Brazil’s Lula gives nod to market veteran and public servant for central bank roles -sources

2023.03.22 16:29

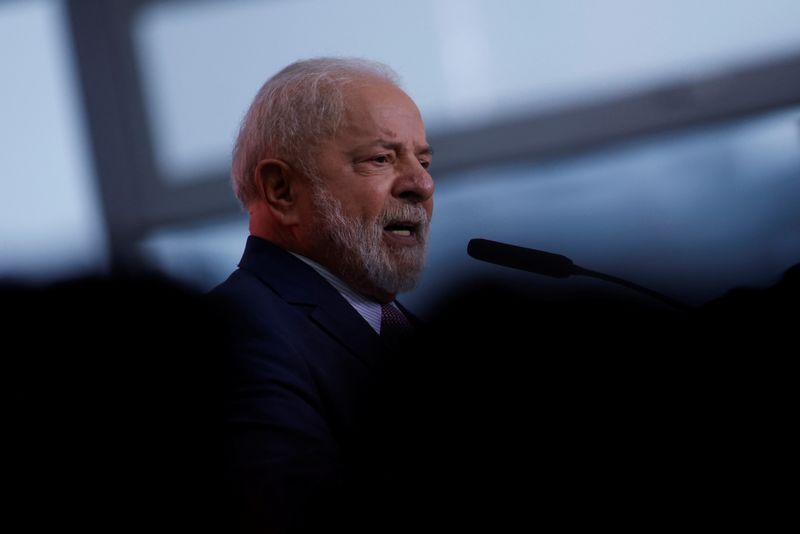

© Reuters. FILE PHOTO: Brazil’s President Luiz Inacio Lula da Silva attends a ceremony at the Planalto Palace in Brasilia, Brazil March 21, 2023. REUTERS/Adriano Machado

By Marcela Ayres, Bernardo Caram and Luana Maria Benedito

BRASILIA (Reuters) – Brazilian President Luiz Inacio Lula da Silva has agreed to nominate a financial market veteran and a public servant for two key positions at the central bank, whose decisions he has blasted recently, three people familiar with the matter said.

The sources, requesting anonymity to discuss internal talks, said former bank executive Rodolfo Froes is expected to replace Bruno Serra as monetary policy director, while career civil servant Rodrigo Monteiro is expected to take over as the head of financial sector supervision, replacing Paulo Souza. Both are subject to Senate approval after Lula’s formal nomination.

Finance Minister Fernando Haddad suggested both names to Lula, according to the sources. Serra and Souza’s terms were set to end in February, but they remain in office and will vote Wednesday on the central bank’s rate-setting decision.

The presidential palace and Finance Ministry did not respond to requests for comment.

Rodrigo Monteiro is a career civil servant at the central bank. Froes describes himself on LinkedIn as an angel investor at San Francisco-based startup Qulture.Rocks.

Froes worked in the early 2000s as a portfolio manager at Bank of America (NYSE:) in Sao Paulo before joining Banco Fator, where he served until 2021 as a board member and vice president. At Fator he worked with Gabriel Galipolo, now executive secretary at the Finance Ministry, who was the bank’s CEO until 2021.

An expert in public-private partnerships, Galipolo is viewed as an economist with connections across the ideological spectrum. He co-authored books and articles with Luiz Gonzaga Belluzzo, a longtime adviser to Lula and economics professor at Unicamp, considered a center of heterodox economic thought.

Carla Argenta, chief economist at CM Capital, said Lula’s approval of Froes was “a pro-market action,” in contrast to the president’s recent attacks on the central bank’s restrictive monetary policy.

Dan Kawa, chief investment officer at TAG Investimentos, called the move “the lesser of two evils,” compared to the possibility of a more left-wing economist.

“The nomination is of an economist without significance in the academic world and with insignificant participation in the financial market,” Kawa said. “It seems to be an indication of Galipolo, from Haddad’s camp.”

Under a 2021 law granting formal autonomy to the central bank, governor Roberto Campos Neto will remain in office until December 2024. Lula, who has attacked Campos Neto and the central bank for keeping interest rates high to fight inflation, will eventually replace all nine members of the bank’s board, which decides monetary policy.

Campos Neto said in February the monetary policy director should ideally have technical experience in trading since the role requires significant interaction with the market. The banking supervision role is usually occupied by central bank’s civil servants.

Lula and several members of his cabinet have harshly criticized the central bank’s benchmark interest rate, which has been held at a six-year high of 13.75% since September despite cooling inflation and an economic slowdown.

Policymakers were expected to keep interest rates unchanged later on Wednesday amid a deterioration in inflation expectations, uncertainty about fiscal policy and growing concerns about a global banking crisis.