Can S&P 500 Still Target 4800?

2023.11.13 15:00

Already in early August, see , we warned that per the Elliott Wave Principle (EWP) a major top could be forming for the . We followed up on our forecast regularly, with the market throwing the obligatory and occasional curve ball. But by the end of October, the index had lost 11%. Three weeks ago, see , we found a reversal was likely and:

“The Bulls have one last chance to reach $4800, as long as $4100 is not breached. A corrective pullback in the EWP analysis always takes shape as an a-b-c structure, wherein the W-a comprises three or five waves, whereas the c-wave encompasses primarily five waves. Therefore, because the initial decline from the July $4607 high into the August $4335 low counts best as three waves, it suggests this is an a-b-c corrective pullback. It sets the index up for a rally to ideally $4800 when the pullback completes. However, only one (!) type of pattern can start as a three-wave move and will still complete a full five waves: the “dreaded” diagonal.”

Fast forward, and the index bottomed at $4103 on October 27 and staged a strong enough rally to produce a Zweig Breadth Thrust. Thus, so far, the Bulls stick saved it by three (4100 vs 4103) But is it enough? Allow me to explain using Figures 1 and 2 below.

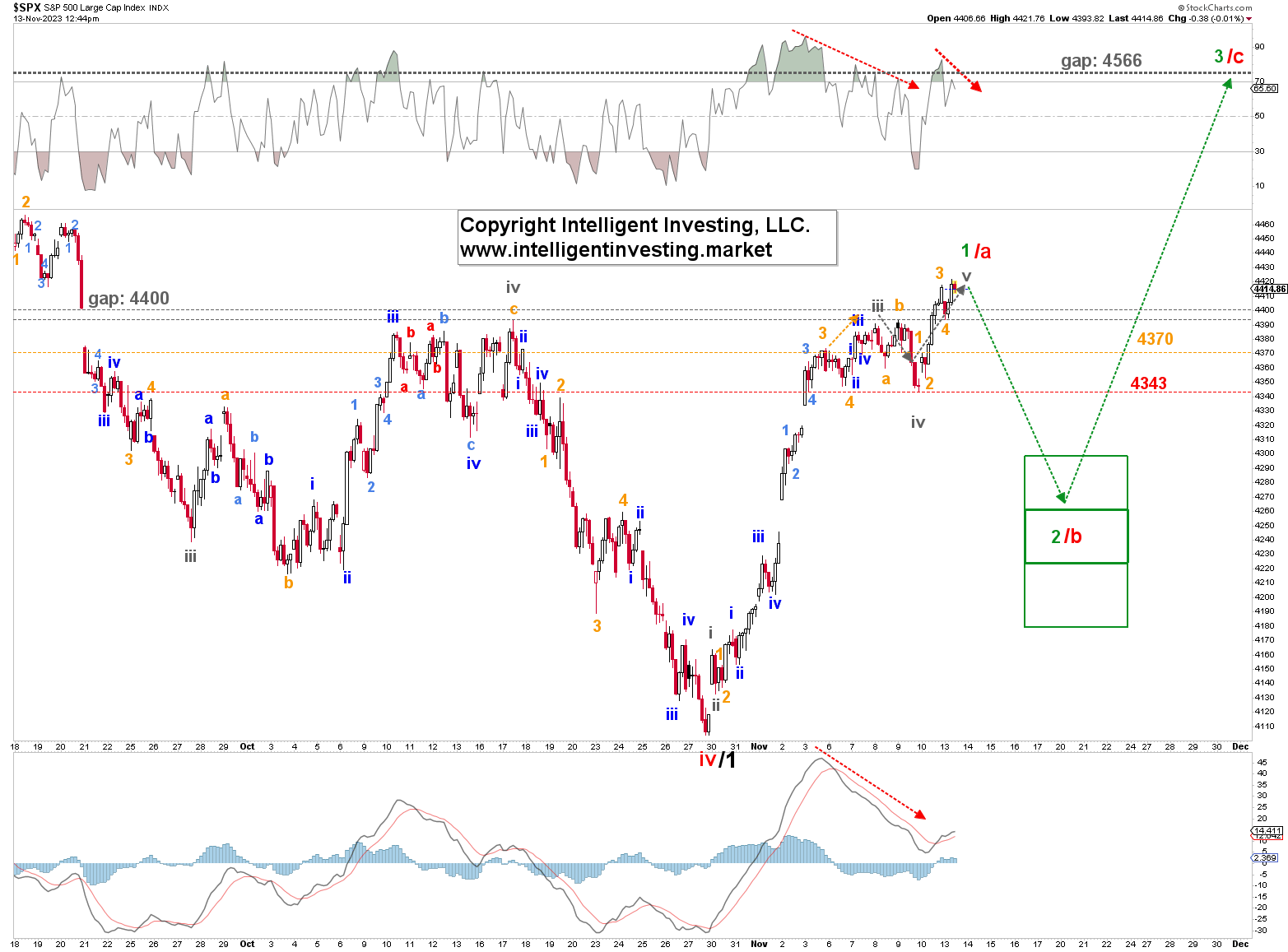

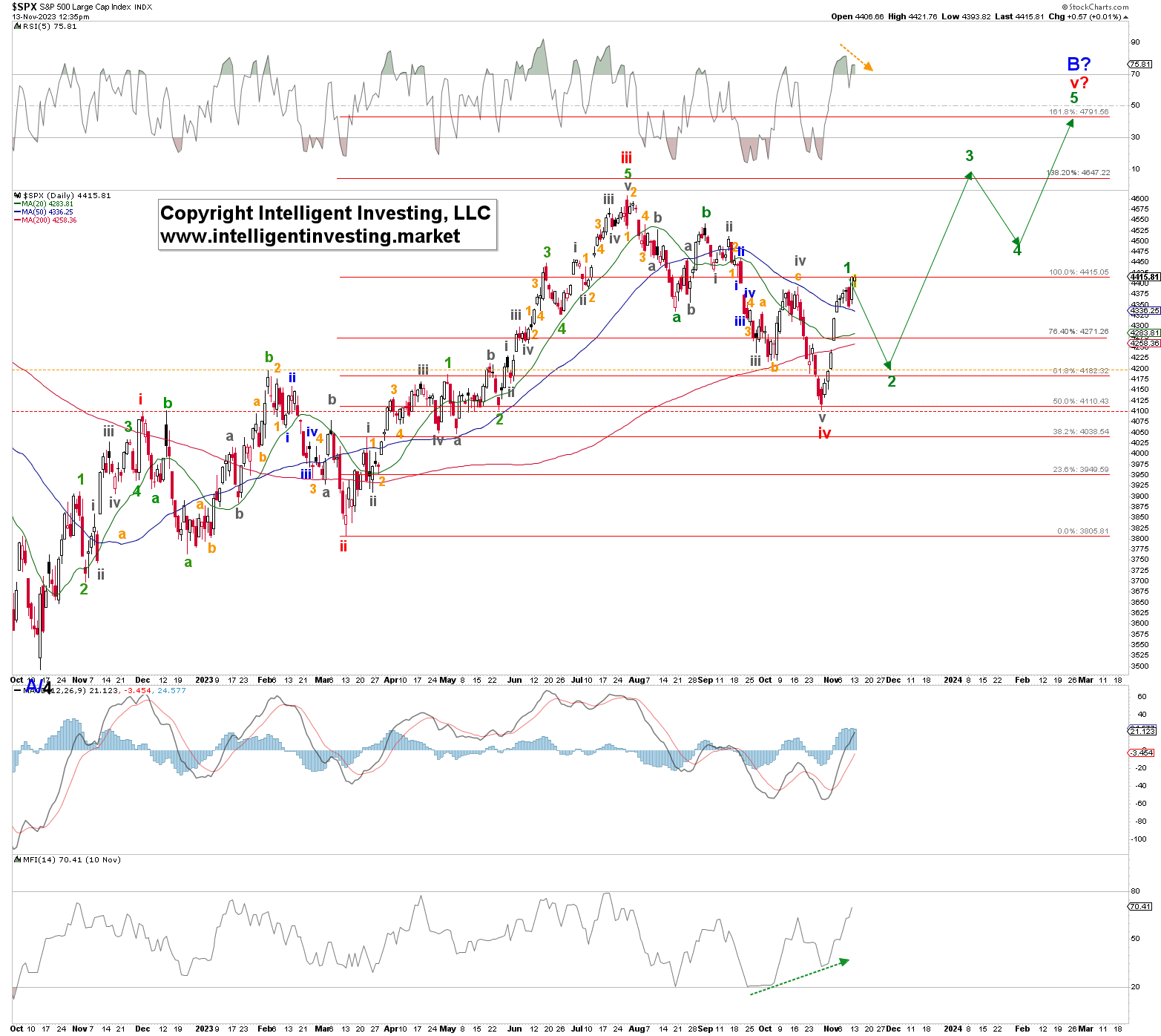

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

The first option, Figure 1, tells us the index bottomed for red W-iv in October and is in a new impulse move (green Wave 1, 2, 3, 4, and 5) higher to the $4800 level: red W-v. Based on the short-term EWP count (See Figure 3), we anticipated green W-1 to wrap up shortly, after which a brief, multi-day pullback, green W-2 to ideally $4240+/-20 will kick in. From there, the index can launch in green W-3 to ideally the $4550ish.

The first option, Figure 1, tells us the index bottomed for red W-iv in October and is in a new impulse move (green Wave 1, 2, 3, 4, and 5) higher to the $4800 level: red W-v. Based on the short-term EWP count (See Figure 3), we anticipated green W-1 to wrap up shortly, after which a brief, multi-day pullback, green W-2 to ideally $4240+/-20 will kick in. From there, the index can launch in green W-3 to ideally the $4550ish.

