Carl Icahn’s firm cuts dividend in half after short-seller attack, shares slump

2023.08.04 13:19

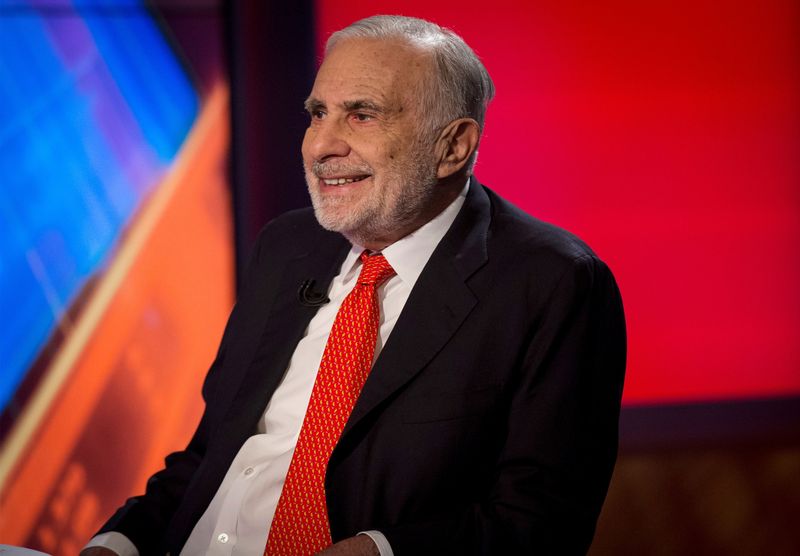

© Reuters. FILE PHOTO: Billionaire activist-investor Carl Icahn gives an interview on FOX Business Network’s Neil Cavuto show in New York February 11, 2014. REUTERS/Brendan McDermid/File Photo

By Niket Nishant

(Reuters) -Activist investor Carl Icahn’s eponymous firm slashed its dividend in half on Friday, just a few months after a prominent short-seller went after the company’s payout structure that triggered a selling frenzy in its shares.

Icahn Enterprises’ shares slumped 25% on Friday, and were on track to shed more than half their value since May 2 when Hindenburg Research accused the company of operating a “Ponzi-like” structure to pay dividends.

Icahn is one of the industry’s best-known activist investors but has struggled to respond to Hindenburg’s challenges, calling the short-seller’s allegations “misleading.”

He has since restructured personal loans that required him to post collateral when the share price fell.

On Friday, he said in a letter that the investment holding company would refocus on activism, reducing unsuccessful bets that the stock market was due for a slump.

Hindenburg said on Friday it remained short on IEP in a post on messaging platform X, formerly known as Twitter.

“Icahn Enterprises will eventually cut or eliminate its dividend entirely, barring a miracle turnaround in investment performance,” Hindenburg said in May when it announced the short position.

On Friday, IEP said it would distribute $1 per depositary unit to its investors for the second quarter, lower than its usual payout of $2 per unit.

The company said losses widened to $269 million, or 72 cents per depositary unit, for the quarter. It lost $128 million, or 41 cents per unit, a year earlier.

Shares fell as low as $20.54 during the session on Friday, hitting their lowest in over two months. Icahn has denied the allegations and has vowed to “fight back” against the short seller’s report.

“We do not intend to let a misleading Hindenburg report interfere with this practice (of distributing dividends),” Icahn Enterprises said on Friday.

In a letter to investors, Icahn touted his firm’s decision to reset its focus on its core activism strategy, and said it had “significantly” reduced hedges over the past six months.

“Our returns have been overwhelmed by our overly bearish view of the market and related oversized short (hedge) positions,” the 87-year-old billionaire investor wrote.

Icahn last month said he had restructured $3.7 billion in personal loans to remove a link between his obligation to post collateral and his holding company’s share price.

After Hindenburg published its report in May, IEP said in a regulatory filing that the U.S. Attorney’s Office for the Southern District of New York was investigating the company.

It is not clear whether the scrutiny from federal regulators was related to Hindenburg’s allegations. The company has provided no update since then.