Australia’s Treasury Wine posts higher profit on U.S. sales, price hikes

2022.08.18 04:17

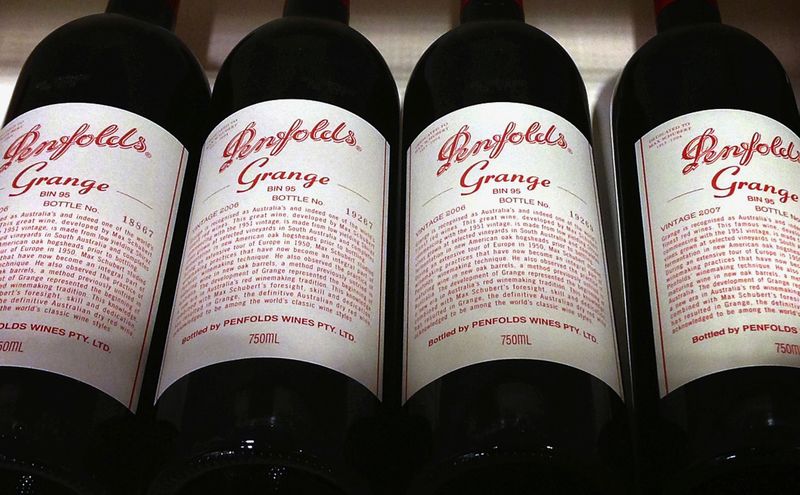

FILE PHOTO: Bottles of Penfolds Grange, a Treasury Wine Estates brand, on sale at a wine shop in Sydney, Australia, August 4, 2014. REUTERS/David Gray

(Reuters) – Treasury Wine Estates (OTC:TSRYF) Ltd posted a 5.3% rise in annual profit on Thursday, as strong U.S. sales and price hikes more than offset a hit from hefty Chinese tariffs on Australian wine.

The world’s biggest standalone winemaker has been re-directing supply of its prized Penfolds label wines to the United States, Europe and domestically since China imposed an anti-dumping duty on some Australian wines in late 2020.

The company, which also owns Wolf Blass and Wynns brands among others, said net sales revenue at its Americas unit grew 2.5%, benefiting from efforts to expand its presence in the market, including collaboration with rapper Snoop Dogg.

Demand for Penfolds label wines, the company’s most premium offering, stayed strong despite soaring inflation in the United States and Europe. While total net sales revenue for the segment fell 9.1%, sales in markets outside China more than doubled.

The winemaker said it was raising prices across divisions to offset the impact of higher input costs and that it expected to improve its margins further in 2023.

Treasury Wine’s global supply chain optimisation programme, which was rolled out in 2021, helped the firm save A$90 million ($62.47 million), more than an earlier estimate of A$75 million, and offset the impact from higher input costs.

“We expect TWE will deliver strong earnings growth in FY23, reflecting a COVID recovery in its higher margin channels,” analysts at Morgans said.

Treasury posted a profit attributable of A$263.2 million for the year ended June 30, higher than A$250.0 million reported a year ago but below an estimate of A$282 million from Morgan Stanley (NYSE:MS). Overall sales revenue fell 3.6%.

Shares of Treasury Wine fell about 1.5% in early trading, while the broader marker was down 0.5%.

The company said its long-term financial objective was still to deliver sustainable top-line growth, high single-digit average earnings growth, and a group operating earnings margin of more than 25%.

($1 = 1.4407 Australian dollars)