Bullish Exuberance Returns, FOMO Kicks in: A Contrarian Signal?

2023.06.13 11:46

Bullish sentiment has surged as the “Fear Of Missing Out,” or FOMO kicked in in recent weeks. It is somewhat interesting to write this blog, given that we the exact opposite roughly one year ago.

“Investor sentiment has become so bearish that it’s bullish.” – May 10, 2022

As I noted then, one of the hardest things to do is go “against” the prevailing bias regarding investing. Such is known as contrarian investing. One of the most famous contrarian investors is Howard Marks, who once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

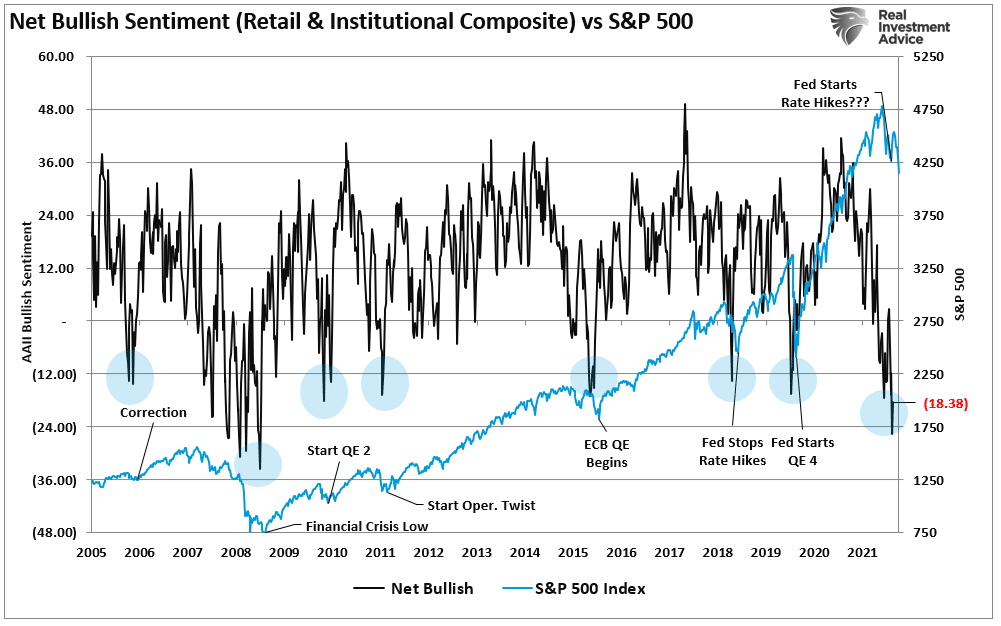

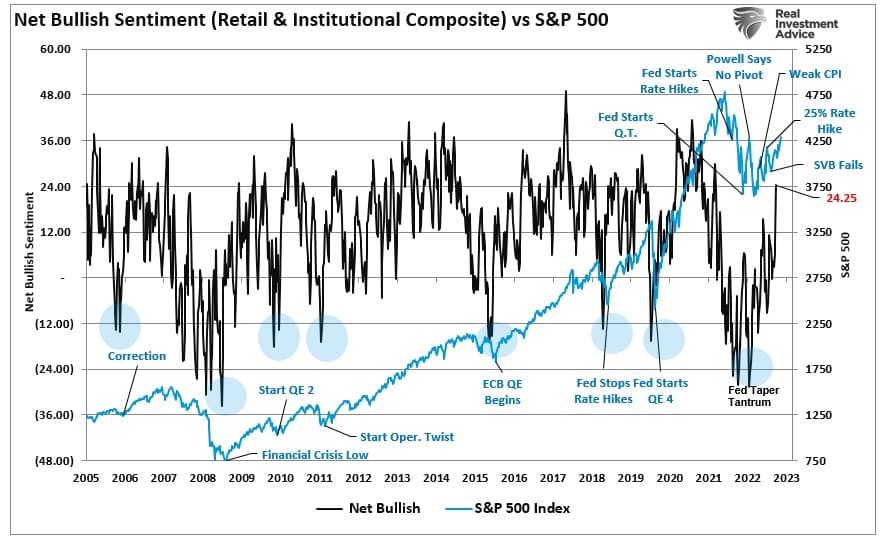

The chart below from that post shows the composite sentiment index. That index combines retail and institutional investor sentiment and, at that time, was hitting bearish extremes, which typically mark short- to intermediate-term market bottoms.

