Berkshire Hathaway: Will It Continue to Dominate in 2025?

2025.01.07 15:09

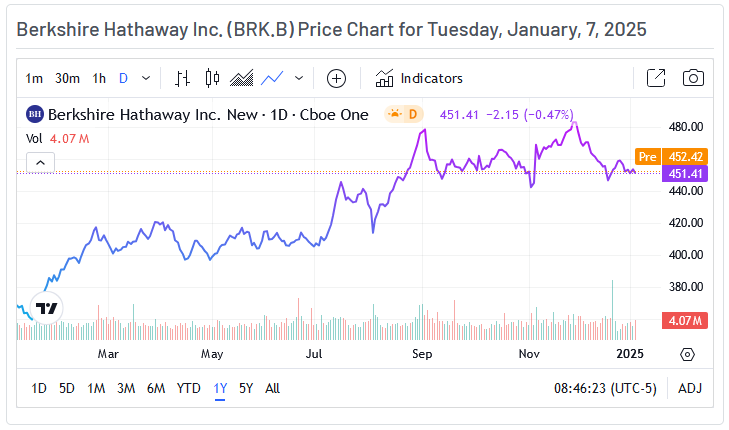

The renowned investment firm Berkshire Hathaway (NYSE:), led by the legendary Warren Buffett, outperformed the in 2024. Berkshire Hathaway stock experienced a remarkable 23% annual increase, culminating in a market capitalization exceeding $978 billion. Forecasting the future, especially in the unpredictable terrain of finance, is always challenging. However, we can create a clearer picture of Berkshire Hathaway’s potential outcomes in the coming year by analyzing different economic and company-specific factors. Can the remarkable growth that Berkshire Hathaway has experienced continue into 2025?

The Bull Case: A Recipe for Continued Success

Berkshire’s positive outlook depends on a combination of positive factors. Suppose the US economy experiences moderate growth in 2025, with inflation continuing its cooling trend and interest rates stabilizing or even declining. In that case, the stage is set for Berkshire to outperform the market. This scenario would likely translate into strong operating earnings growth across many of its subsidiaries. GEICO’s improved underwriting results, driven by higher average premiums and efficiency gains, point to continued strength in the insurance sector.

BNSF Railway’s strong performance, underpinned by increased unit volumes and productivity improvements, suggests its contribution to Berkshire’s bottom line will remain significant. Given the increasing demand for cleaner energy sources, Berkshire Hathaway Energy is poised to capitalize on favourable macroeconomic conditions and expand its operations. This positive outlook comes despite the company incurring costs related to wildfires. Additionally, strong results from Pilot Travel Centers, fully consolidated into Berkshire’s financials, would likely contribute positively to overall profitability.

In this scenario, investors’ potential shift towards value stocks could also benefit Berkshire. With its portfolio heavily concentrated in established companies possessing solid fundamentals and attractive valuations, a value stock rotation would likely boost the share price. Further buoying the company’s outlook is its substantial cash reserves, which exceed $320 billion. This provides considerable flexibility for acquisitions, strategic investments, or further share buybacks, all of which have the potential to boost shareholder value.

Berkshire Hathaway’s seasoned management team, led by Warren Buffett, has considerable experience navigating diverse economic cycles. While the transition of leadership from Buffett remains a concern for some, the succession plan is already underway, with the promotions of Greg Abel and Ajit Jain to Vice-Chairmen roles, providing some degree of investor confidence.

Navigating the Headwinds: Potential Challenges to Growth

However, several factors could temper Berkshire’s growth in 2025. A recessionary environment would undoubtedly impact several of Berkshire’s business segments, notably manufacturing, retail, and transportation, as consumer spending typically declines. Resurgent inflation could also significantly impact Berkshire’s performance, particularly if it necessitates prolonged high interest rates from the Federal Reserve.

This would likely translate into slower economic growth. Conversely, high interest rates may favor growth stocks over value stocks, creating a less favorable environment for Berkshire’s investment strategy. Moreover, Berkshire’s high valuation compared to historical averages makes it vulnerable to downturns. If earnings growth slows or investor sentiment shifts negatively, Berkshire’s stock price could experience a correction.

The ongoing litigation related to the 2020 wildfires and their potential financial impact on PacifiCorp, a Berkshire subsidiary, pose a significant financial risk. The uncertainty surrounding the ultimate resolution of these claims, which could be lengthy and expensive, introduces a degree of unpredictability to Berkshire’s financial outlook.

Warren Buffett’s eventual departure introduces uncertainty despite the succession plan. While the transition has been planned, and Abel and Jain are well-regarded, any shifts in strategy or investment focus could affect the company’s trajectory. Additionally, the fact that a significant portion of Berkshire’s portfolio is tied up in a few high-performing companies introduces a high degree of risk. A decline in any of these holdings could substantially impact overall portfolio performance.

A Balanced Outlook: The Potential for Parity

In 2025, Berkshire Hathaway’s performance may mirror that of the S&P 500 due to a mixed economic climate characterized by uncertain indicators and fluctuating investor sentiment.

Berkshire’s extensive portfolio diversification might provide a degree of stability, with gains in some sectors offsetting losses in others.

If the market efficiently incorporates all available information into asset prices, Berkshire might simply mirror the broader market’s movement.

This is the case when no clear signals are provided that point to a definitively bullish or bearish environment.

The Oracle of Omaha’s Next Move

Berkshire Hathaway’s future in 2025 is uncertain and depends on macroeconomic conditions, company performance, and investor sentiment. The company has many strengths, including substantial cash reserves, a diverse portfolio of assets, and a seasoned management team. However, it also faces potential challenges, such as economic downturns, inflation, and the eventual need for new leadership as Warren Buffett steps down.

Berkshire Hathaway’s proven ability to adapt and remain resilient suggests it can successfully navigate challenging economic conditions. Investors should, however, maintain a balanced outlook for 2025. While Berkshire Hathaway’s fundamental strengths offer great potential, external factors and uncertainty around succession planning pose significant risks.

Investors should maintain a long-term perspective and conduct thorough due diligence when considering an investment in Berkshire Hathaway. The company’s success is built on its commitment to long-term value creation, decentralized management, and financial prudence. This suggests the company will continue to navigate uncertainty and generate value despite short-term market fluctuations.

Original Post