British Pound Finds A New Bottom

2022.09.26 15:20

[ad_1]

The is plummeting against the USD. On Monday, after retreating to and testing 1.0350, the lowest bottom since 1985, has returned to 1.0590.

However, it’s not only because of the strong greenback, which significantly influences other traded currencies. The GBP rate drop is also supported by raising concerns about British economic health, and these concerns are pretty huge.

Last Friday, the British chancellor announced a £45-billion tax cut package, expected to be the biggest in the last 50 years. The package is the result of already introduced plans of the British government to compensate for electricity expenses for the country’s population and businesses. Most of these compensations will be financed by selling government bonds.

All this is happening amid the benchmark interest rate hikes announced by the . The regulator must raise the rate by 100 basis points or more to reduce Pound volatility. However, the BoE is highly unlikely to do it.

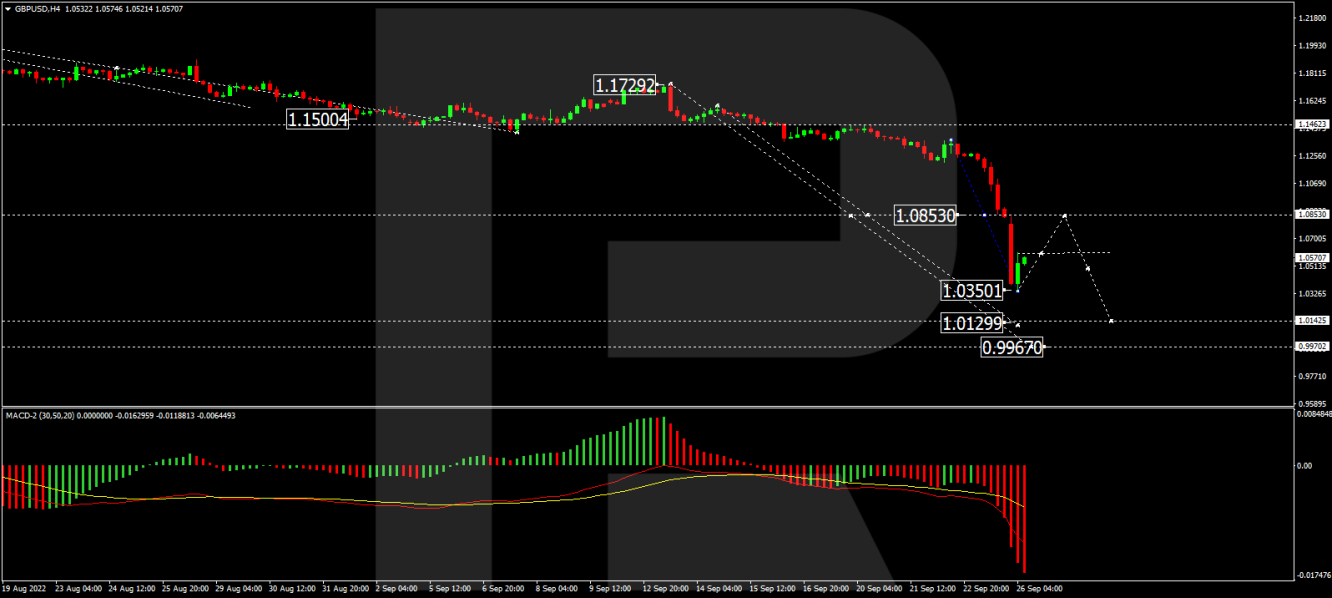

GBP/USD – Technical View

As we can see in the H4 chart, after finishing the descending wave at 1.0853 and forming a new consolidation range, GBP/USD has broken it to the downside to reach the short-term target at 1.0350.

Possibly, the pair may correct to test 1.0850 from below and then resume trading downwards with the target at 1.0130 or even extend this structure down to 0.9967.

From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving below 0 and may continue falling to reach new lows soon.

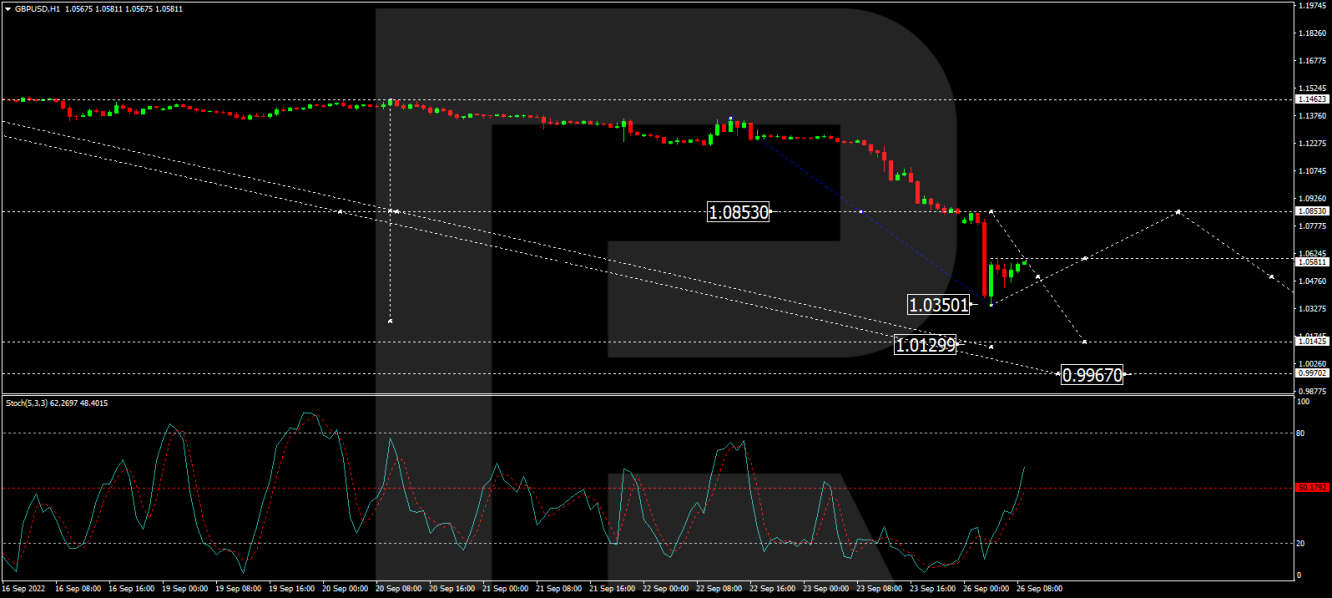

On the H1 chart, GBP/USD has completed the third structure within the descending wave towards 1.0305. Today, the pair may correct to reach 1.0588 or even extend this pullback up to 1.0850.

Later, the market may resume trading within the downtrend with the target at 1.0130.

From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal line is moving above 20. In the future, it may grow to rebound from 50 and resume falling to 20.

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

[ad_2]

Source link