Bank Of England Signals Markets Are Overestimating Future Rate Hikes

2022.11.03 16:04

[ad_1]

Budrigannews.com – The Bank of England faced a choice today between a ‘hawkish’ 50 basis-point rate hike and a ‘dovish’ 75bp – and in the event, it chose the . Unlike the and the , this is the first time the BoE has hiked by 75bp in this cycle.

But there are no good options for the Bank, and the central message from its latest communications is clear: investors are expecting too much tightening at future meetings. We think today’s 75bp move is likely to be a one-off.

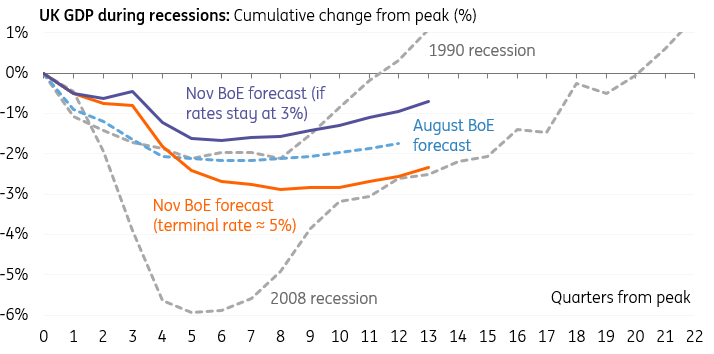

The BoE’s new projections show that, if policymakers were to follow investor expectations and hike rates to 5%, the size of the economy would shrink by roughly 3 percentage points over several quarters. Inflation would be at zero in 2025.

The Bank of England is forecasting a deep recession regardless of whether it hikes any further.

U.K. GDP During Recessions

Curiously the message is similar – though far less extreme – in the Bank’s projections based on interest rates staying flat at 3% from now on. Not only does that suggest markets are overdoing tightening expectations, but at a pinch you could also say this hints at potential rate cuts somewhere down the line.

Admittedly the Bank has been telling this story to a more limited extent for several months now in its forecasts. Governor Bailey also highlights that there’s an upward skew to its inflation forecasts, and policymakers are unsurprisingly nervous about putting too much weight on its models at a time of such uncertainty.

75bp Hike Likely To Be A One-Off

Nevertheless, Andrew Bailey was very forthright in his press conference that rates are unlikely to rise as far as markets expect (currently just shy of 5%). What’s more, the committee is very divided. One policymaker, Silvana Tenreyro, voted for just 25bp worth of tightening today.

The Bank may have stepped up the pace this month, but central banks globally are having to assess whether ongoing aggressive rate hikes can be justified at a time when housing and corporate borrowing markets are beginning to creak.

The choice the Bank faces at coming meetings is one of hiking aggressively to protect sterling, or moving more cautiously to allow mortgage rates to gradually fall. With around a third of UK mortgages fixed for just two years, we suspect the latter option will increasingly be seen as more palatable. The dovish messages littered throughout today’s statement and forecasts are a clear sign of that. We’re pencilling in a 50bp rate hike in December and we think the Bank rate is unlikely to rise above 4% next year.

[ad_2]

Source link