Canadian Dollar Powers to 5-Week High on Strong Job Numbers

2023.05.08 08:38

- Canada add 41K new jobs

- US nonfarm payrolls jump to 253K

- Canadian dollar surges by 1.2%

The Canadian dollar has extended its gains on Monday. is currently trading at 1.3339, down 0.26%.

Canada’s job market stays hot

Canada’s labor market defied expectations in April, as the economy added 41,400 jobs, above the March gain of 34,700 and the consensus estimate of 20,000. The unemployment rate remained at 5.0%, below the forecast of 5.1%. Wage growth remained unchanged at 5.2%. The employment report was surprisingly strong given that there are signs of the economy weakening, with GDP for March expected at -0.1%.

The BoC is keeping a watchful eye on inflation, which has fallen to 4.3% but is still more than double the BoC’s target. The central bank would like to continue pausing, but a rate cut is unlikely so long as wage pressures remain high.

In the US, for April surprised on the upside, rising to 253,000. This follows a March gain of 165,00, revised down from 236,000, and well above the consensus estimate of 179,000. Wage growth ticked up to 4.4%, above the upwardly revised 4.2% gain in March and above the estimate of 4.2%. Unemployment fell to 3.4%, down from the March reading of 3.4% which was also the estimate.

Somewhat surprisingly, the better-than-expected jobs data did not boost the US dollar, and the Canadian dollar jumped 1.2%, its best one-day showing since January. The markets have repriced a pause in July at 90%, down from 99% just before the employment release on Friday. Fed Chair Powell said last week that rate cuts were not on the table, but the markets have priced in a cut in rates in the fourth quarter.

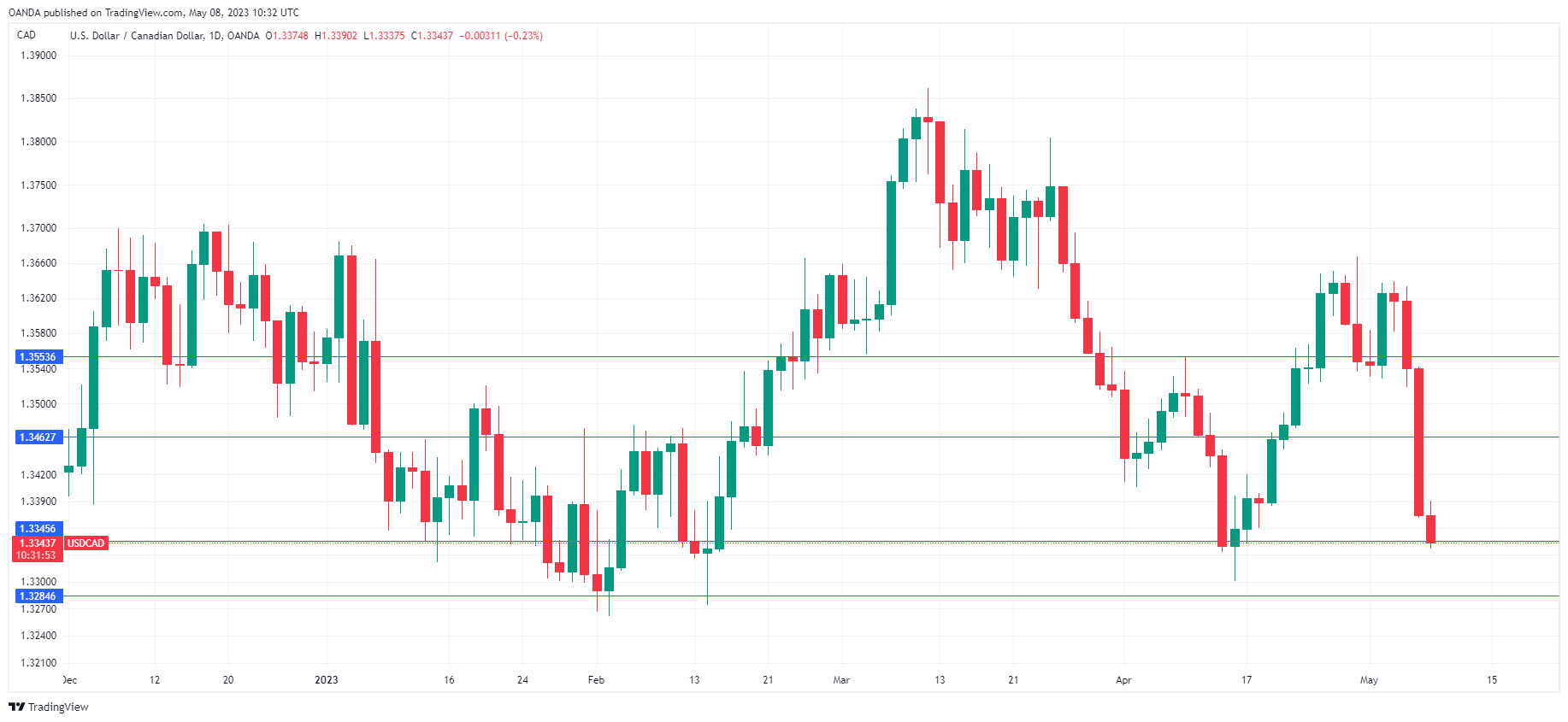

USD/CAD Technical

- USD/CAD is testing support at 1.3345. Below, there is support at 1.3284

- 1.3462 and 1.3553 are the next resistance lines

Original Post