Bulls Deliver Confirmed Accumulation in U.S. Indexes

2023.04.03 04:00

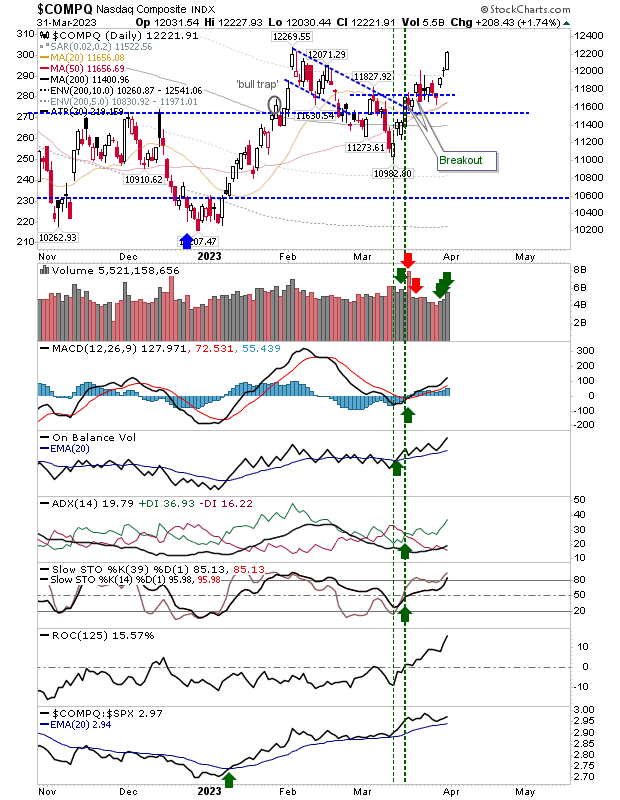

Friday was an excellent day for longs, with all indexes recording gains on higher volume accumulation. The is outperforming both the and , and with the smell of recession in the air, this index is performing remarkably well.

Technicals are net bullish. I want to find something bad to say about the index, but there is little negative to say at this point.

COMPQ Daily Chart

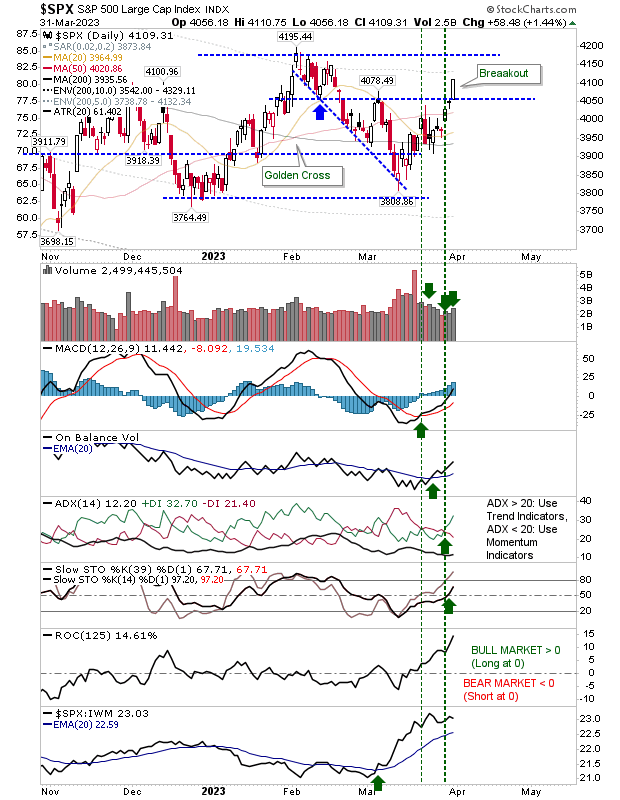

The S&P 500 has surged in relative terms since the start of March. Friday’s gain marked a new resistance breakout, taking out the early March high. As with the Nasdaq, technicals are net bullish.

The index trades above all key moving averages and has room for more. Next up is the February high.

SPX Daily Chart

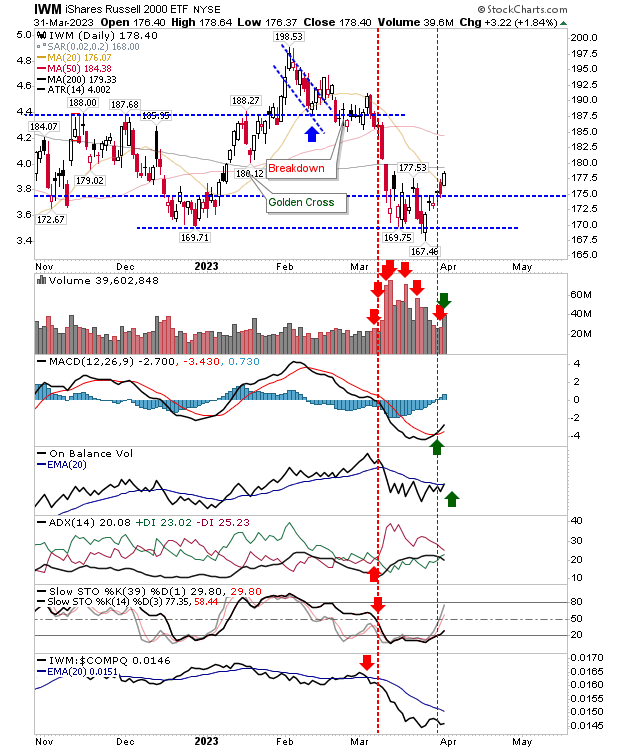

The Russell 2000 has work to do as it works off its lows. The index is sharply underperforming peer indexes as Friday’s gain brings it close to its 200-day MA.

Technicals have started to improve, helped by the ‘buy’ signal in the MACD and On-Balance-Volume. While the Nasdaq is close to new all-time highs, there is the potential for it to help drag this key speculative index with it.

IWM Daily Chart

This week is about consolidating Friday’s mini-surge. It could all turn pear-shaped today, but given a clean breakout, expectations are for something more.