Bitcoin Breaks Through $24,000 Despite Declining Hashrate

2022.07.21 15:14

Bitcoin’s declining hashrate leads to the most significant mining difficulty fall since July 2021 as BTC price rallies.

The last week has seen the entire cryptocurrency market witness a relief bounce in price after a persistent decline. Bitcoin, whose short investment vehicles continue to see significant inflows, witnessed an over 15% spike over the past seven days. Even surpassing the $23,000 mark and even reaching $24,000.

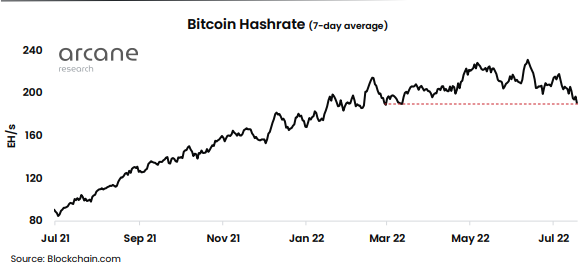

Meanwhile, the latest data from Archane Research shows that the Bitcoin hashrate has declined despite the price rally. The mining hashrate is an indicator that measures the total computational power connected to the Bitcoin network. Generally speaking, greater network performance results from larger metric values, and more robust network security results from more decentralized hashrate.

Mining Difficulty Sees Largest Negative Adjustment in A Year

Aside from helping to secure the entire Bitcoin Network, the hashrate also represents the competition between the various miners linked to the chain. Therefore, mining difficulty has a direct relationship with the hash rate. This is due to the Bitcoin network’s requirement to maintain a steady pace of block discovery.

Bitcoin Hashrate

Bitcoin Hashrate

Accordingly, the decline in Bitcoin hashrate has caused a corresponding drop in the mining difficulty. The chart above shows that the 7-day moving average of the hashrate has fallen to levels last seen in March 2022. Over the past month, the value has fallen by more than 26%, from 292.02 EH/s in June to its current 189.84 EH/s

Incidentally, Bitcoin’s hashrate recorded its all-time high value amidst the current crypto winter. Unlike in 2021, when it signaled the continuation of a bull run.

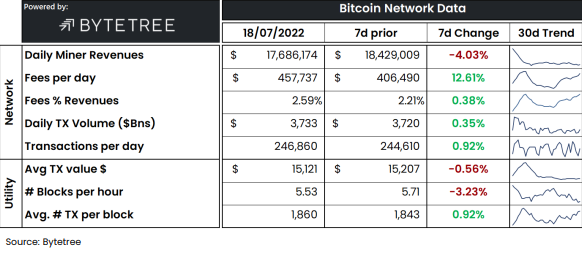

Bitcoin Network Data

Bitcoin Network Data

As seen above, the block rate has decreased to just 5.53 per hour, much less than the network’s requirement of 6 per hour. As a result, the difficulty is anticipated to drop by roughly 6% in the upcoming adjustment. Consequently, mining difficulty will have its most considerable negative adjustment in over a year, the biggest since China’s crackdown on mining.

Correlation Between BTC Price and Hashrate

Correlation Between BTC Price and Hashrate

Correlation Between BTC Price and Hashrate

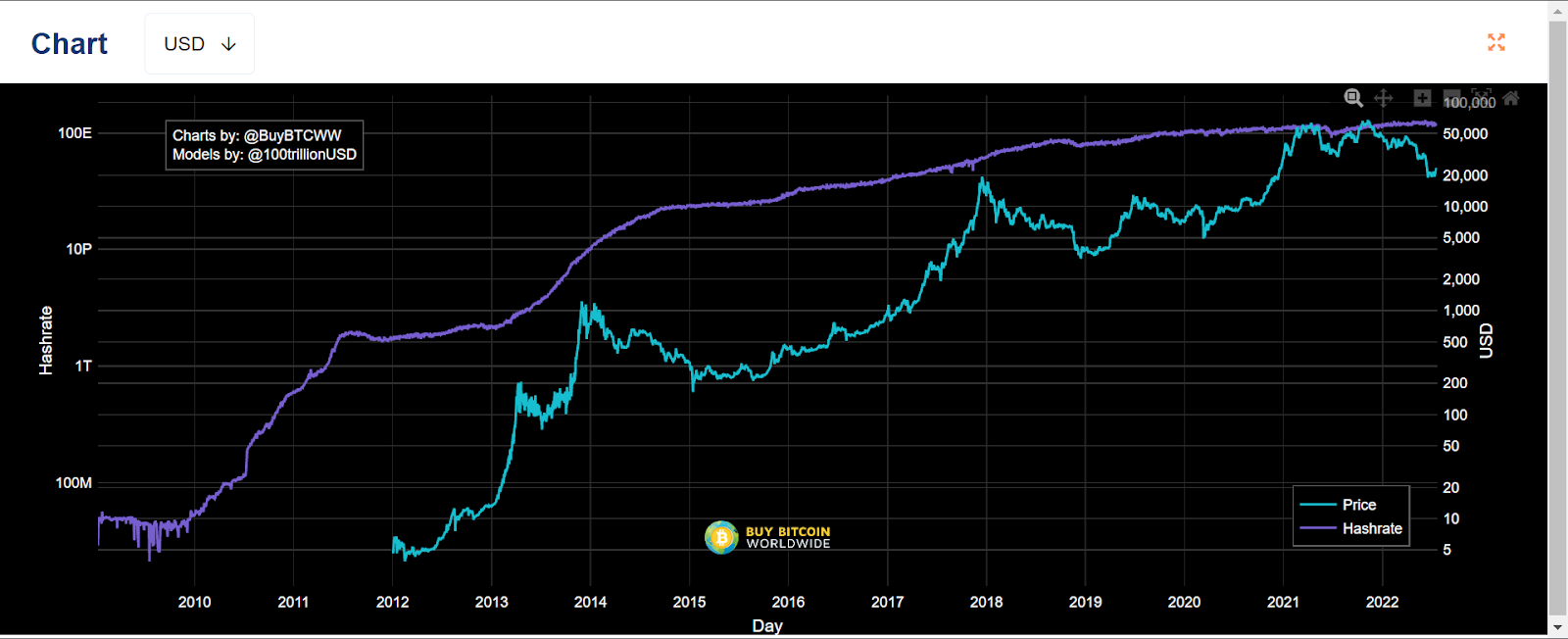

Contrary to common assumption, Bitcoin’s hashrate does not significantly affect the digital asset price. The chart above clearly supports this notion. While BTC’s price has increased and decreased, the mining hash rate has continued its upward climb without significant change.

However, there is the belief that Bitcoin’s price affects the mining hashrate. When the Bitcoin’s price is high, more miners will join the network because inefficient miners may still make money thanks to higher margins. But if the price declines, the margin thins and fewer miners can remain profitable.

It remains to be seen if Bitcoin can sustain its upward price rally over the past few days. With June’s inflation data beating the expectation of analysts, many expect the Feds will continue its aggressive interest rate hike later this month. This may cause further declines for the digital asset.

BTC/USD daily chart.

BTC/USD daily chart.

Source: TradingView

Although Bitcoin has been up by over 10% in the past 7-days, it has been down by around 2% in the last 24 hours. The digital asset saw its price surge yesterday from $23,400 to $24,200 before seeing a significant sell-off and plummeting to $22,900.