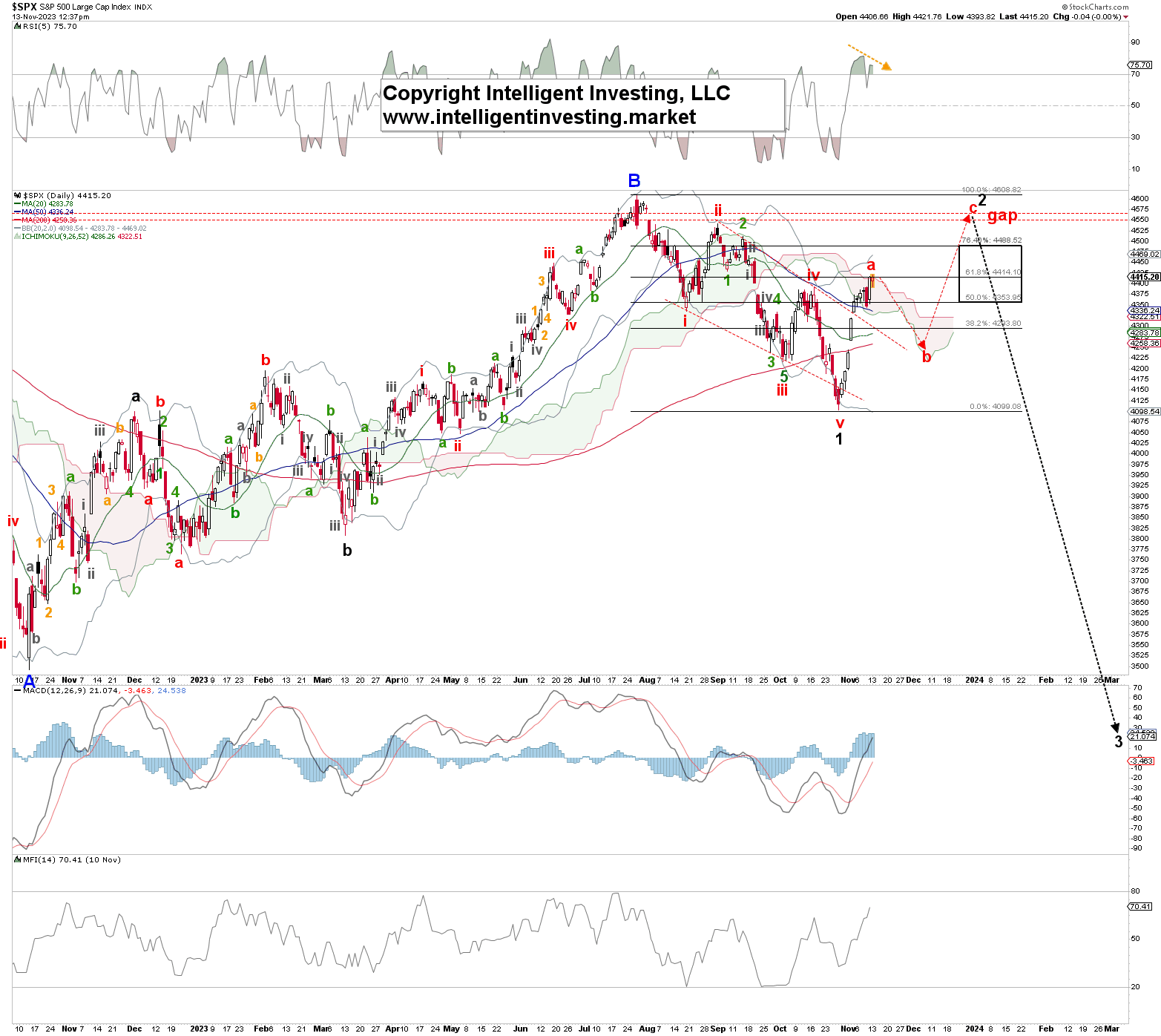

The second option, Figure 2, follows a similar path, but the leading diagonal (black W-1) bottomed out in October, and a counter-trend rally (black W-2) is now underway. As we learned, counter-trend moves, aka corrections, comprise three waves, and in this case, based on the short-term EWP count (See Figure 3), we anticipated the five-wave red W-a to wrap up shortly after which a brief, multi-day pullback, red W-b to ideally $4240+/-20 will kick in. From there, the index can launch in red W-c to ideally the $4560 to close the August 2n gap down open, where c=a.

Figure 2. Daily SPX chart with detailed EWP count and technical indicators

Hence, in the intermediate term (over the next few weeks), both options allow for the same path forward, but once the $4550/60 level is reached, the market can decide to take path 1 or 2. We don’t know yet. From a risk/reward perspective, please note that path 1 will lead to marginally higher prices ($4800), with the potential of $5000 (+5 to 10%) from where the next significant pullback can be expected. In contrast, path 2 says the subsequent considerable decline (-50%) will start there.

Hence, in the intermediate term (over the next few weeks), both options allow for the same path forward, but once the $4550/60 level is reached, the market can decide to take path 1 or 2. We don’t know yet. From a risk/reward perspective, please note that path 1 will lead to marginally higher prices ($4800), with the potential of $5000 (+5 to 10%) from where the next significant pullback can be expected. In contrast, path 2 says the subsequent considerable decline (-50%) will start there.

Figure 3. Hourly SPX chart with detailed EWP count and technical indicators