Bear Market Is Vastly Bigger Than Any Counter-Trend Bounce

2022.09.27 12:57

[ad_1]

Here we are again. Is this the bullish base? Is this the bottom? Is the “epic squeeze” starting now? I dunno. As I’m typing this, an hour before the opening bell, the (/ES) is up over 50 points and is approaching a breakout point. It just goes to show how volatile things have been: the fact that an /ES being up over 50 is kind of a shoulder-shrug “meh” moment instead of a breakout.

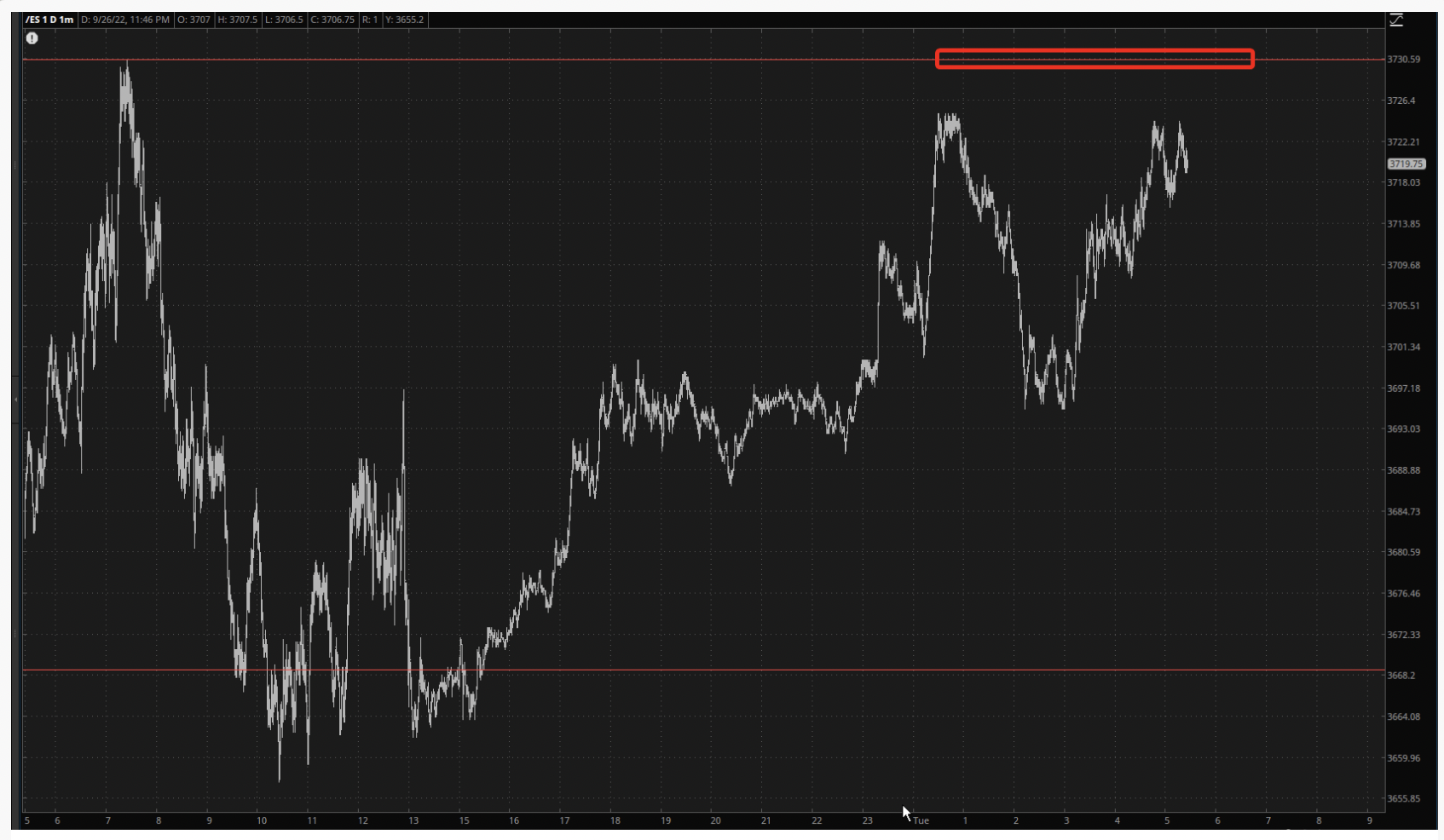

S&P 500 E-Mini Futures Daily Chart

S&P 500 E-Mini Futures Daily Chart

If we do get a break and, crucially, if that break sustains, then we’re on track to the 3800 target I specifically cited this weekend. It’s a sensible resolution point.

