Bullish Compression in Consumer Staples

2023.04.13 03:11

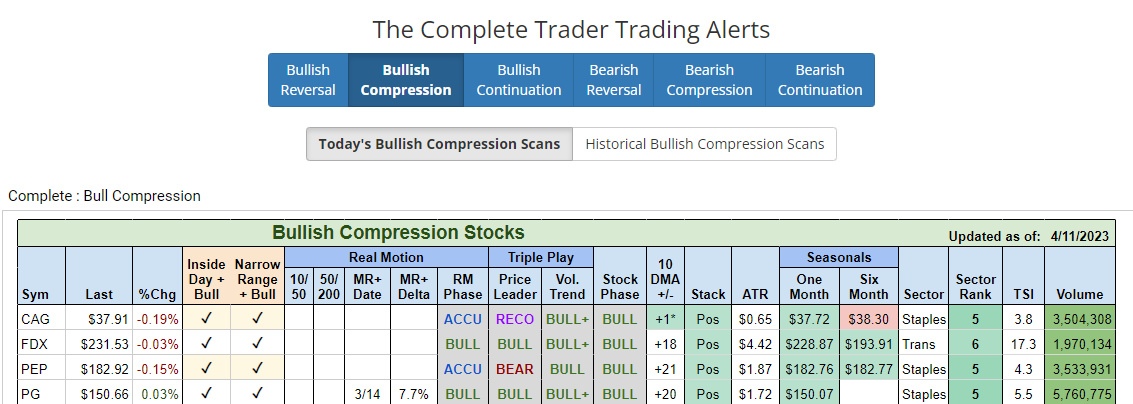

The Complete Trader, as displayed below, is one of my favorite go-to’s for trading ideas.

The columns help determine the trade setup. For example, an “Inside Day” that is also in a bullish stock phase.

And narrow range that shows a narrower trading range than the prior four days ranges.

I like to use it based on market conditions.

So, I will look at bullish compression for example, if the overall market is holding support.

And I also like to look at sectors that are setting up if those sectors are in alignment with the market and, any new economic data.

Today, CPI came in basically as expected.

With my bias towards consumers buying more of what they need, I like the area of consumer staples.

The first 3 of 4 picks are consumer staple companies.

Conagra Brands (NYSE:), Pepsico Inc (NASDAQ:) and Procter & Gamble (NYSE:)).

These featured stocks are for educational purposes only and not buy recommendations. Trading involves risk and we use specific risk parameters with profit targets for every trade we make.

CAG, at the time of writing, has a second inside day potential. That means investors have paused, which makes sense given the heavy data week.

We like to watch range breaks after multiple inside days.

The price is above the 50- and 200-day moving averages. The Real Motion indicator is in line with price so there is no divergence. The risk, if you like moving averages as lines in the sand, is clear.

PEP had a golden cross of the 50 and 200-DMAs at the start of April. The price might be a bit extended as we look at distance from major moving averages to ascertain if we like the risk/reward.

Real Motion has had a mean reversion right at the top prints of 185. Nonetheless, the price action is worth watching.

PG recently had a golden cross. Like PEP, real motion indicates a mean reversion.

Both PEP and PG would be more attractive to us if the price drops closer to the moving averages to control risk.

Nonetheless, 3 takeaways:

- Price Compression in good phases

- Momentum and distance from MAs

- Strong Sector-Seeing the Best Risk/Reward

ETF Summary

- S&P 500 (SPY) 405 support 410 pivotal over- a weekly close over 412.35 positive

- Russell 2000 (IWM) 170 support- 180 resistance

- Dow (DIA) Over some recent consolidation so watch 336 to hold

- Nasdaq (QQQ) 312 support over 320 better

- Regional banks (KRE) 41.28 March 24 low held and now has to clear 44

- Semiconductors (SMH) 258 resistance with support at 250

- Transportation (IYT) 219-228 the wider range to watch

- Biotechnology (IBB) 130 major pivotal area

- Retail (XRT) Becoming a troublesome area-so before we get too giddy-needs to hold 5