Central Bank of Philippines announced rate hike next month

2023.01.10 04:31

Central Bank of Philippines announced rate hike next month

By Ray Johnson

Budrigannews.com – On Tuesday, the head of the Philippine central bank said that interest rates would probably need to go up another 25 or 50 basis points at the policy meeting next month. However, he said that there was less pressure to match rate increases by the US Federal Reserve.

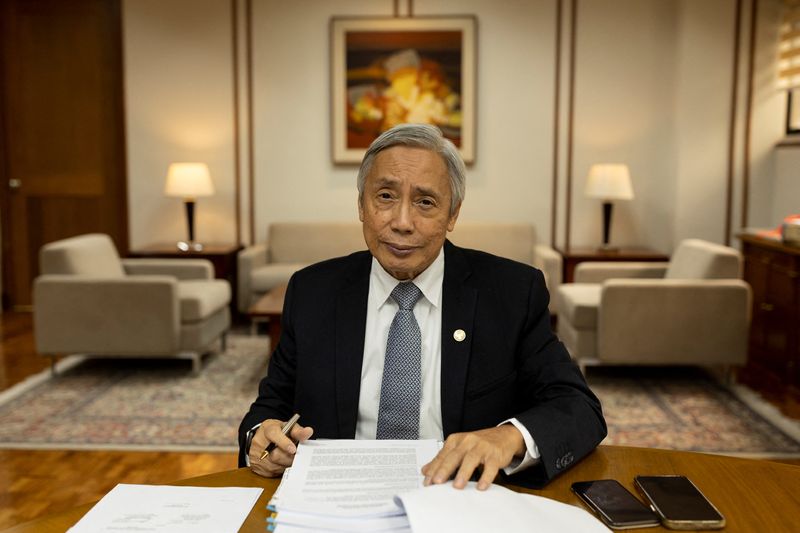

“The pressure on us to match U.S. increases will be much lower,” Governor Felipe Medalla of the Bangko Sentral ng Pilipinas (BSP) told reporters. We no longer need to make significant adjustments.”

Medalla anticipates that inflation will fall within the 2 to 4 percent target range for this year by the second half, as the BSP prepares to take additional measures to ease consumer price pressure.

He predicted that inflation will likely fall below the target range’s midpoint by the end of 2023 or early 2024.

On February 16, the BSP will hold its first policy meeting of the year. Last year, as inflation reached a 14-year high, the BSP raised its benchmark interest rate by 350 basis points.

Inflation and, to some extent, a strong dollar are currently the central bank’s primary concerns, and Medalla stated that he could not rule out further rate increases until inflation pressures ease.

“I will say that the output reduction caused by the monetary policy does not concern me. “The fact that we are behind schedule and will have to sacrifice more output in the future is what worries me,” he stated.

The full-year average for inflation was 5.8% in December, well above the central bank’s target range of 2%-4%. This was the highest level since 2008.

More France’s New Pension Reform

Nevertheless, Medalla asserted that despite the BSP’s tightening of policy, the economy remained robust, with pent-up domestic demand likely to continue supporting growth.

He predicted that the economy could expand by more than 6% this year.