Canadian Dollar Drifting, ISM Manufacturing PMI Next

2023.07.03 10:24

- Canada’s GDP surprises to the upside

- US PCE Price Index eases in June

- ISM Manufacturing PMI expected to contract

The Canadian dollar is trading at 1.3259, up 0.07%. Canadian markets are closed for a holiday and I expect movement to be limited. On the economic front, the US releases ISM Manufacturing PMI. The index is projected to tick lower to 46.9 in June, down from 47.0 in May.

Canada’s GDP climbs in May

Canada wrapped up the week with a strong GDP report. The economy is estimated to have gained 0.4% in May, after flatlining in April. The Canadian economy continues to surprise with its resilience despite rising interest rates.

The Bank of Canada raised rates to 4.75% earlier this month after a five-month pause, arguing that monetary policy was not restrictive enough. The BoC statement pointed at strong consumer spending and higher-than-expected growth as factors in the decision to raise rates. The BoC also expressed concerns that inflation could remain entrenched above the 2% target.

The strong GDP report has added fuel to speculation that the BoC will raise rates again on July 12th but there is also concern that higher rates will lead to a recession. Canadian 10-year bonds have fallen further below the 2-year bonds, as the yield curve inversion, a predictor of recession, has become even more pronounced.

Inflation has been falling and headline inflation eased to 3.4% in May, down from 4.4% in April. Core inflation also declined to 3.8%, down from 4.2%. The question remains whether inflation, still well above the 2% target, is falling fast enough to prevent another rate hike in July.

In the US, there were more signs that inflation is weakening. On Friday, the PCE Price Index, which is the Fed’s favourite inflation gauge, declined from 0.4% to 0.1% in June. As well, UoM Inflation Expectations dropped to 3.3% in June, down from 4.2% in May and the lowest since March 2021. Despite these signals that inflation is decelerating, the Fed is widely expected to raise rates at the July meeting.

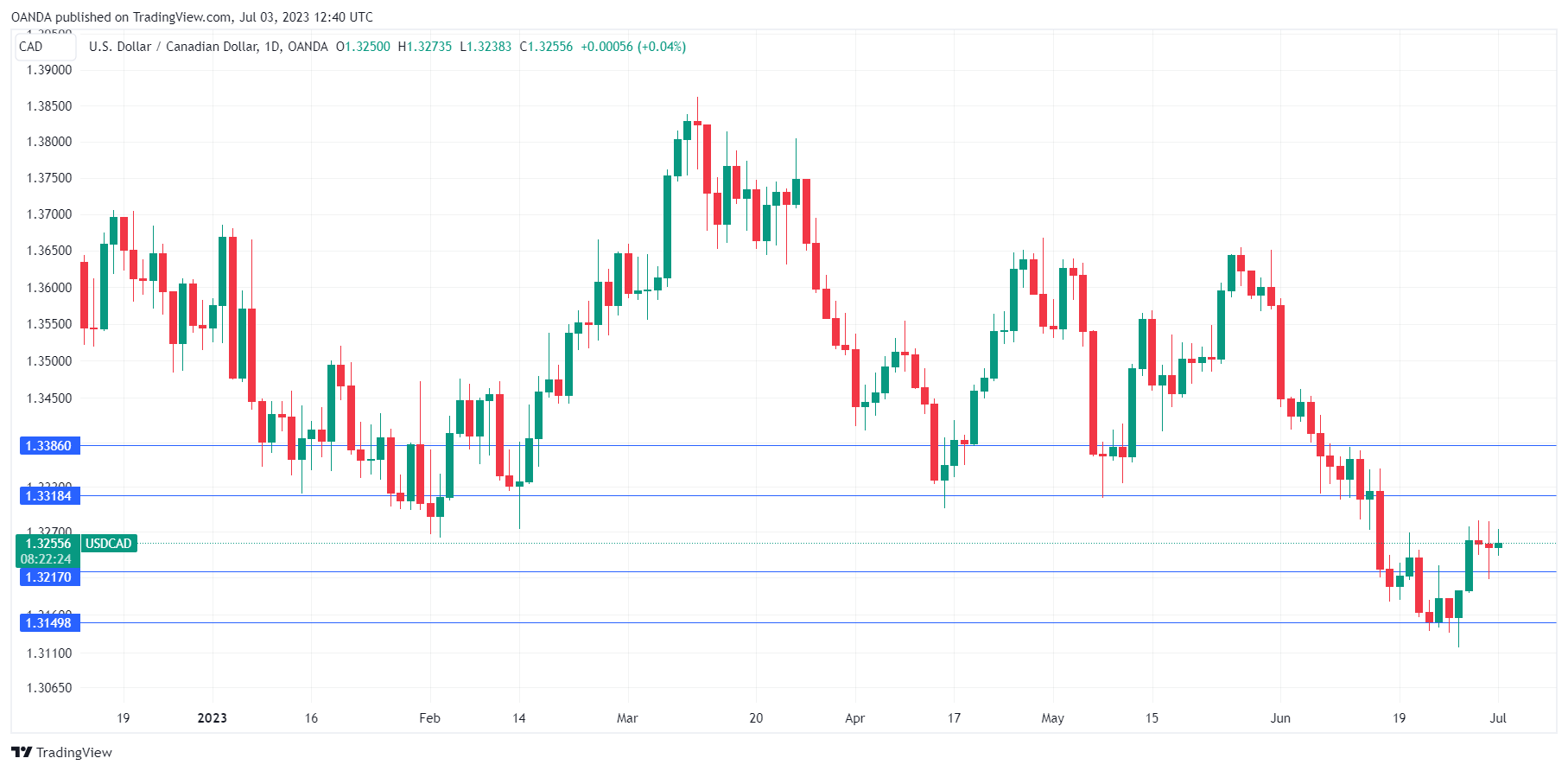

USD/CAD Technical

- USD/CAD is putting pressure on resistance at 1.3254. Next, there is resistance at 1.3328

- 1.3175 and 1.3066 are providing support

Original Post