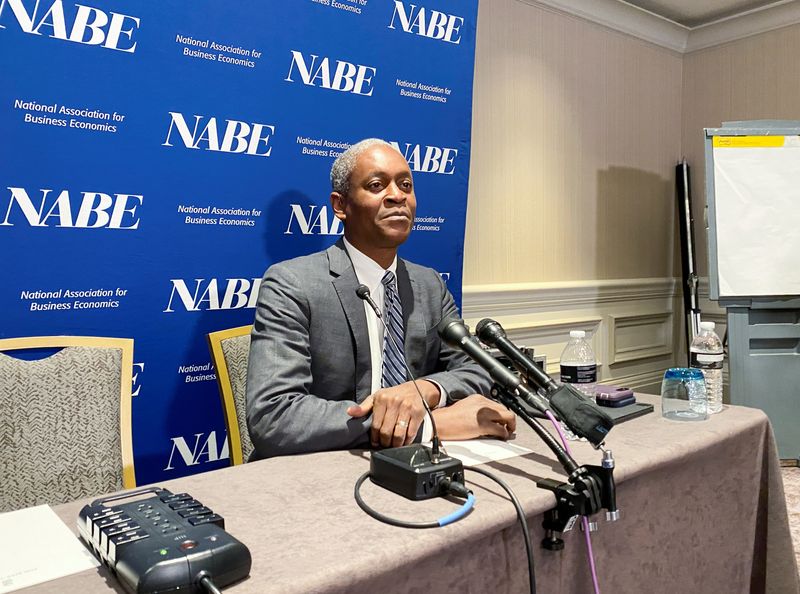

Bostic: Recent inflation data not as encouraging as hoped

2022.07.12 03:17

Budrigannews.com – Recent inflation data “has not been as encouraging as I would have liked,” Atlanta Fed president Raphael Bostic said on Monday, saying that the lack of month-to-month improvement in the pace of price increases warrants another 0.75 percentage point increase in the federal funds rate when policymakers meet later this month.

“The data that came in the last several months really pointed to a need for us to get closer to that neutral stance faster,” Bostic said in comments to reporters, noting that the current federal funds rate, set in a range of between 1.5% and 1.75%, is still in his view “accommodative” and encouraging economic activity.

Following the expected increase at the July meeting, “we will have to see how the economy evolves. … I am not putting too much weight on probabilities for what we will do two, three, four meetings from now.”

Bostic in late May said he wanted to avoid “recklessness” in raising interest rates and supported sticking with the half-point rate increases that Fed officials seemed to broadly back at that point.

But when data showed inflation jumped in May, foiling hopes it had reached a peak, Bostic supported a larger three-quarter-point increase at the Fed’s June meeting, and has now backed another at the session upcoming on July 27-28.

Bostic said he was “comfortable” the U.S. economy is strong enough to weather another large rate increase, and pointed to continued strong job gains even as higher interest rates begin to cool parts of the economy like housing.

The current situation “does not feel like a recession,” Bostic said.

Actions beyond the Fed’s July meeting, however, will depend on how the economy evolves.

“If demand comes down much faster than we expected or supply comes back, I will be comfortable pulling off” further rate increases, Bostic said.

Inflation data to be released on Wednesday is expected to show consumer prices continued rising in June at a more than 8% annual rate, but “what I am looking for … is signs that the month-to-month shift is narrowing in terms of the pace,” Bostic said.