate – many expect will be the next shoe to drop as loans need to be refinanced. Tighter liquidity could limit new construction. HVAC surveys point to 2H23 slowdown.

- Banking, insurance, auto loans are all areas where there is a mis-match in duration between the assets and liabilities. But this is more a problem for the banks (and their shareholders) than consumers.

We expect more risk for SMBs vs. large corporations that may actually benefit from higher interest rates.

- Corporates that generate cash or have large cash balances can now get a decent yield on the cash they hold. Even high-growth tech companies like Crowdstrike, Tesla (NASDAQ:), called this out as a tailwind.

- Start-ups are struggling, but the real hit was last year when rates went from 0% to 4%. Companies that have no clear path to profitability are in trouble regardless of the “banking crisis”.

- SMBs are an area we are watching in terms of incremental tightening in liquidity. We gathered few datapoints from Tier 4-5 suppliers having tougher time obtaining credit – but larger corporates have the potential to step in and bridge the gap.

- Consumer – while there is an initial headline shock affecting sentiment (bank collapses don’t ooze confidence), deposits going from savings to money market funds mean consumers are generating yield on their savings. The consumer was already facing tight liquidity in 2022 with mortgage rates near high and record inflation. What would be the source of the incremental downside?

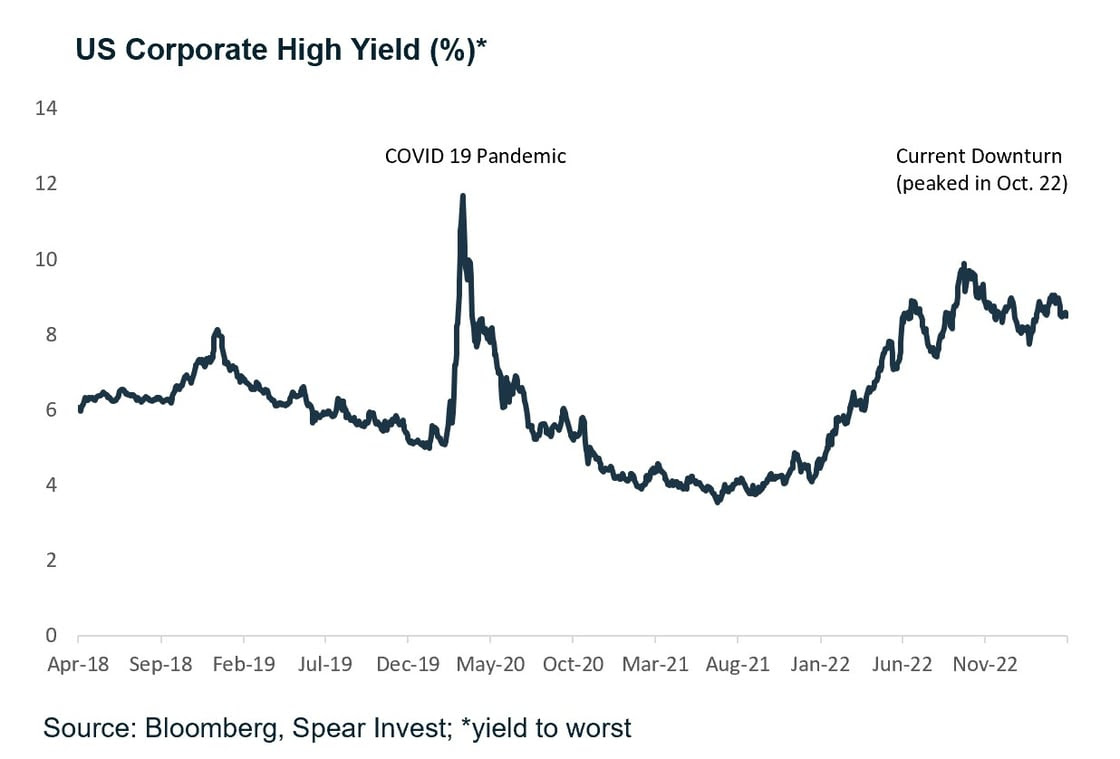

Despite all recession worries, US corporate high yields, which usually signal a crisis are down from their peak in Oct. 22. The bottom line is that investors have now started to worry about a liquidity crunch, but liquidity has been very tight for many end-markets throughout 2022, especially in the second half of the year.

US Corporate High Yield Chart

US Corporate High Yield Chart

Disclosure:

Views expressed here are for informational purposes only and are not investment recommendations. SPEAR may, but does not necessarily have investments in the companies mentioned. For a list of holdings click here. All content is original and has been researched and produced by SPEAR unless otherwise stated. No part of SPEAR’s original content may be reproduced in any form, without the permission and attribution to SPEAR. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence. Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on SPEAR’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice.

All statements made regarding companies or securities or other financial information on this site or any sites relating to SPEAR are strictly beliefs and points of view held by SPEAR or the third party making such statement and are not endorsements by SPEAR of any company or security or recommendations by SPEAR to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that SPEAR’s objectives will be achieved.

Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. Click here for our Privacy Policy.