Berkshire Hathaway Reports Increased Liquidity: Buffett Gearing Up for Dip Buying?

2023.11.06 05:47

- Warren Buffett’s Berkshire Hathaway reported robust earnings and increased liquidity in the third quarter.

- Despite the solid performance, Warren Buffett maintains a cautious outlook on market valuations, considering them overvalued.

- Berkshire Hathaway’s financial health reveals impressive strengths but prompts a closer look at the stock’s average valuations and potential for a 35% upside based on fair value analysis.

Segueing into discussions about market valuations and opportunities, the market still appears overvalued from the perspective of Warren Buffett.

Berkshire Hathaway (NYSE:) (NYSE:), America’s seventh-largest company by market capitalization, reported robust in the third quarter.

Notably, the company also reported a substantial $10 billion increase in liquidity during the quarter, pushing its total liquidity to a record $157 billion, in close proximity to Apple (NASDAQ:)’s ($162 billion) liquidity.

The company disclosed operating profits of $10.76 billion, marking a substantial 41% increase, or $7.4 per Class A share. This performance was attributed to the impact of high interest rates on liquidity and gains in its insurance businesses.

However, when factoring in losses on investments and derivatives, Berkshire reported unrealized losses of nearly $12.8 billion, equivalent to $8.8 per Class A share, significantly exceeding the previous year’s losses of $2.8 billion, primarily stemming from its stake in Apple, which experienced a 12% decline.

On a separate note, Berkshire Hathaway B third-quarter earnings per share of $10.22, which fell short of analysts’ estimates of $4.34.

The company’s revenue for the quarter reached $93.21 billion, exceeding estimates. Additionally, Berkshire Hathaway engaged in buybacks amounting to $1.1 billion during the third quarter, bringing the year-to-date total to approximately $7 billion.

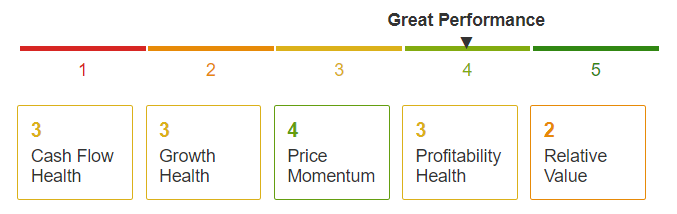

Evaluating Berkshire Hathaway’s Class A financial health through InvestingPro involves ranking the company across more than 100 factors in comparison to other firms within the same industry.

Source: InvestingPro

The company earned a score of 4 out of 5 by performing better than all of its competitors on profit margins, high earnings quality, higher liquidity than debt on the balance sheet, and free cash flow exceeding net income.

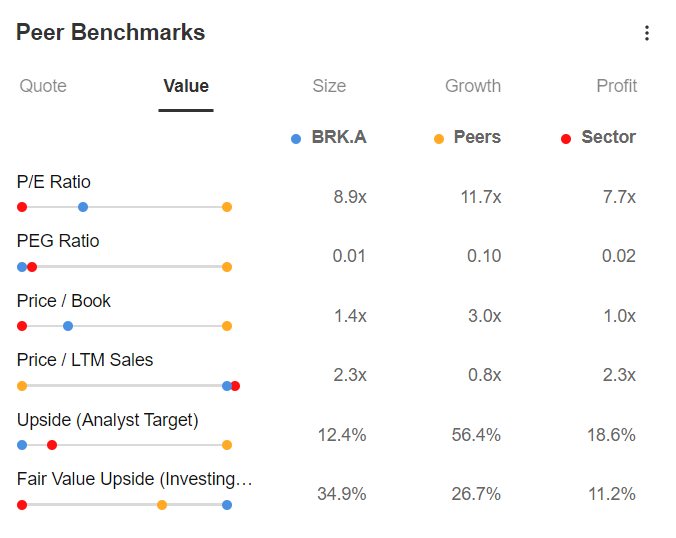

Delving deeper, however, we can see how the comparison with the market and competitors, sees the stock at average valuations:

Berkshire Peer Comparison

Berkshire Peer Comparison

Source: InvestingPro

In fact, if we look at the most popular indicators, we can see it is now worth more than 2 times its revenues, and more than 8 times its earnings.

