BOE to Hike Further After Hot Wage Data, U.S. Stocks Struggle on China

2023.08.16 03:48

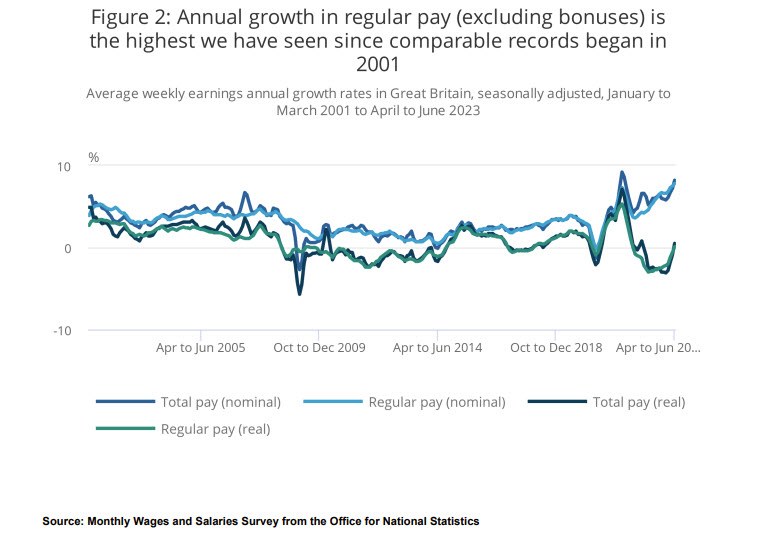

- Record UK wage growth keeps the pressure on the BOE to deliver more tightening

- PBOC rate cut surprise shows officials growing concern with the property crisis

- Fitch warns US banks could face downgrades

Record wage growth will keep the pressure on the BOE to deliver more tightening. The economy still has a tight labor market as companies need to pay their employees more money. The rise in the unemployment rate was due to more people returning to the workforce. Average pay excluding bonuses easily exceeded the consensus estimate of 7.4%, rising 7.8% in the three months through June from a year ago.

This hot wage data is giving the BOE hawks a win as they were right in calling for a half-point rate increase last meeting. The British pound is starting to look attractive again as it seems the BOE will easily be raising rates at both the September and November meetings.

GBP/USD

The British pound is rebounding against the dollar following some hot wage data that is leading to some profit-taking. The pound’s slide which has been in place from a month ago is showing signs of exhaustion. This could be the early stages of a steep bullish correction if prices can recapture the 1.2800 handle. Further bullishness target the 1.2880 level, which is the 50% Fibonacci retracement level of the July high to August low move.

However, if dollar strength remains, bearish momentum could accelerate if price falls below the 1.2600 handle.

US stocks

US stocks remained heavy after a robust retail sales report sent yields higher and raised the odds that the Fed might not be done raising rates. A healthy consumer was supposed to drive soft landing calls, but too much consumer resilience will drive the Fed to keep rates higher for longer. This US retail sales report showed spending is picking up, especially given the upward revisions for June’s report.

Equities were heavy in early trade as concerns grow that China is in a lot worse shape than initially thought. Ahead of some key data, the PBOC decided to be proactive and delivered a surprise rate cut. China cut the 1-year medium-term lending rate facility from 2.65% to 2.50%, which was the steepest reduction since 2020. The data that followed the rate cut was uninspiring for the rest of the year and will force officials into delivering a lot more easing. Key Chinese industrial production, retail sales, and investment data all came in softer-than-expected.

Also weighing on stocks was news that Fitch may be forced to downgrade dozens of banks. Given we probably won’t have a catalyst to make a run at record highs, stocks are vulnerable to weakness throughout the rest of summer.

Stocks

Home Depot

Home Depot (NYSE:) delivered mostly in-line results, but they were able to hold onto their guidance. Big-ticket projects are under pressure, but small projects remain in demand. Share prices rose given the lowered May outlook was reaffirmed and after they set a $15 billion buyback.

Original Post