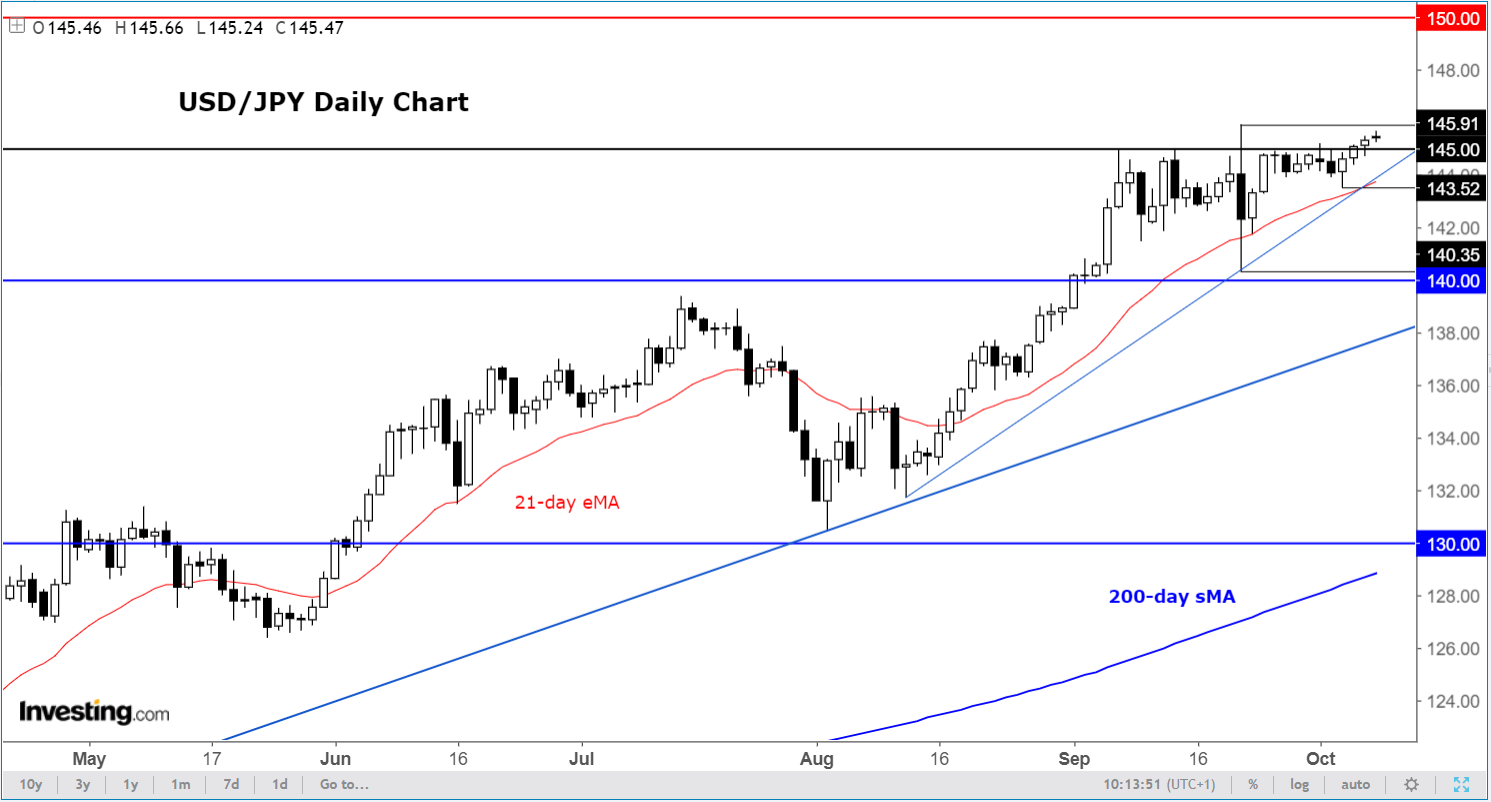

Chart Of The Day: USD/JPY Intervention

2022.10.10 08:29

[ad_1]

- USD/JPY rises for 8 consecutive week

- Yen’s weakness persists; returns to pre-intervention levels

- Watch out for more intervention and/or a sharp move in USD/JPY

The has climbed above the 145.00 handle, which had presumably been the line in the sand for the Japanese government when it decided to spend around $19.3 billion (or a record 2.8 trillion yen) from its reserves intervening in the foreign exchange market last month. Now that the USD/JPY is testing that intervention zone again, there is a risk that Japan might step in again to defend its currency. So, the USD/JPY is definitely one to watch closely this week.

Last week, the USD/JPY barely moved, as traders were seemingly not too keen to take any bold positions in case of another intervention. But the pair ended the week higher for the eighth consecutive time, its longest such streak since May.

The continued weakness of the yen means Japan’s intervention has not worked very well, although it has helped to slow the speed of the yen’s falls. It is clear that more needs to be done to address the currency’s slump. While Japan has one of the largest dollar reserves in the world, the record fall in its foreign reserves in September shows buying yen using currency reserves as a form of intervention is very costly and might not have the intended impact for very long. At the end of September, Japan’s reserves stood at $1.238 trillion. This was the lowest since March 2017.

Meanwhile, the case for an even stronger continues, after Friday’s publication of a stronger gave investors more reason to believe the Fed will continue its aggressive in order to create a soft landing in the economy to help bring to more acceptable levels.

Against this backdrop, the dollar is likely to remain supported on the dips, with yield-seeking investors likely to be discouraged from investing in currencies where the central bank is still very dovish, such as the Japanese yen.

Thus, for the yen to strengthen, the Japanese government needs to align its intervention and monetary policies more closely. At the moment, the BoJ is continuing to press the accelerator while the government is trying to hit the brakes.

With the Bank of Japan continuing with its yield curve control policy, you can’t help but feel that the USD/JPY is either going to explode higher soon or there will be another big intervention coming from Japanese authorities, or both. In fact, Japan’s top currency diplomat, Masato Kanda, on Friday, warned of more intervention and said that he had never felt there was a limit in “ammunition” available for currency interventions.

“I’ve never felt any restrictions. To achieve that end, we are making various efforts.”

It is thus very important to ensure you take extra care when trading the yen pairs.

Disclaimer: The author currently does not own any of the instruments mentioned in this article.

[ad_2]

Source link