Cameco Is the Leading Play on Nuclear Power – And It Pays to Own

2024.10.30 12:31

- Cameco is the leading provider of uranium fuel for nuclear reactors and is well-positioned to benefit from a boom.

- The company makes money, generating sufficient cash flow to pay an annual dividend.

- Analysts and institutions support the uptrend in price action: analysts predict another 25% to 50% upside is possible.

Cameco (NYSE:) is the leading player in nuclear power today because it is the leading provider of uranium. The industry would be powerless without uranium and the services that turn the raw ore into usable fuel.

Cameco’s business spans the industry from mining to finished products that fuel light and heavy-water reactors. The critical detail is that this company makes money today, unlike the speculative next-gen reactor stocks, and its 250% two-year share price increase reflects this.

What matters today is that a growing demand for fuel from the established nuclear power production industry supports Cameco’s business. The company has ample reserves, sufficient exploration to offset reserve depletion, and positive cash flow to sustain balance sheet health and capital returns. The business is also supported by diversification into services. The recent acquisition of Westinghouse, an established provider of reactor supplies, equipment, and services, provides a more diversified revenue stream, increased visibility, and an avenue for growth.

Cameco’s Tier-One Assets Sustain a Healthy Growth Outlook

Cameco’s quarterly results are variable due to the timing of shipments but sustain an upward annual growth trajectory over time because of the growing demand for products. The results in Q2 reflect YoY growth, but operational quality and the trend are more important. The company operates a network of tier-one assets that are large, low-cost, have a long life span, and drive solid cash flows annually and throughout business cycles. The latest company data lists 485 million pounds of U₃O₈ reserves, also known as yellowcake, or about 16 years of sales at the current pace of production.

Cameco’s margin is solid and improving due to steadily rising uranium prices. The uranium spot price has trended higher because of increasing demand since hitting bottom in 2017 and is only expected to increase as time goes by. The U.S. alone has a half-dozen or more nuclear projects tracking toward completion within the next five to seven years and nearly 60 worldwide.

Recent investments from big names like Amazon (NASDAQ:), Google (NASDAQ:), and Microsoft (NASDAQ:) will likely increase the number of reactor projects over the next year or two, as they need nuclear to power their data centers. The next-gen data centers built to run the high workloads of AI use significantly more power than their predecessors, and their consumption will only increase as AI infrastructure technology advances.

The capital return isn’t robust but is reliable. The payout runs at less than 0.25% yield, with shares near $80, but it is only 15% of the earnings. The outlook for earnings is for substantial growth in 2025, aided by internal efficiency, uranium prices, and demand, so a distribution increase is possible.

Analysts and Institutions Provide a Tailwind for Cameco Stock Price

The sell-siders, including analysts and institutions, provide a tailwind for Cameco’s stock price in 2024. The institutions own a significant 72% of the stock and bought on balance in Q2 and Q3 and so far in Q4, helping to lift the price action by 28% for the year and nearly 35% since the low set over the summer.

The analyst activity suggests the upswing will continue, with seven tracked by MarketBeat rating the stock with a consensus of Buy and a price target 25% above the all-time highs near $56. The revision trend is positive, with the consensus up by 11% since the Q2 release and the freshest targets leading to the high-end range or 20% above the consensus.

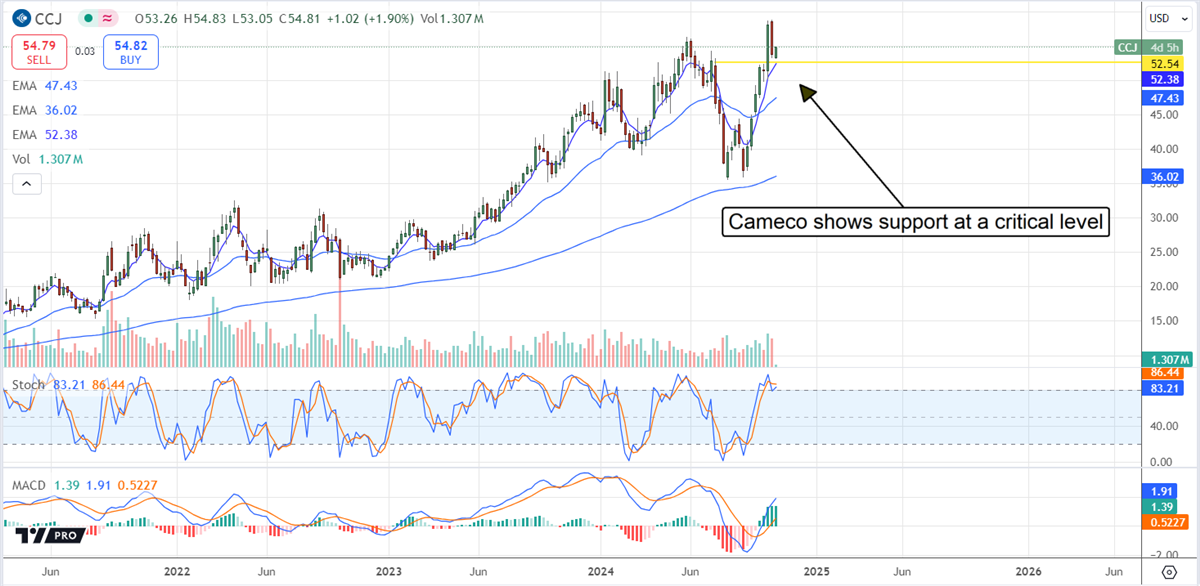

The price action in Cameco stock is favorable. The trend is upward, and the indications are strong, with MACD steady near a recent peak and a record high for the histogram. There is a risk of a deeper pullback in the price action, but support appears to be strong at nearly $52.50, which is the critical level.

A move below that level could lead to another 5% to 10% price contraction, but that is not expected. The company reports Q3 results in early November and is expected to produce another quarter with solid cash flow.

Original Post