China: How Far Will the Stimulus-Fueled Bullish Frenzy Go?

2024.10.02 09:38

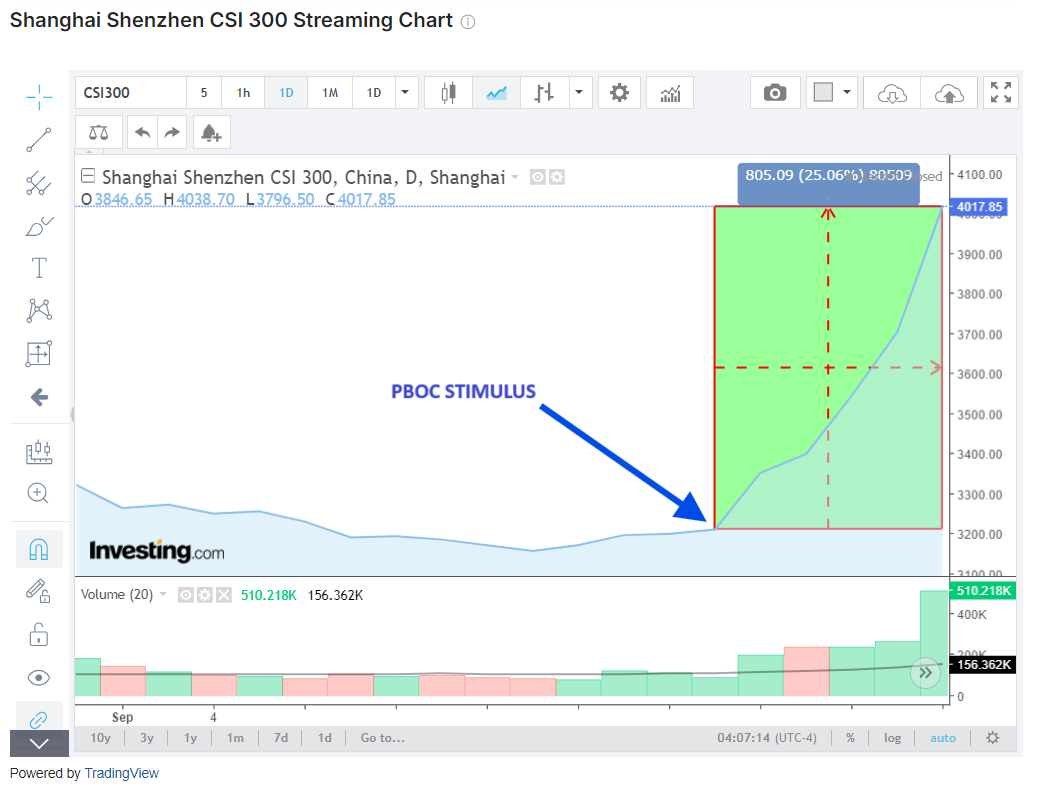

China’s comeback could be the most dramatic market story of the year. After months of sluggish post-Covid growth, Beijing unleashed its economic “Bazooka”, flooding the market with liquidity and igniting a powerful rally.

The impact was immediate.

Within days, major brokers shifted their stance on China from “uninvestible” to something worth considering. In the week that followed the stimulus, the surged over 22%, and the posted its best week since 2008, soaring 25%.

Will the Bazooka Be Enough to Lift China’s Economy and Stocks?

Markets are now asking two key questions: Will these measures be enough to lift China’s economy, and how long will the stock rally last?

On the economic front, Beijing’s intervention resembles a “whatever it takes” moment for the People’s Republic. The timing was perfect too, coming right after the Fed’s first U.S. rate cut, aimed at defending the Yuan.

The goal? Free up banks, rescue the housing market from crisis and flood the economy with liquidity. The message from Beijing is loud and clear: they’ll do whatever it takes to reignite growth.

This is exactly what investors seemed to be waiting for. Concerns over a recession in the West, which many feared but has yet to materialize, led investors to stockpile cash. Now, Chinese stocks are drawing them back in.

Chinese Stocks Lure Investors

For months, analysts urged caution, suggesting investors wait at least until after the U.S. elections in November. But China’s bold turnaround presented an irresistible opportunity.

Capital is now flowing into the Shanghai and Hong Kong stock exchanges. While U.S. tech stocks have become expensive, their Chinese counterparts still trade at a discount, with price-to-earnings ratios that look tempting.

For example, Alibaba (NYSE:) and PDD (NASDAQ:) have surged 37% and 48% in the past month, yet Alibaba trades at a P/E ratio of 26.5x, and PDD at just 14.4x, compared to Amazon (NASDAQ:) 47.3x.

Other Chinese tech giants, such as Baidu (NASDAQ:) and NetEase (NASDAQ:), show similar promise, with P/E ratios around 14 to 15x after a strong rally.

