Bitcoin, $Trump slide, waiting for crypto president Trump’s promises

2025.01.21 04:39

By Tom Westbrook

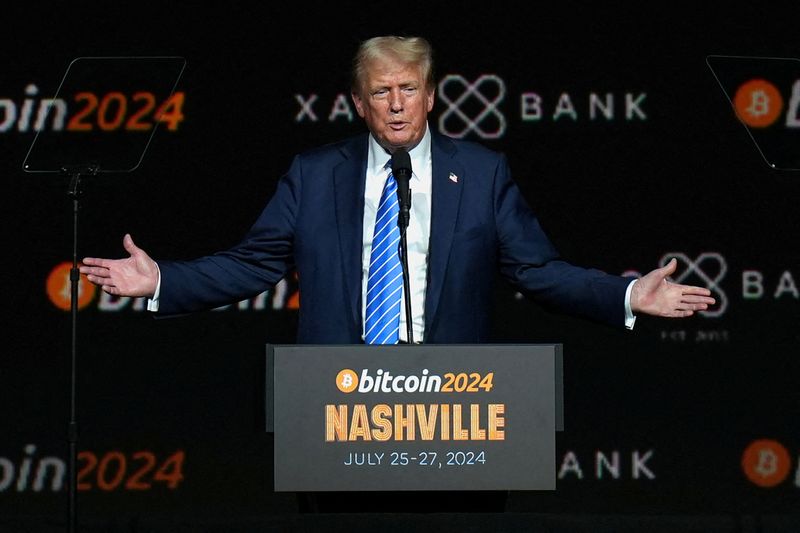

SINGAPORE (Reuters) – and other cryptocurrencies and even the newly minted token bearing Donald Trump’s name recoiled on Tuesday, after the U.S. president’s first set of policies following inauguration made no reference to this asset class.

Bitcoin, the world’s largest cryptocurrency, hit a record high $109,071 on Monday when Trump was sworn in as the 47th U.S. President, but later pared those gains and was last trading at $101,705.40.

The Trump-branded meme coin, launched on Friday night, was last trading at $34.4, according to cryptocurrency price tracker CoinGecko. That is half its peak price of $74.59 on Monday, when valuation exceeded $14 billion. The coin had initially been priced around $6.5 at its launch.

Trump’s inaugural speech on Monday was accompanied by a host of executive orders and plans relating to trade tariffs, immigration, energy deregulation and even a reprieve for popular Chinese short-video app TikTok.

But he did not mention cryptocurrencies, disappointing an industry that had for months been excited the crypto-friendly president would kick-start a sea change in U.S. policies towards the volatile asset class.

“I think in the short term there’s a chance this could be a sell-the-news event,” said Matthew Dibb, chief investment officer at crypto asset manager Astronaut Capital, adding that crypto investors had been anticipating some executive actions to be rolled out during Trump’s first day in office.

“The market has some great expectations about a bitcoin strategic reserve and a loosening of regulations around digital assets, but it’s more likely these developments will be drip-fed over a series of months rather than days. Bitcoin has already retreated … We are expecting further volatility here and likely a selloff,” Dibb said.

Crypto exchange-traded funds sold off too. The ChinaAMC bitcoin ETF shed nearly 6%.

However, Trump has already set in motion personnel changes that the industry sees as encouraging.

He has tapped Mark Uyeda, a Republican member of the U.S. Securities and Exchange Commission, to be acting chair of the agency and plans to nominate former SEC Commissioner Paul Atkins to run the agency on a permanent basis.

Atkins is widely expected to end a crypto crackdown led by former President Joe Biden’s Democratic SEC chair Gary Gensler and Uyeda has criticised the SEC for failing to offer guidance on how crypto companies can register with the agency.

Top Republican officials at the SEC are poised to begin overhauling the agency’s cryptocurrency policies potentially as early as next week, said three people briefed on the matter.

CONFLICT OF INTEREST

Meanwhile, Trump’s launch of the $TRUMP token and the $MELANIA token, for first lady Melania Trump, shortly before his inauguration creates new conflict-of-interest concerns, ethics experts and industry insiders said.

Eighty percent of Trump coin’s tokens are owned by CIC Digital, an affiliate of Trump’s business, and another entity called Fight, Fight, Fight, according to its website.

The companies said they are not investments or securities but are an “expression of support for, and engagement with, the ideals and beliefs embodied by the symbol ‘$TRUMP'”.

World Liberty Financial, a separate Trump-linked crypto project, also announced on Monday that it had completed an initial token sale, raising $300 million, and would look to issue additional tokens.

Trump has pledged to hand management of his assets to his children, but the crypto asset is raising particular concerns due to its ability to quickly attract billions of speculative dollars with little transparency.