AAII Net Bullish Sentiment

AAII Net Bullish Sentiment

Of course, May did not mark the absolute bottom but did mark the start of a strong rally into August, where the bulls temporarily regained control of the narrative.

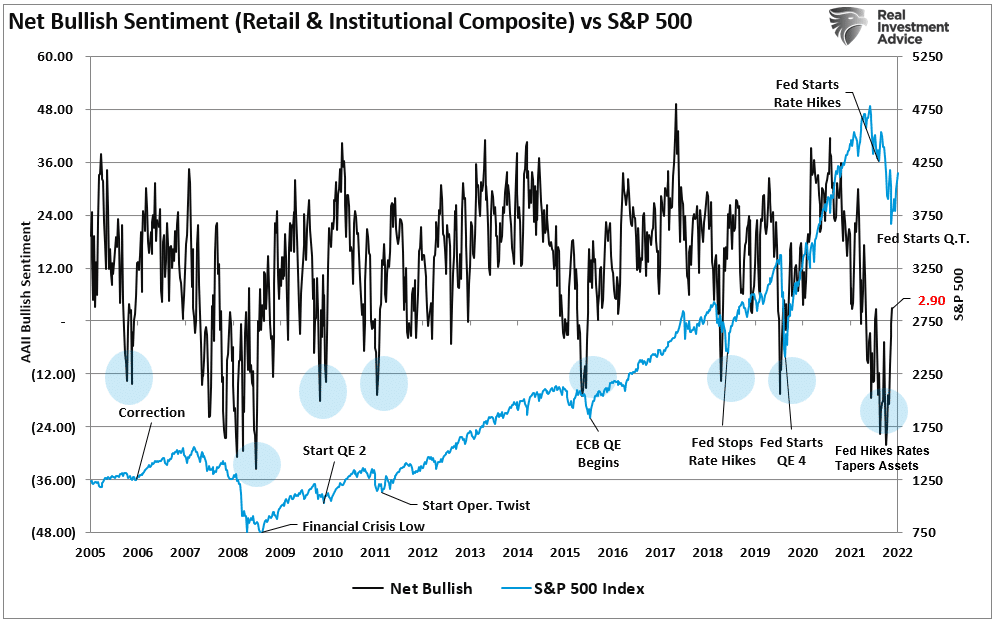

“Following the recent Fed rate hikes and some “better than expected” economic data, the market surged this week. The rally is not surprising given the extremely negative sentiment and positioning in the markets in June. As we noted then, such extreme negative sentiment is a “contrarian” indicator and provides the fuel for a market rally. Such was the case, much like we saw in March this year.”

The previous extreme pessimism levels formed the perfect foundation for a strong bull market rally. That rally took many by surprise, and bullish sentiment began to appear.

AAII Sentiment vs S&P 500

AAII Sentiment vs S&P 500

Of course, it was over the next week as the Federal Reserve crushed the bull’s “hope” for a pivot at the Jackson Hole summit speech. In October, bullish sentiment again plunged to lows as the market set a new low for the year.

However, hope remained that the Fed would “pivot,” and the extremely negative sentiment gave rise to a rally from the October lows. At the end of January 2023, we noted that bullish sentiment was still missing despite the rally, which would fuel a further rally.

“Our sentiment gauge of professional and retail investor sentiment, which, while improved from the October lows, remains depressed.” – Everyone Bearish

At that time, the conclusion was simple. If everyone remains bearish, such suggests the possibility of the market doing something no one expects.