Plenty of Room to Grow

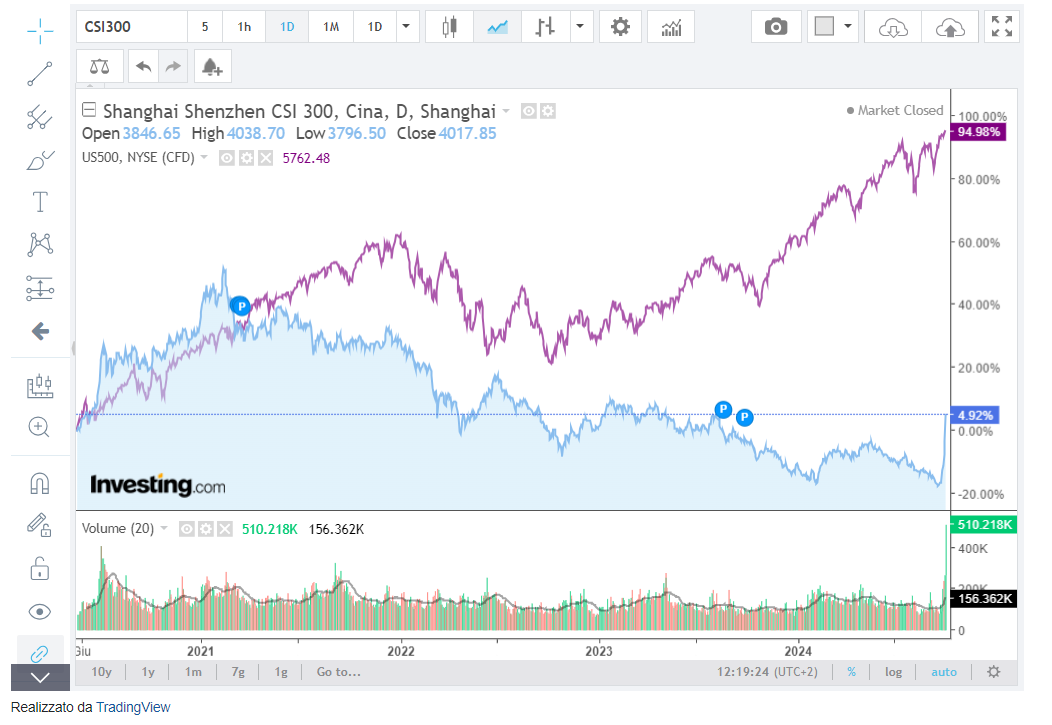

Despite the recent rally, China’s markets still have significant ground to cover. A comparison of the and the Shanghai CSI 300 reveals a wide gap that remains from the peaks of early 2021.

Even after recent gains, Chinese stocks are trading at steep discounts compared to most global markets, with earnings multiples roughly half that of the U.S.

Matteo Ramenghi, chief investment officer at UBS WM in Italy, notes that despite the similarities in sector composition, the index remains undervalued, particularly when it comes to technology stocks.

A Word of Caution

Still, investors are approaching China’s stock market cautiously. As Ramenghi points out, Chinese tech companies have compressed multiples, and leaders in sectors like artificial intelligence could benefit from China’s ongoing development of its tech ecosystem.

However, Lizzi C. Lee, a researcher at the Asia Society Policy Institute, believes it’s too early to declare victory.

While the recent rebound in Chinese stocks is significant, she argues that lasting momentum will require more than short-term stimulus. Long-term success hinges on Beijing’s ability to push through structural reforms.

“The long-term success of this rally-and, by extension, of China’s broader economic recovery-depends on Beijing’s ability to implement meaningful structural reforms.”

“The coming months will reveal whether the recent policy turnaround can yield a lasting economic turnaround or whether the current surge will prove ephemeral.”

Lessons from the Past

While the market enthusiasm is palpable, challenges remain. Investors can’t forget the sharp correction of 2015 when the Shanghai CSI 300 plummeted nearly 45% from its June highs.

But China’s economy has evolved since then. Both the Covid pandemic and the real estate crisis have taught Beijing valuable lessons, giving the leadership hope for a more stable future.

Mark Tinker, chief investment officer of Toscafund Hong Kong, believes the latest measures signal a shift in China’s strategy.

“Xi Jinping’s goal is no longer rapid growth at any cost, but sustainable household demand,” he explains. “Five percent growth means little if it fuels destabilizing leverage.”

Conclusion: China Needs More Than Just Stimulus to Sustain This Rebound

China is aiming to show it can grow sustainably, and a thriving stock market is key to that vision. However, it’s clear that China’s future isn’t being shaped in Beijing alone—it’s also being influenced by decisions made in Washington.

With the U.S. election looming, whoever takes the White House will have to reckon with China’s growing ambitions. Both political parties seem to agree on one thing: the U.S. isn’t eager to see China’s Dragon soar unchecked.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.