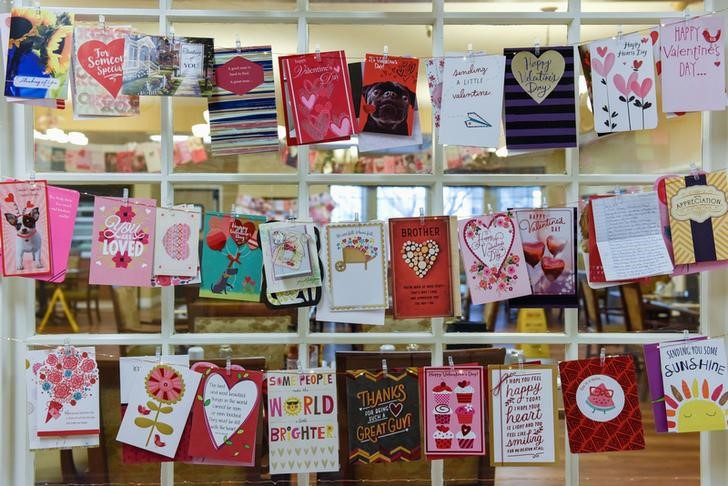

CD&R explores sale of American Greetings, sources say

2024.08.01 17:07

By Abigail Summerville

NEW YORK (Reuters) – Private equity firm Clayton, Dubilier & Rice (CD&R) is exploring options including a sale of American Greetings that could value the 118-year-old greeting card maker at about $1.5 billion, including debt, according to people familiar with the matter.

CD&R, which acquired a majority stake in American Greetings in 2018, is working with Bank of America and Centerview Partners on the sale process, which is expected to attract interest from other private equity firms, the sources said, requesting anonymity as the discussions are confidential.

Founded in 1906, American Greetings could command a valuation equivalent to more than 5 times its 2024 earnings before interest, taxes, depreciation and amortization of about $288 million, the sources said.

The Weiss family, who are descendants of founder Jacob Sapirstein, took the card maker private in 2013. CD&R owns a 60% stake in the company, with the Weiss family holding the rest.

CD&R, Bank of America and Centerview declined to comment. American Greetings did not respond to requests for comment.

The greeting card industry has been struggling to stem a fall in revenue due to the rapid growth of digital cards and the decline of brick-and-mortar retailers. This has forced card makers to revamp their operations, slash costs, and shift their focus towards growing sales of online cards.

U.S. demand for greeting cards has declined at a rate of 5.7% a year on average during the five-year period between 2018 and 2023, according to market researchers IBIS World. Hallmark Cards is the market leader in the industry, followed by American Greetings, according to IBIS.

Cleveland, Ohio-based American Greetings still generates a majority of its revenue from paper greeting cards that are sold in retailers like Walmart (NYSE:), Target and Kroger (NYSE:). Over the years, it has expanded into gift packaging and party goods, and also operates a digital business called AG Interactive, which offers e-cards and celebrations content.

Its greeting card brands include Papyrus, Recycled Paper Greetings, Paper Rebel, and Carlton Cards.

New York-based CD&R invests across several sectors, including consumer, healthcare, industrials, and technology. Its notable consumer investments include food manufacturer Shearer’s, apparel company S&S Activewear, and pet goods maker PetSafe.