Australian Dollar Steadies, Retail Sales Dip

2023.09.28 05:29

- Australia’s retail sales decelerate to 0.2%

The is in positive territory on Thursday after three straight daily losses in which AUD/USD lost over 1% and hit an 11-month low. In the European session, AUD/USD is trading at 0.6367, up 0.23%.

Australia Retail Sales Rise Slightly

Australian consumer spending, a key driver of economic growth, has been showing cracks. Consumers have been squeezed by high borrowing costs and elevated inflation. These difficulties were reflected in today’s weak retail sales report for August, which showed a gain of 0.2% m/m. This was down from 0.5% m/m in July and missed the consensus estimate of 0.3% m/m. The reading would have been even weaker if not for the FIFA Women’s World Cup, which was held in Australia and New Zealand and boosted sales of merchandise and eating establishments.

For the Reserve Bank of Australia, the soft retail sales report adds support for a fourth straight pause. The RBA meets again in October and a key question is whether interest rates have peaked at the current benchmark rate of 4.10%. The RBA’s new governor, Michelle Bullock, has not made any splashy moves, instead opting to stick to the script of Philip Lowe, her predecessor. Bullock has said that upcoming rate decisions will be based on key data and has warned that rate hikes remain on the table.

Bullock’s hawkish stance is understandable, as inflation, which rose in August to 5.2%, remains way above the Bank’s 2% target. Bullock does not want to lose credibility by saying rates have peaked and then having to raise rates if inflation continues to move higher. The markets are viewing the uptick in inflation as a temporary blip and expect the overall downward trend to continue, and have priced in a rate cut for May 2024.

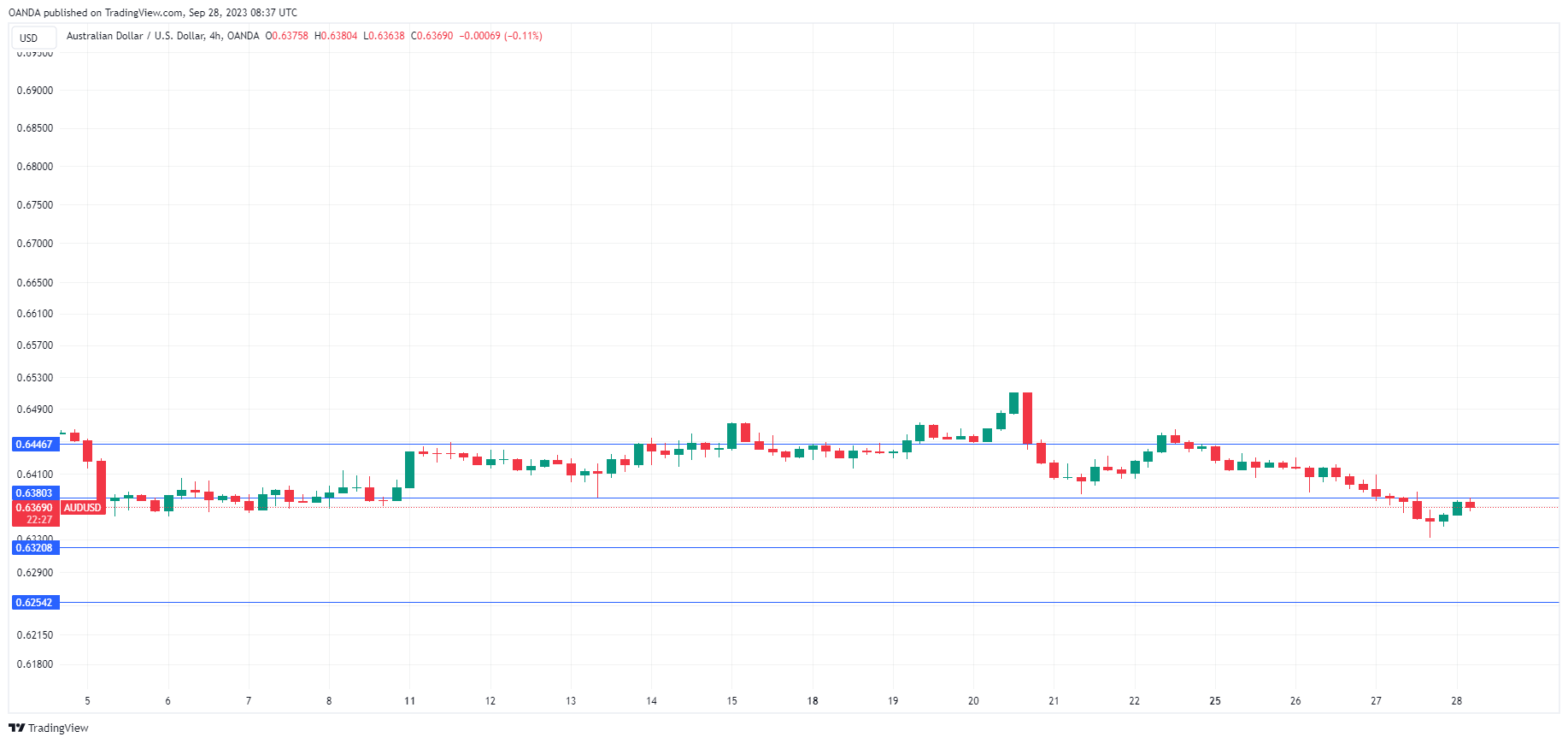

AUD/USD Technical

- AUD/USD is testing support at 0.6380. The next support line is 0.6320

- There is resistance at 0.6446 and 0.6506

Original Post