Biden still opposes Nippon Steel deal’s bid for U.S. Steel

2024.09.27 16:56

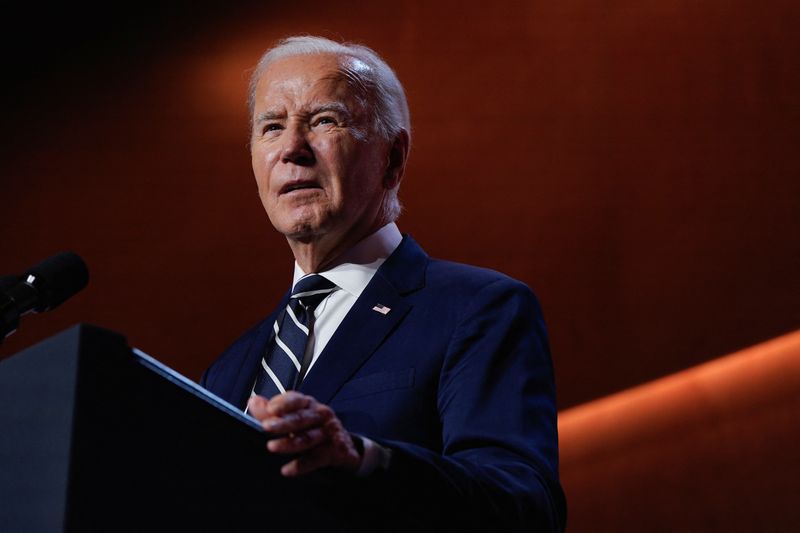

DOVER, Delaware (Reuters) -U.S. President Joe Biden said on Friday his opposition to Nippon Steel’s $14.9 billion bid for U.S. Steel hadn’t changed despite a decision by his administration to extend a national security review of the proposed tie-up.

“I haven’t changed my mind,” he told reporters, when asked if the extension indicated a change of heart.

Nippon Steel and U.S. Steel did not immediately respond to requests for comment.

The remarks threw cold water on hopes by deal supporters that the proposed tie-up could get a green light from the Committee on Foreign Investment in the United States, which reviews foreign investments for national security risks.

The proposed merger appeared set to be blocked when CFIUS alleged on Aug. 31 the transaction posed a risk to national security by threatening the steel supply chain for critical U.S. industries, as exclusively reported by Reuters.

But a move reported by Reuters earlier this month to delay a decision on the politically sensitive merger until after the Nov. 5 presidential election gave hope to proponents of the tie-up that it might yet win approval.

Biden, as well as his Vice President and Democratic presidential nominee Kamala Harris, and Republican challenger Donald Trump, have said U.S. Steel should remain American-owned.

The company is headquartered in Pennsylvania, a hotly contested swing state in the November presidential election.

The United Steelworkers Union vehemently opposes the deal and both parties have sought to woo union voters.

In response to CFIUS’s finding of an alleged national security risk, Nippon Steel wrote a 100-page response letter pledging to invest billions of dollars in U.S. Steel facilities that otherwise would have been idled, “indisputably” allowing it to “maintain and potentially increase domestic steelmaking capacity in the United States.”

The company also reaffirmed a promise not to transfer any U.S. Steel production capacity or jobs outside the U.S. and said would not interfere in any of U.S. Steel’s decisions on trade matters, including decisions to pursue trade measures under U.S. law against unfair trade practices.