China is being quarantined again due to COVID

2022.12.31 01:19

China is being quarantined again due to COVID

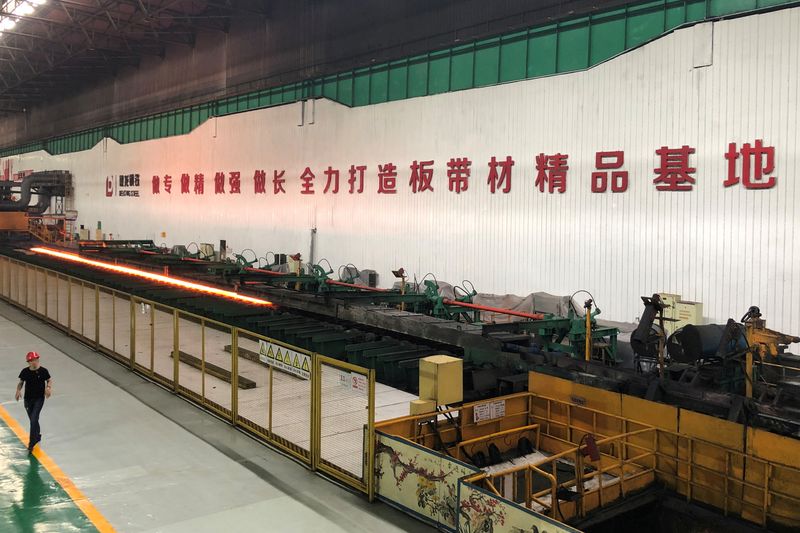

Budrigannews.com – As a result of Beijing’s abrupt reversal of anti-virus measures, China’s factory activity decreased in December for the third month in a row and at the sharpest rate in nearly three years. COVID infections spread through production lines all over the country.

The official purchasing managers’ index (PMI) decreased from 48.0 in November to 47.0 on Saturday, according to the National Bureau of Statistics (NBS). A poll conducted by Reuters had economists anticipating a reading of 48.0 for the PMI. On a monthly basis, contraction and growth are separated by the 50-point mark.

Since the beginning of the pandemic in February 2020, the decrease was the largest.

After China lifted the most stringent COVID restrictions in the world at the beginning of December, the data provided the first official snapshot of the manufacturing sector. Airfinity, a UK-based health data company, estimated that there were 18.6 million cumulative infections in December.

Examiners said flooding contaminations could cause impermanent work deficiencies and expanded production network disturbances. On Wednesday, Reuters reported that Tesla (NASDAQ:) plans to run a reduced production schedule at its Shanghai plant in January, which will continue into the following year.

China’s exports may be further slowed as a result of growing concerns about a global recession, rising interest rates, inflation, and the war in Ukraine. This would hurt the country’s huge manufacturing sector and make it harder for the economy to recover.

“Most production lines I know are way underneath where they could be this season for orders one year from now. Cameron Johnson, a partner at Tidalwave Solutions, a supply chain consulting firm, stated, “A lot of factories I’ve talked to are at 50%, and some are below 20%.”

Therefore, despite China’s opening, manufacturing will continue to slow as the rest of the world’s economy slows. Workers will work in factories, but there won’t be any orders for them.

NBS reported that in December, 56.3% of manufacturers surveyed said they were greatly affected by the epidemic, up 15.5 percentage points from the previous month. However, the majority also said they expected the situation to improve gradually.

Zhou Hao, chief economist at brokerage Guotai Junan International, stated, “While (the factory PMI) was lower than expected, it is actually difficult for analysts to provide a reasonable forecast given the virus uncertainties over the past month.”

“We generally believe that the worst is over for the Chinese economy and that a robust economic recovery is on the horizon.”

This week, the country’s banking and insurance regulator said that small and private businesses in the catering and tourism industries that were hard hit by the COVID-19 epidemic will get more money, and that recovering consumption will be a top priority.

The NBS data showed that the non-manufacturing PMI, which looks at activity in the services sector, fell to 41.6 from 46.7 in November. This was also the lowest reading since February 2020.

The authority composite PMI, which consolidates assembling and administrations, declined to 42.6 from 47.1.

Mark Williams, Chief Asia Economist at Capital Economics, stated, “The weeks before Chinese New Year are going to remain challenging for the service sector because people will not want to go out and spend more than necessary for fear of catching an infection.”

“However, the outlook should improve around the time people return from the Chinese New Year holiday because infections will have decreased and a significant portion of people will have recently been infected with COVID and believe they are immune.”

More Russia’s services sector fell again in December