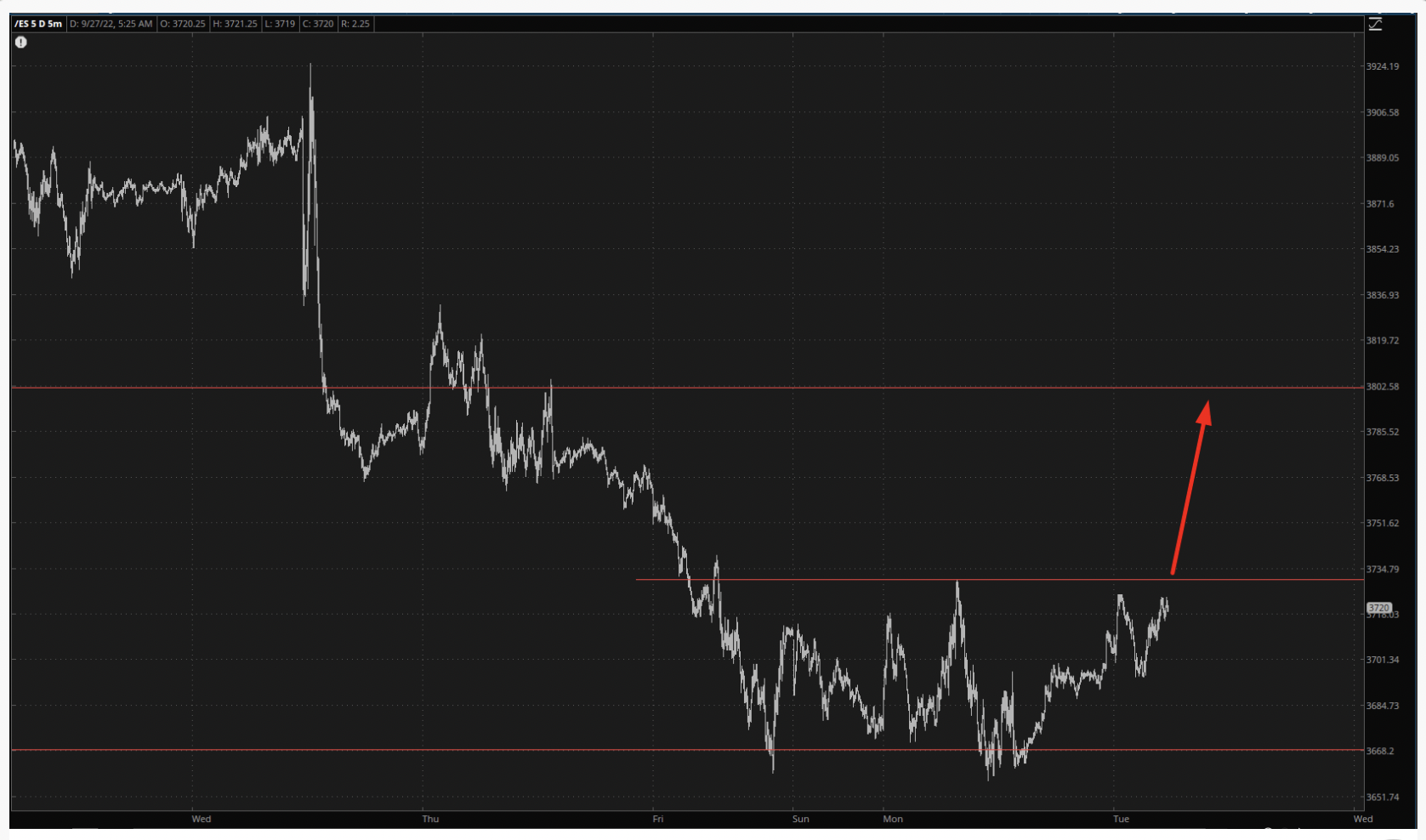

S&P 500 E-Mini Futures 5-Minute Chart

S&P 500 E-Mini Futures 5-Minute Chart

And obviously we’re going to rally at some point, but I’d just like to point out that recent history has its fair share of “OK, there’s the base, and now we rally!” formations.