The Market Did Something No One Expected

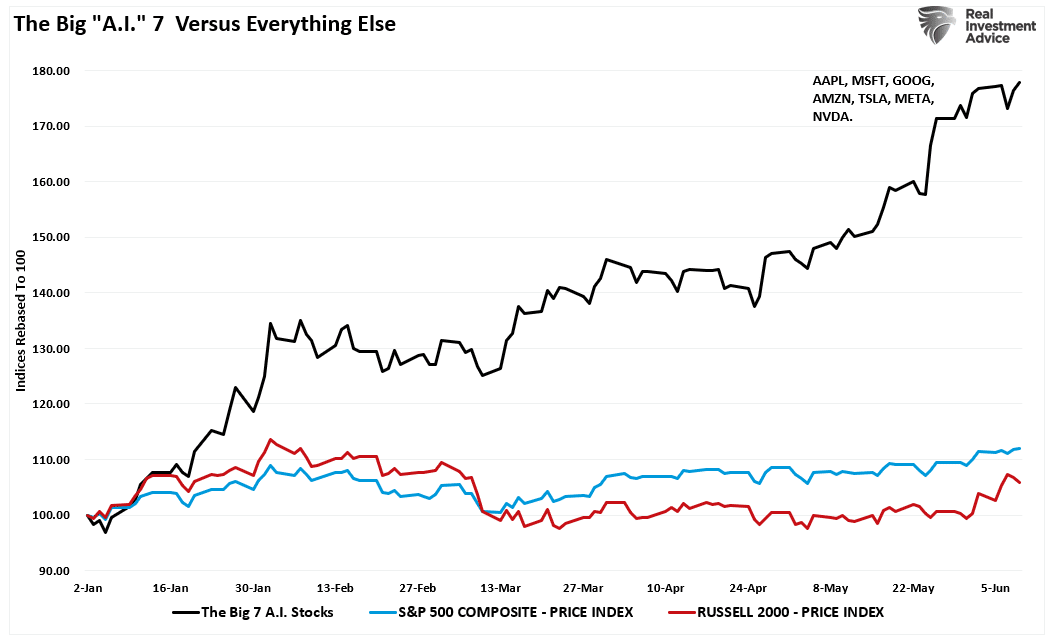

Since the end of January, despite the Fed hiking rates, a bank solvency crisis, and weakening economic data, the market has continued to “climb a wall of worry.” In fact, not only did it climb a wall of worry, investors latched onto a whole new investment theme of “artificial intelligence.”

As earlier this month, if it weren’t for the 7-largest market capitalization-weighted stocks in the , the market would only be higher by a measly 3% for the year, not 12%.

BIG A.I 7 vs Everything Else

BIG A.I 7 vs Everything Else

Of course, given that most investors watch the main index, the pressure on professional investors to generate returns forces money into the market.

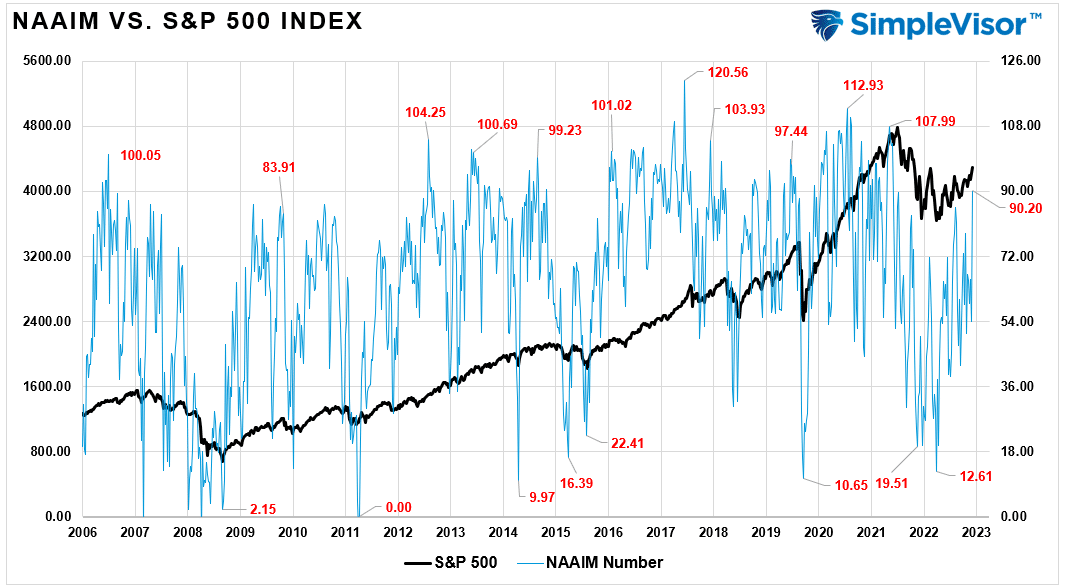

This is seen in the latest shift in the sentiment of professionals, as reported by the National Association of Active Investment Managers (NAAIM).

