BOJ’s dovish deputy Amamiya top candidate as next head – Reuters poll

2022.09.21 00:39

[ad_1]

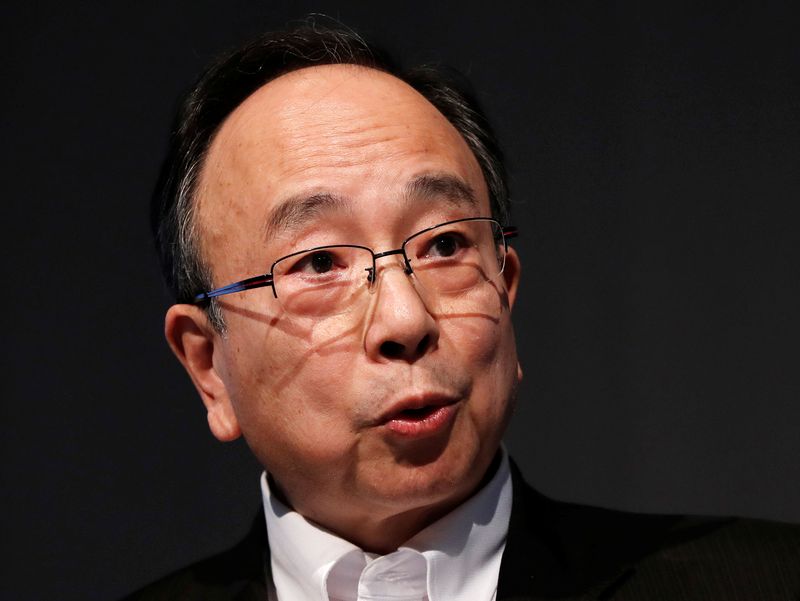

© Reuters. Bank of Japan Deputy Governor Masayoshi Amamiya speaks during a Reuters Newsmaker event in Tokyo, Japan July 5, 2019. REUTERS/Issei Kato

By Leika Kihara

TOKYO (Reuters) – The Bank of Japan’s dovish deputy governor Masayoshi Amamiya ranked top among candidates to become the bank’s next head in a Reuters poll of economists, a sign he remains the market’s favourite to succeed incumbent Governor Haruhiko Kuroda.

The government’s choice of a successor to Kuroda, whose term ends in April next year, will be crucial to whether and how soon the BOJ could phase out the massive stimulus programme he deployed a decade ago.

Of the 21 economists who replied to a Reuters poll conducted Sept. 8-19, 13 chose Amamiya as the most likely candidate to become next BOJ governor in a race that is set to intensify in coming months.

Amamiya is considered by markets as dovish on monetary policy and earned the nick-name “Mr. BOJ” for master-minding many of the bank’s unconventional monetary easing steps.

As Kuroda’s right-hand man, he has consistently called for the need to keep monetary policy ultra-loose to ensure Japan makes a sustained exit from deflation.

Former deputy governor Hiroshi Nakaso ranked second in the poll with seven votes. Like Amamiya, Nakaso is considered a safe pair of hands with his expertise on central bank affairs.

Unlike Amamiya, Nakaso’s career at the BOJ centred on market and international affairs rather than monetary policy.

Long touted as front-runners in the BOJ leadership race, neither Amamiya nor Nakaso would rush into tightening monetary policy given Japan’s fragile economy and the need to keep low the cost of funding its huge public debt, analysts say.

Compared with Amamiya, however, Nakaso is seen as more in favour of dialing back Kuroda’s radical stimulus. In a book published earlier this year, he laid out in detail how the BOJ could end ultra-loose policy.

“The next governor would face the challenge of enhancing the operational functions of the BOJ’s policy framework, without causing big market disruptions,” said Naomi Muguruma, chief bond strategist at Mitsubishi UFJ (NYSE:) Morgan Stanley (NYSE:) Securities.

“It requires technocratic expertise and strength in decision-making,” which makes Amamiya a strong candidate, said Muguruma, who is a veteran BOJ watcher.

Dark horse candidate Masatsugu Asakawa, who is currently head of the Asian Development Bank (ADB), got one vote. Like Kuroda, Asakawa became ADB president after serving as Japan’s top currency diplomat.

A decision is expected to be made by early next year with the prime minister having the final say in the choice.

Two deputy governor posts will also need to be filled with incumbents Amamiya and former academic Masazumi Wakatabe seeing their five-year terms end in March next year.

Hand-picked by then premier Shinzo Abe, Kuroda deployed a massive asset-buying programme in 2013 to fire up inflation to the BOJ’s 2% target. After years of heavy money printing failed to drive up prices, the BOJ reverted to a policy targeting interest rates in 2016 and adopted a 0% cap on 10-year yields.

While rising raw material costs and the weak yen have recently pushed Japan’s consumer inflation above 2%, Kuroda has ruled out raising rates until wage and domestic demand growth accelerates enough to make price rises sustainable.

Economists in the wider poll expected core CPI to rise to 2.4% this fiscal year before decelerating to 1.2% in fiscal 2023. [ECILT/JP]

The BOJ’s dovish stance has made it an outlier among a global wave of central banks tightening monetary policy to combat surging inflation.

Some analysts say the BOJ’s leadership transition as a possible trigger for a policy shift due to mounting concerns over the side-effects of prolonged easing, such as the hit to financial institutions’ profits from ultra-low rates.

“While Kuroda is at the helm, the BOJ’s ultra-loose monetary policy won’t change,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

“But under a new leadership, the bank could reassess its view on the inflation outlook and thinking on monetary policy.”

(For other stories from the Reuters global economic poll:)

[ad_2]

Source link