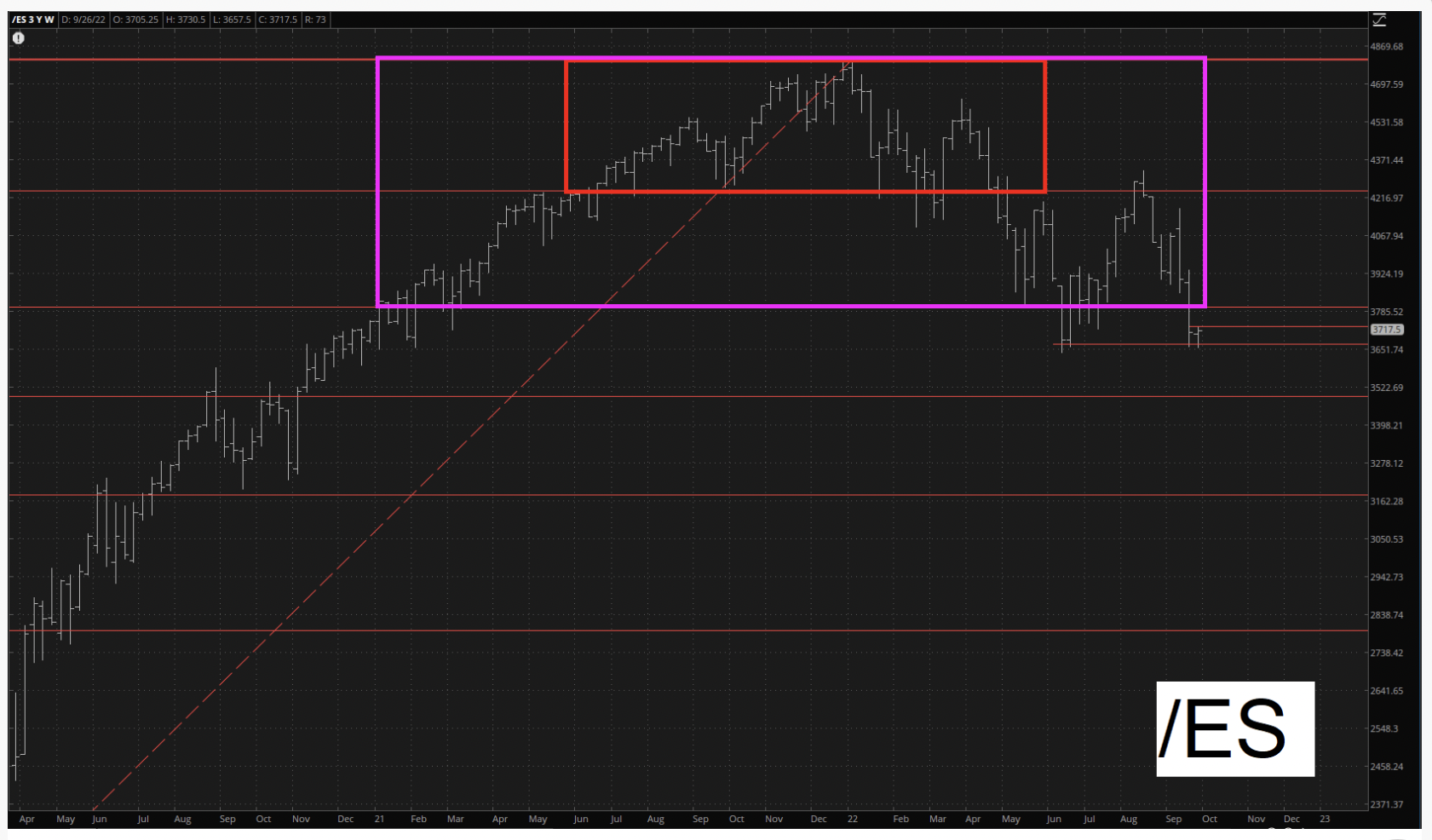

S&P 500 E-Mini Futures 1-Hour Chart

S&P 500 E-Mini Futures 1-Hour Chart

Indeed, over a period of days, or maybe even two-three weeks, there may be a rally. But the bear market is vastly bigger than any counter-trend bounce. The tops are enormous.