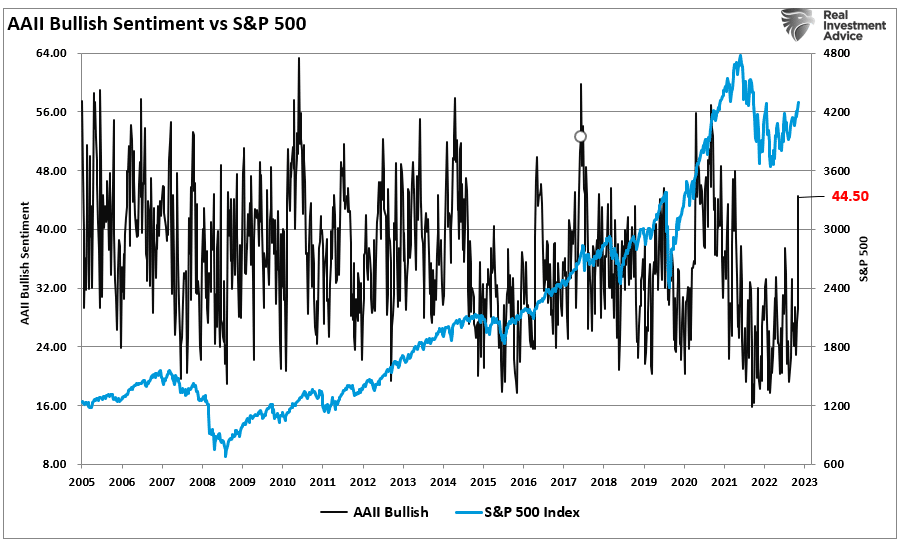

Of course, since retail investors tend to be the most emotionally driven players in the market, it is not surprising that the media headlines have sent them rushing back into the casino.

Exuberance Returns

“The current chase for stocks related to “artificial intelligence” has undoubtedly grabbed everyone’s attention. Retail investors are jumping back into the markets with both feet for the first time since last year.”

AAII Bullish Sentiment vs S&P 500

AAII Bullish Sentiment vs S&P 500

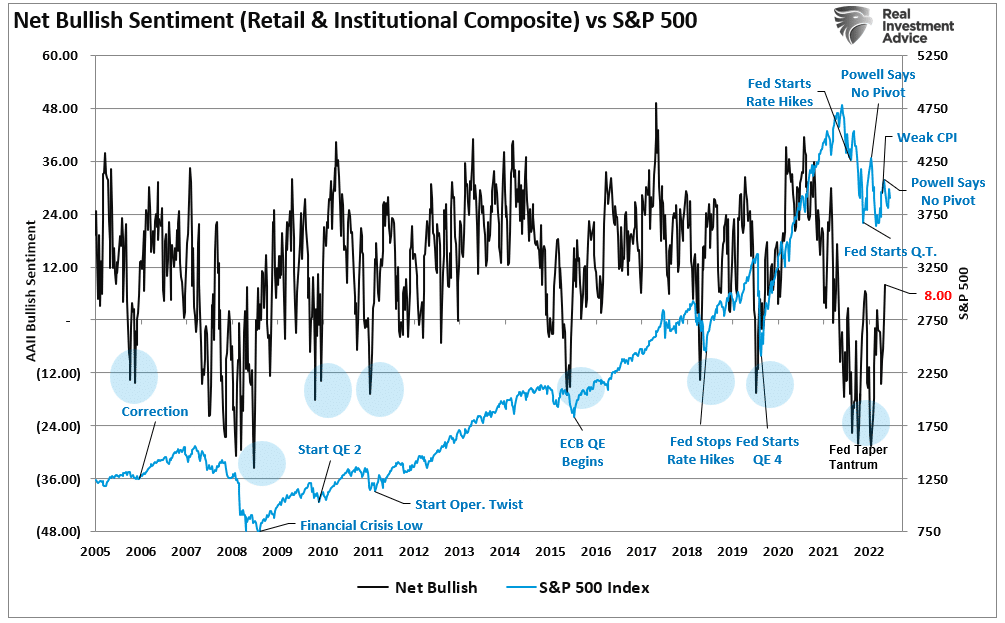

The shift from bearish to bullish sentiment has been steady since the beginning of March. However, recently, there was an apparent capitulation as bearish investors turned bullish.

