Boom in weight-loss drugs to drive up US employers’ medical costs in 2024 – Mercer

2023.11.17 09:54

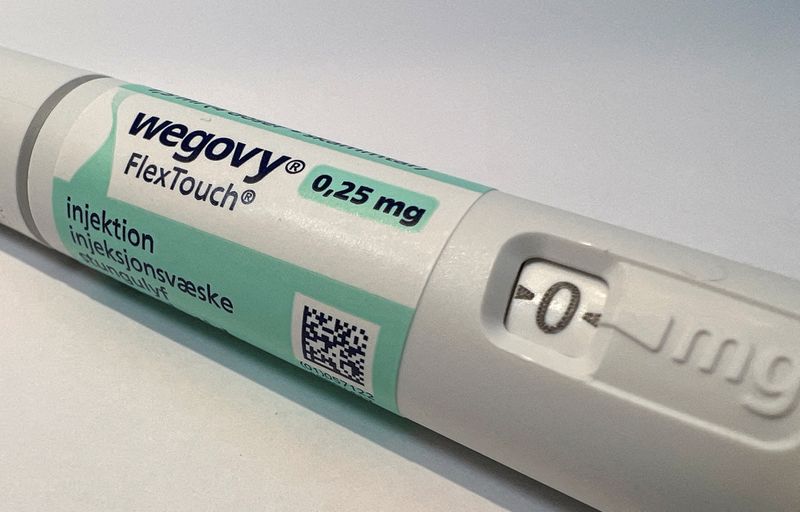

© Reuters. FILE PHOTO: A 0.25 mg injection pen of Novo Nordisk’s weight-loss drug Wegovy is shown in this photo illustration in Oslo, Norway, August31, 2023. REUTERS/Victoria Klesty/Illustration/File Photo

By Leroy Leo and Khushi Mandowara

(Reuters) – Booming demand for newer weight-loss and diabetes drugs is expected to accelerate the rise in medical expenses for employers in the United States next year, staff health benefits consultant Mercer (NASDAQ:) said on Friday.

GLP-1 medications approved by the U.S. Food and Drug Administration could contribute between 50 and 100 basis points to the trend, Mercer’s Chief Health Actuary, Sunit Patel, told Reuters in an interview.

U.S. employers, on average, have budgeted a likely 5.2% rise in these costs for next year, according to Mercer’s survey of nearly 1,900 employers, representing about 134,000 employer health plan sponsors.

An upswing in the use of GLP-1 drugs has had a notable impact on the higher growth of pharmacy benefit costs under such health insurance plans, Mercer said. In 2023, pharmacy benefit costs increased 8.4% year-on-year, compared to 6.4% in 2022.

The higher cost associated with these drugs is due to their pricing as well as the increasing number of patients, Mercer said. GLP-1 drugs, which work by suppressing hunger and making a person feel full longer, are typically priced around $1,000 per patient per month.

Earlier this month, U.S. and UK regulators approved Eli Lilly (NYSE:)’s weight-loss treatment Zepbound, paving the way for a powerful new rival to Novo Nordisk (NYSE:)’s Wegovy in a market estimated to generate $100 billion in annual sales by the end of the decade.

While employers cover the use of GLP-1 drugs as a treatment for diabetes, the debate around providing coverage for them as an obesity treatment lingers. Currently, around two-fifths of large employers cover GLP-1 medication for the treatment of obesity and another 19% say they are considering it, Mercer said.

The impact of staff wage increases by various hospitals on insurance plans is just phasing in, Patel said.

“It may take another couple of years for price increases stemming from higher healthcare sector wages and medical supply costs to be felt across all health plans.”

Despite rising health-plan costs, large employers have avoided shifting additional costs to employees through higher deductibles, co-pays, or out-of-pocket maximums in 2023.

Average insurance premium deductible for employees rose by just $2 at large companies this year and their share in the overall healthcare cost was only 22% on average, similar to 2022, Mercer said.

Most companies are expected to keep their staffers’ share in employer benefit costs at similar levels in 2024, said Beth Umland, director of research for health and benefits at Mercer.

She said employers could instead offset the cost by offering multiple plans and encouraging participation in options that offer better discounts relative to the more expensive ones.

“Healthcare growth rising faster than the general inflation is a concern. And we’re going to be seeing this for a few years to come.”