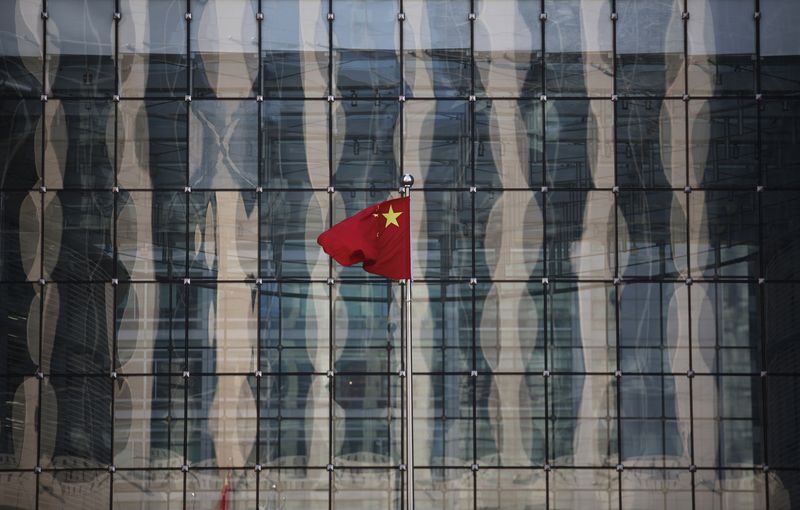

China central bank leaves medium-term rate unchanged as expected

2024.07.14 22:25

SHANGHAI (Reuters) -China’s central bank left a medium-term rate unchanged as expected on Monday when rolling over maturing medium-term loans.

WHY IT’S IMPORTANT

The steady medium-term lending facility (MLF) rate was in line with market expectations, as narrowing interest margins at lenders and a weak Chinese currency continue to limit Beijing’s ability to use monetary easing to shore up the sputtering economy. Meanwhile, the central bank has been working to avoid money idling in the financial system.

BY THE NUMBERS

The People’s Bank of China (PBOC) said it was keeping the rate on 100 billion yuan ($13.8 billion) in one-year MLF loans to some financial institutions unchanged at 2.50% from the previous operation.

With 103 billion yuan in MLF loans set to expire this month, the operation resulted in a net 3 billion yuan fund withdrawal from the banking system.

The central bank also injected 129 billion yuan through seven-day reverse repos while keeping borrowing costs unchanged at 1.80%.

CONTEXT

has lost 2.3% against a resurgent U.S. dollar so far this year, pressured by its relative low yields versus other economies.

China’s central bank introduced a new cash management tool, which market participants expect will cap short-term market rates in a range around the seven-day reverse repo rate, as PBOC Governor Pan Gongsheng said recently the rate “basically fulfils the function” of the main policy rate.

Traders and analysts said the significance of the MLF rate will gradually diminish as the PBOC tries improve the effectiveness of its interest rate corridor.

KEY QUOTES

The cash injection through the reverse repo operation was meant to counteract factors including tax payments, while the MLF loans “fully fulfilled demand from financial institutions,” the PBOC said in a statement.

The central bank-backed Financial News reported on Friday, citing industry experts, that there is still downside room for interest rate to adjust, but it faces the internal constraint of net interest margins on commercial banks and the external constraint of the currency’s value.

“The yuan exchange rate is the most resilient (among other emerging market currencies), but interest rate adjustments need to consider the impact on the exchange rate,” the official newspaper said.

($1 = 7.2500 yuan)