California regulator to decide on PG&E base rate hike request

2023.11.16 14:33

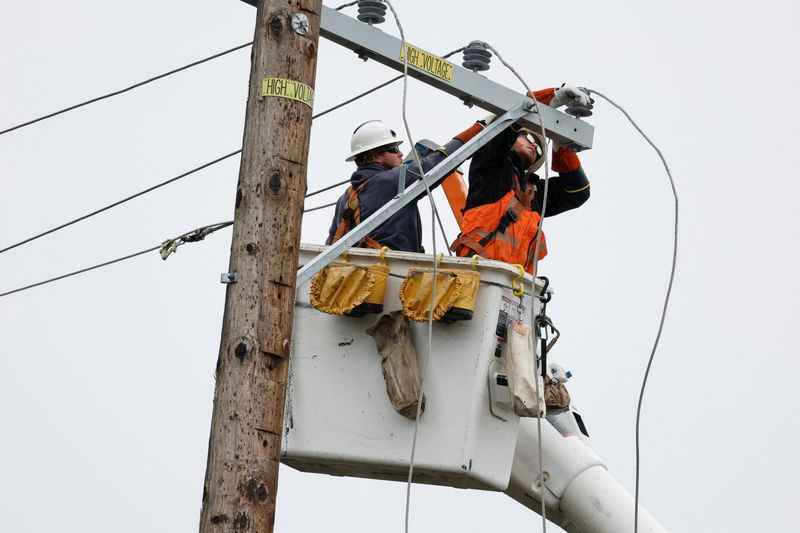

© Reuters. Pacific Gas & Electric crew repairs power lines in West Sacramento, California, U.S. January 11, 2023. REUTERS/Fred Greaves/File Photo

(Reuters) – The California Public Utilities Commission (CPUC) on Thursday will vote on the state’s biggest utility Pacific Gas and Electric’s request to increase its base rate.

PG&E (NYSE:), which serves more than 16 million people across 70,000 square miles in Northern and Central California, aims to utilize the higher rates to boost revenue to aid its wildfire mitigation plans by passing the costs onto customers.

As per the General Rate Case filed with the CPUC last year, PG&E is seeking to raise revenue by nearly 26% in the 2023 test year. The company said it would invest nearly 62% of the requested revenue requirement for its wildfire risk management plans.

CPUC judges, however, have suggested raising revenue by 11% or 13% from 2022.

PG&E said in October this year that it does not see either decisions suggested by the CPUC as sufficient, adding it was falling short of providing the funding to accomplish the necessary safety work it has proposed on behalf of customers.

The amended GRC in 2022 showed a nearly 15% increase in customer bills.

One of the main wildfire mitigation efforts PG&E has been undertaking is undergrounding, or burying power lines. This lessens the need for public safety power shutoffs, which are a last resort during dry, windy conditions to reduce the risk of sparking a wildfire.

In 2021, PG&E had said it would bury 10,000 miles of power lines in high-risk fire zones as a safety measure after its equipment caused multiple destructive wildfires over several years.

So far in 2023, the company said 197 miles of powerlines had been undergrounded and energized as of Oct. 30. The end-of-the-year target is 350 miles.

PG&E proposes to underground approximately 3,600 circuit miles in its 2022-2026 time frame.