Bank Of England Delivers 50 Basis Point Hike, Sterling Steady

2022.09.22 14:33

[ad_1]

As expected, the Bank of England hiked by 0.50%, bringing the cash rate to 2.25%. There was an outside chance that the BoE would press the rate pedal to the floor and deliver a 0.75% increase, but in the end, members decided unanimously on a less aggressive hike. The central bank is grappling with 9.9% inflation and a falling , which means that more large hikes are likely coming. The British pound has edged higher and is trading at 1.1287.

With the rate decision out of the way, the markets will focus on UK releases, which are expected to be soft. Later today, , which has been in a deep freeze, is projected to tick up to -42, up from -44. The week wraps up with Manufacturing and Services PMIs on Friday. Manufacturing PMI is expected to rise to 47.5, up from 47.3, while Services PMI is projected to slow to 50.0, down from 50.9.

Fed Raises Rate By 0.75%

The Federal Reserve delivered a third straight hike of 0.75% on Wednesday, raising the benchmark rate to 3.25%. This was largely expected, although there was a possibility that the hawkish Fed might raise rates by a full point. The Fed’s was a hawkish 0.75% hike, which gave the a significant boost, as GBP/USD plunged 1.01% on Wednesday and closed below the 1.13 line.

The Fed sent a clear message that it plans to remain aggressive, as has proven much more persistent than anticipated. August inflation fell from 8.5% to 8.3%, but this was higher than the forecast of 8.1% and only reinforced the Fed’s hawkish stance. Fed Chair Powell left the door wide open for yet another 0.75% increase in November, and unless inflation shows a dramatic drop, December is likely to bring a hike of 0.50% or 0.75%. With the benchmark rate now above the neutral rate of 2.50%, additional hikes will likely lead to a recession, but this is a price the Fed is willing to pay in order to curb red-hot inflation.

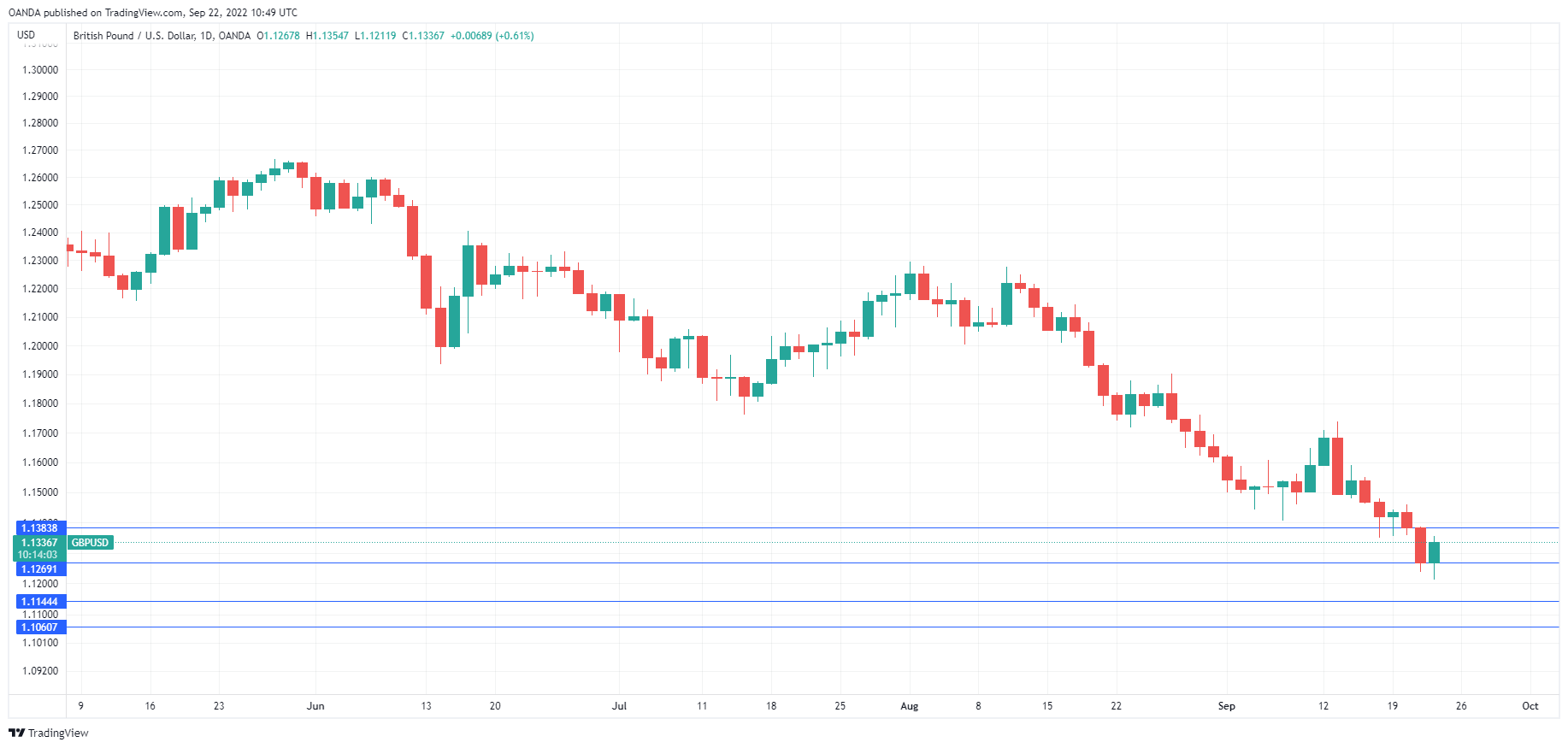

GBP/USD Technical

- GBP/USD is testing resistance at 1.1269. Next, there is resistance at 1.1384

- There is support at 1.1144 and 1.1061

[ad_2]

Source link