Bond yields rise due to strong peyrolls report

2022.12.02 12:45

[ad_1]

Bond yields rise due to strong peyrolls report

Budrigannews.com – Assumptions for where the Central bank should accept its benchmark rate in 2023 increased strongly and Depository yields flooded after US work and compensation acquires surpassed conjectures during November.

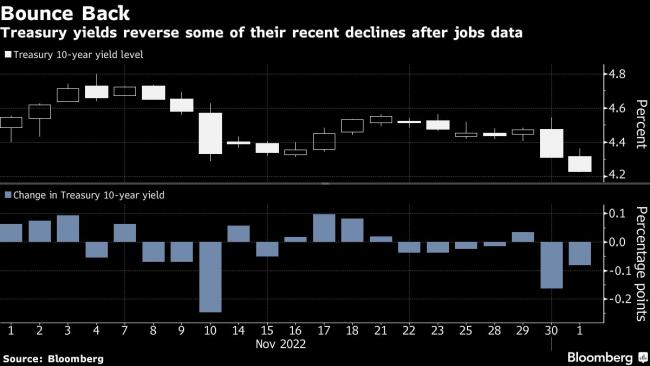

Two-year yields increased as much as 18 basis points to 4.41 percent as a result of the Treasury selloff, while the 10-year yield increased by 13 basis points to 3.63 percent. The outlook for where the central bank’s target will top out rose to 4.98 percent in overnight index swaps linked to Fed meetings, up more than 10 basis points from before the jobs data.

A Treasury market that had rallied strongly over the previous two days was jolted by the upside surprise from the jobs data. This move was sparked by Fed Chair Jerome Powell’s suggestion that the central bank could shift to smaller rate increases as early as this month to avoid over-tightening. The two-year yield was trading below 4.20 percent ahead of the jobs data, its lowest level since early October and down from a high of 4.54% on Wednesday prior to Powell’s speech.

Gregory Faranello, AmeriVet Securities’ head of US rates trading and strategy, stated, “The market was mispriced.” With the Fed expected to raise rates by 50 basis points this month, two-year yields probably belong close to 4.75 percent.He stated that the response to Powell’s remarks “took the anticipated downsizing in rate hikes too far.”

Market expectations that the Fed will return to a half-point rate increase this month following its four three-quarter point hikes were unaffected by the selloff. However, in relation to the final destination and how long to stay there while waiting for inflation to moderate, the pace of hikes has lost importance.

In a note, Chief Investment Officer of Private Wealth at Glenmede Jason Pride stated, “This employment report fails to provide the picture the Federal Reserve would prefer to feel that they are making progress in slowing the economy.”

Employers in the United States created more jobs in November than anticipated and wage growth increased from the previous month, indicating that labor demand is still too strong for the Federal Reserve to control inflation.

Friday’s Labor Department report showed that nonfarm payrolls increased by 263,000 after an upwardly revised 284,000 gain in October.As participation fell, the unemployment rate remained at 3.7 percent.After an upward revision to the previous month, average hourly earnings increased twice as much as anticipated.

On Bloomberg TV, University of Chicago professor and former central bank governor Randall Kroszner stated, “The Fed is going to keep at it until the labor market cracks.” “And the labor market has not cracked.”

[ad_2]