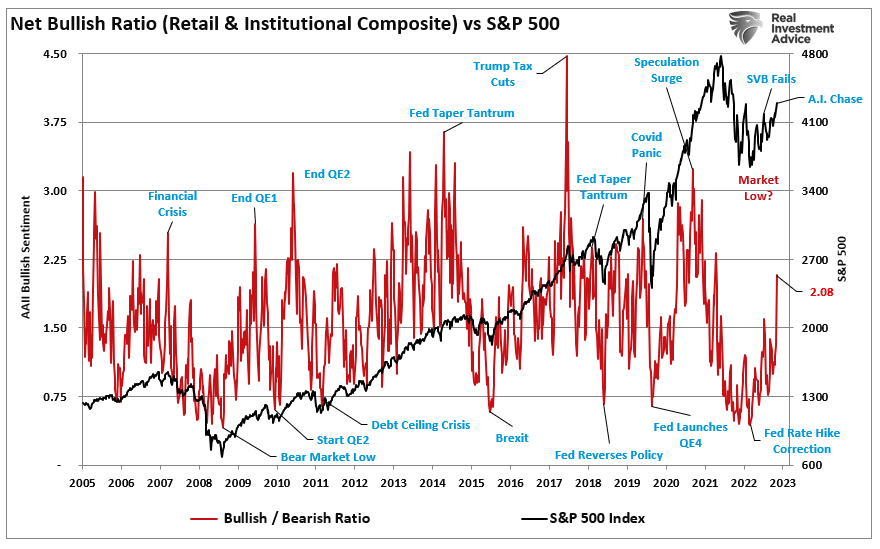

As the market climbed, the “Net Bullish Ratio” (bullish, less bearish investors) of retail and professional investors turned sharply higher in recent weeks.

While not at levels usually associated with market peaks, the sharp turn higher suggests a capitulation by the bears.

Net Bullish Ratio vs S&P 500

Net Bullish Ratio vs S&P 500

At the same time, many Wall Street firms have also capitulated to raise year-end price targets substantially higher. To wit:

- “BofA is raising its S&P 500 2023 year-end target from 4000 to 4300 based on five indicators yielding a range from 3900 (Fair Value) to 4600 (Sentiment).” – Savita Subramanian.

- “With the end of the Fed hiking cycle upon us, and the AI story probably with further legs, we move our US equity underweight back to neutral, and the technology sector to an overweight.” – Citi.

- “We are raising Goldman’s S&P 500 year-end price target to 4500 from 4000, representing 5% upside from the current 4299 level.” – David Kostin.

Not surprisingly, as the rally ensued, being out of the market, or underweight equities, made it extremely challenging to maintain client happiness. The turn in sentiment resulted from the “pain” felt by investors on the sidelines. However, while that turn in bullish sentiment is not yet to more extreme levels, it is often the sign of the end of a rally rather than the beginning of one.

As Bob Farrell’s Rule Number 9 states:

“When all the experts and forecasts agree – something else is going to happen”

It’s Your Choice

As noted above, the return to exuberance continues to rise as fears of a “recession” and “bear market” fade from investor memories. Such is unsurprising, as humans are psychologically wired to forget painful episodes quickly.

If such were not the case, the human race would cease to exist as we would all be huddled in caves, unwilling to venture outside and face the potential of injury or death to gather food.

Returning to our composite net bullish indicator, which suggested extreme bearishness last October, we now see bullishness rapidly returning to the market.

AAII Net Bullish Sentiment

AAII Net Bullish Sentiment

As a contrarian investor, excesses get built by everyone being on the same side of the trade. Previously, everyone was so bearish that the bullish trade higher was inevitable.

As Sam Stovall, the investment strategist for Standard & Poor’s, once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

Regardless of your personal views, the bull market that started in October remains intact. Therefore, we must continue to follow the investment rules practiced by the greatest investors in history.

- Cut Losers Short And Let Winners Run.

- Investing Without Specific End Goals Is A Big Mistake.

- Emotional And Cognitive Biases Are Not Part Of The Process.

- Follow The Trend.

- Don’t Turn A Profit Into A Loss.

- Odds Of Success Improve Greatly When Technical Analysis Supports Fundamental Analysis.

- Try To Avoid Adding To Losing Positions.

- In Bull Markets, You Should Be “Long.” In Bear Markets – “Neutral” Or “Short.”

- Invest First with Risk in Mind, Not Returns.

- The Goal Of Portfolio Management Is A 70% Success Rate.

There are plenty of reasons to be very concerned about the market over the next few months. However, markets can often defy logic in the short term despite the apparent weight of evidence to the contrary.

As investors, we can choose to “hide in our caves,” afraid of the next decline. Or, we can take advantage of the market we have by following rules that bolster our probability of survival.

It’s your choice.