S&P 500 E-Mini Futures Weekly Chart

S&P 500 E-Mini Futures Weekly Chart

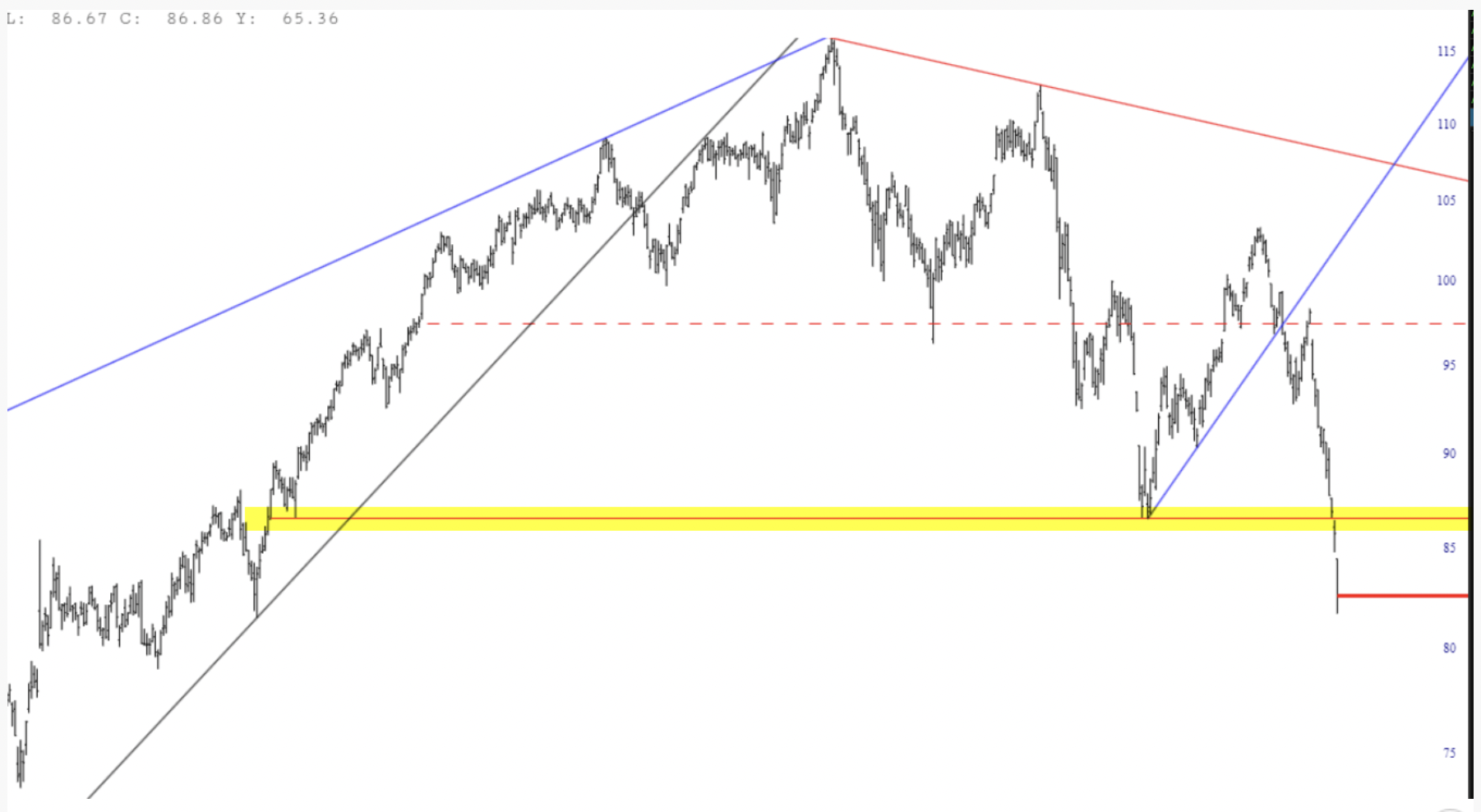

So if we get a big ol’ rally, what will be a good sign to get aggressive again on the bear side? I’d like to suggest the tired old chart I get weepily dragging out, the iShares U.S. Real Estate ETF (NYSE:). A rally to its massive failure point, tinted below, would make abundant sense.

I’m thinking I’ve been getting to greedy, so maybe I’ll lighten up some. On the whole, though, with 115 days left on these positions, no need to freak out over the prospect of a short-term bounce.

[ad_2]

Source link