Beware: Nvidia Gains Are Masking Broader Market Weakness

2024.06.04 03:15

Stocks traded modestly lower on the day, but some declines were masked by strength in Nvidia (NASDAQ:). That meant the market cap-weighted index was up just 11 bps, while the equal-weight was down about 50 bps. Meanwhile, the Nvidia-less fell by 30 bps.

Nvidia has indeed distorted the index and made the S&P 500 useless in some ways. When one stock can offset one index by a meaningful amount daily, that index does not accurately indicate the broader market. The S&P 500 was up almost 6 points, while Nvidia had contributed almost a 16-point gain. So, without Nvidia being up almost 5% on the day, the index would have been down around 10 points. Now, if this happened as a one-off, it is not a big deal, but this seems to happen nearly daily.

It is what it is, but if you aren’t considering this stuff and thinking about its potential impacts, you are missing a significant risk factor that needs to be considered. The data shows that many more stocks were down on the day versus up.

(BLOOMBERG)

US Dollar Drops on Weak Data

Meanwhile, the was sharply lower on the day, following the “weaker” than expected report. The ISM manufacturing report has been pretty weak for a long time; using it to gauge the economy’s health hasn’t worked well for some time.

Yesterday’s reading suggests the real GDP is growing around 1.7%, which is okay but certainly not recessionary. It probably suggests that the dollar has fallen too much, but the data for the rest of the week will be just as important.

Crude Oil Prices Eye $70

Still, rates fell sharply, primarily due to a decline in oil. fell following news that OPEC production cuts were being extended until year-end but that some voluntary cuts could be eased by October.

Oil prices fell by 4%, plunging to around $74, and are now facing a big test of support. A break of support at $74 would potentially result in the prices falling even lower to around $70. Suddenly, the technicals look less favorable than when oil was testing the $80 level at the start of last week.