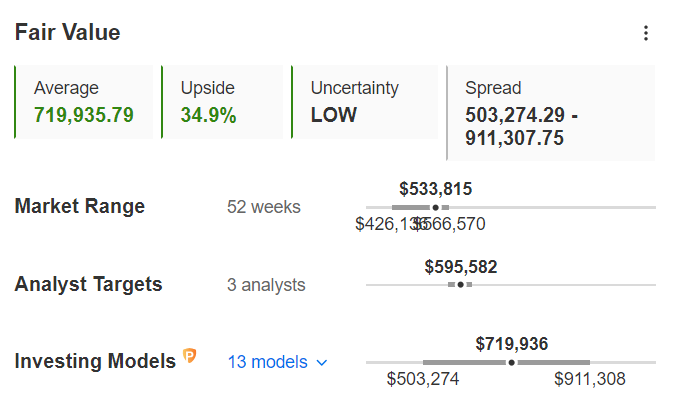

The Fair Value, which represents the target price determined through 13 different models, currently stands at $719.935. This indicates a potential upside of 35% with a low level of uncertainty associated.

Another critical aspect is the spread price, which guides us through the periodic fluctuations, falling within the range of $503,000 to $911,000.

This range is calculated as an average, factoring in the price performance over the past 52 weeks, the analysts’ target, and insights derived from the InvestingPro tool.

Source: InvestingPro

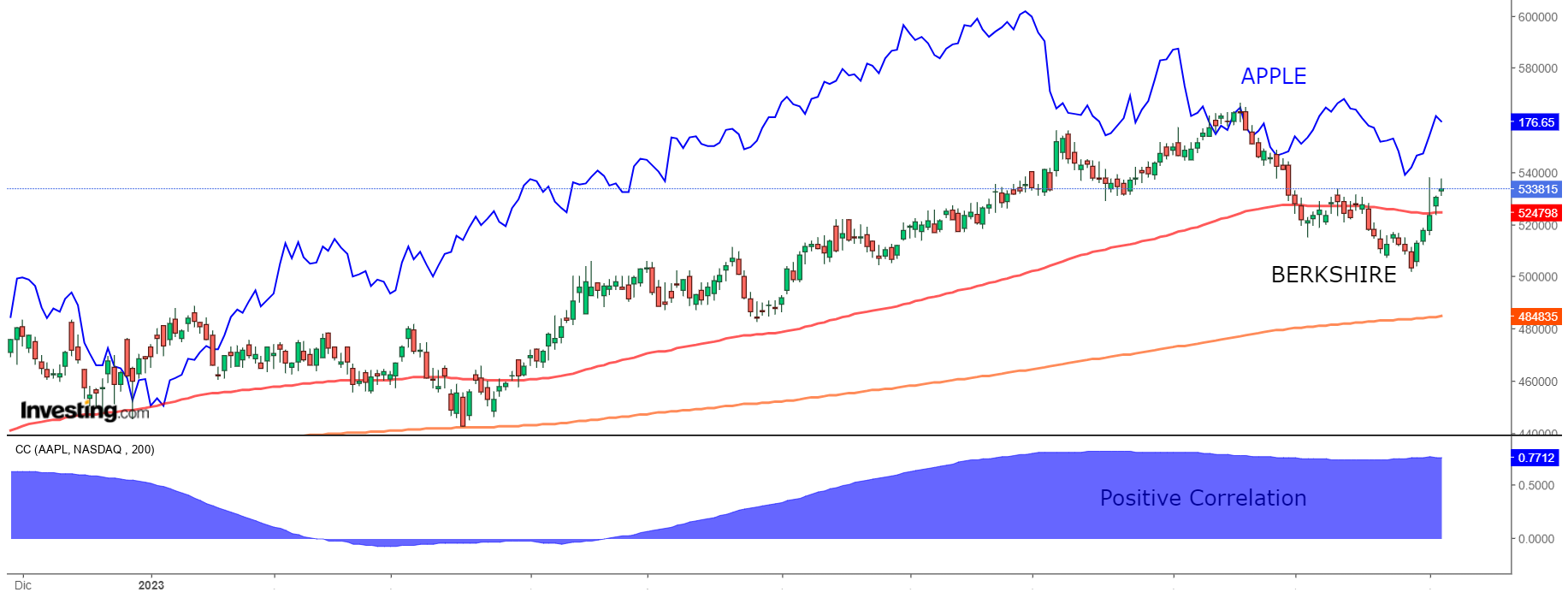

Its performance from the October 2022 bottom to date has been more than +30%, recording a new all-time high in September 2023

Berkshire Hathaway Class A Stock Price Chart

Berkshire Hathaway Class A Stock Price Chart

When comparing the performance of Berkshire Hathaway to Apple, it’s clear that they often move in tandem.

The correlation coefficient, used in statistics to measure the relationship between assets on a scale from 1 to -1, indicates a strong positive correlation when it’s close to 1, meaning that both assets tend to rise and fall together.

***

Find All the Info You Need on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.