China commercial banks’ bad loan ratio declines at end-June, regulator says

2022.07.21 11:21

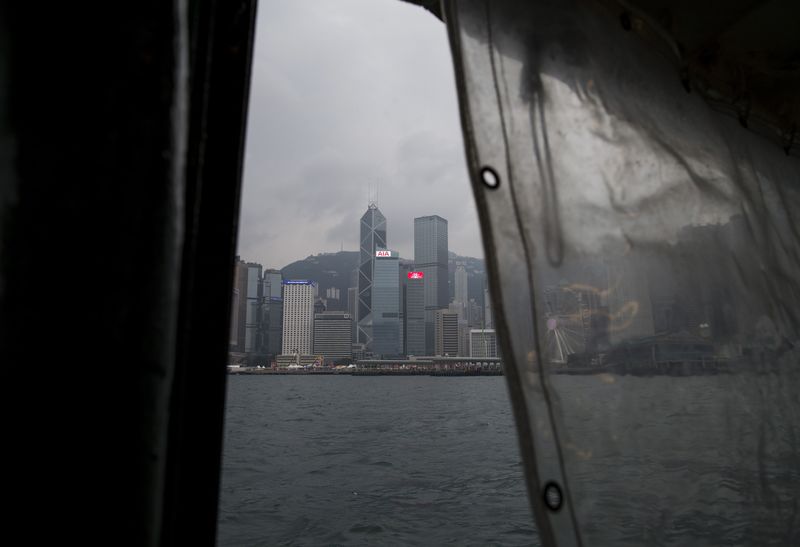

FILE PHOTO: A general view of the Central Business District, including the Bank of China Tower (center L) and China Construction Bank (CCB) Tower are seen from a Star Ferry in Hong Kong’s Victoria Harbour December 26,2014. REUTERS/Tyrone Siu

BEIJING (Reuters) – China’s commercial banks saw their bad loan ratio decline 0.06 percentage points to 1.67% at end-June versus three months earlier, the sector’s regulator said on Thursday.

Outstanding non-performing loans in the commercial banking sector stood at 2.95 trillion yuan ($436.20 billion), an increase of 106.9 billion yuan from the end of the first quarter, according to a statement on the website of the China Banking and Insurance Regulatory Commission (CBIRC).

($1 = 6.7630 Chinese yuan renminbi)