Peso Drops

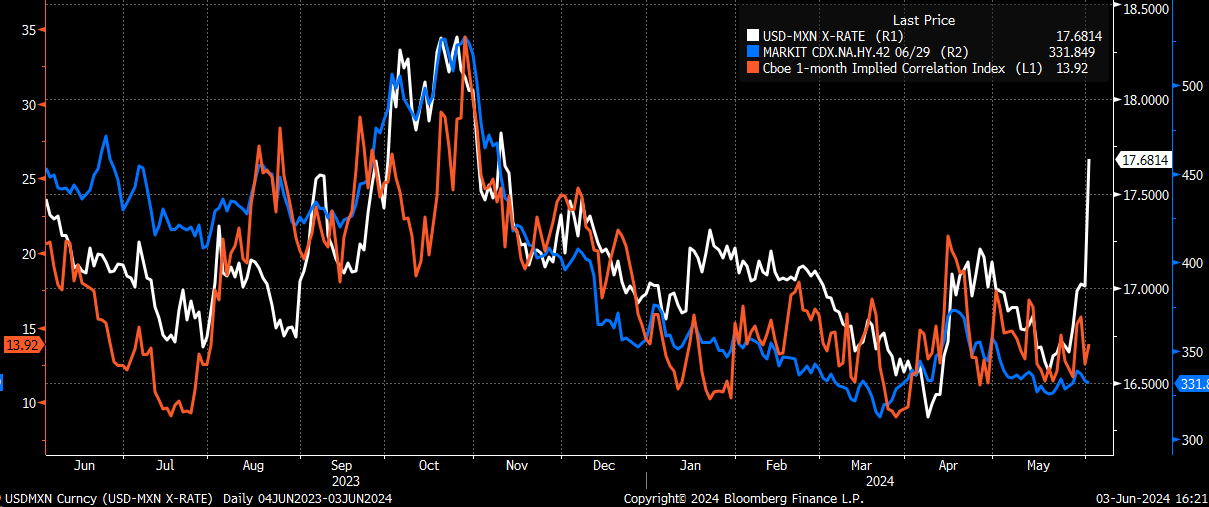

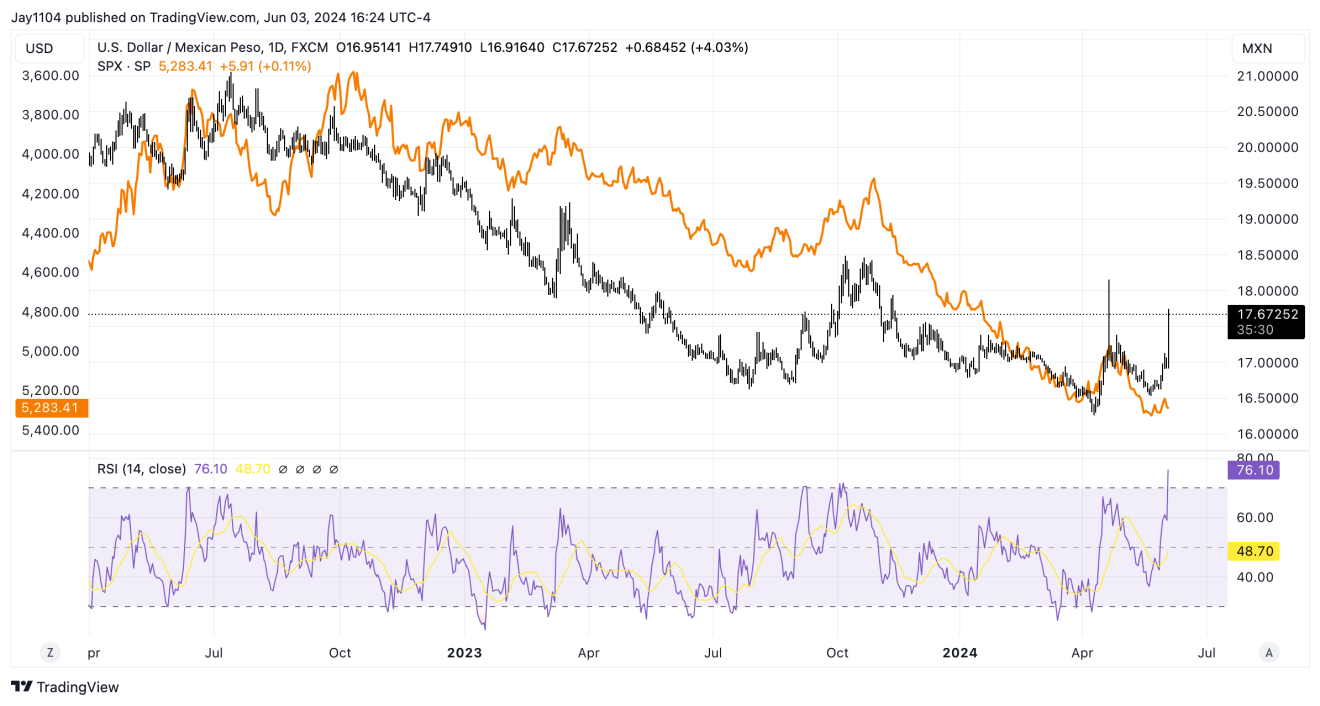

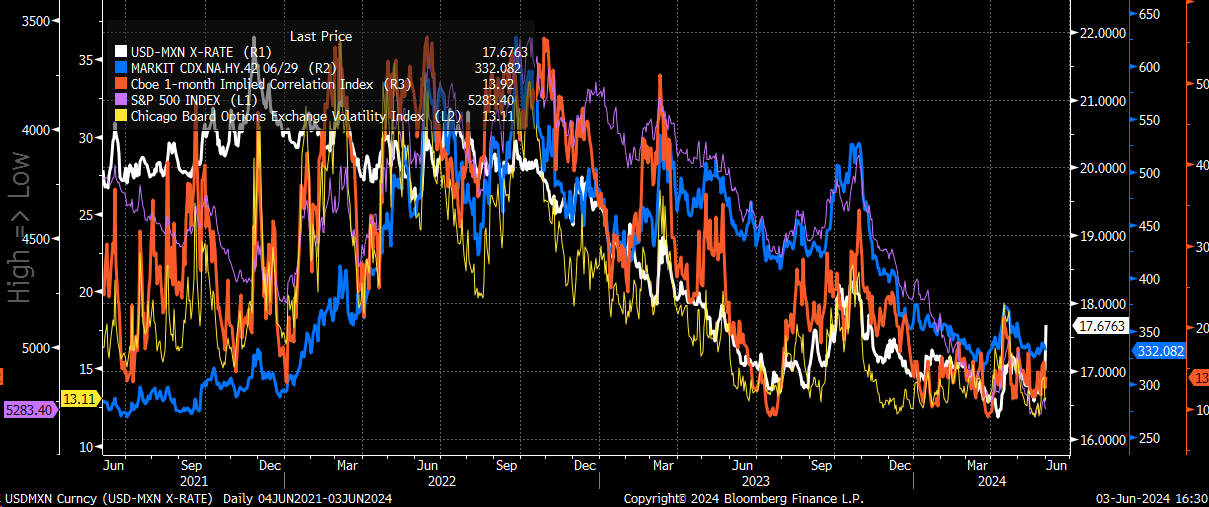

It was not a great day for the Mexican Peso, which saw the rise by more than 4% following the election. The Peso is more of a risk gauge than anything, and yesterday’s move higher will make me wonder what is to follow and if the CDX high-yield credit spreads and 1-month implied correlation index move higher in sympathy.

At least over time, the S&P 500 and the USD/MXN have had an inverse relationship, and if that relationship continues, then the aftershocks of yesterday’s peso move could be felt in the days to come.

Because in the end, it is all the same trade.

Original Post