Australian Dollar Lower on Evergrande Bankruptcy

2023.08.18 09:20

- The Australian dollar’s slide continues

- Evergrande bankruptcy raises contagion fears

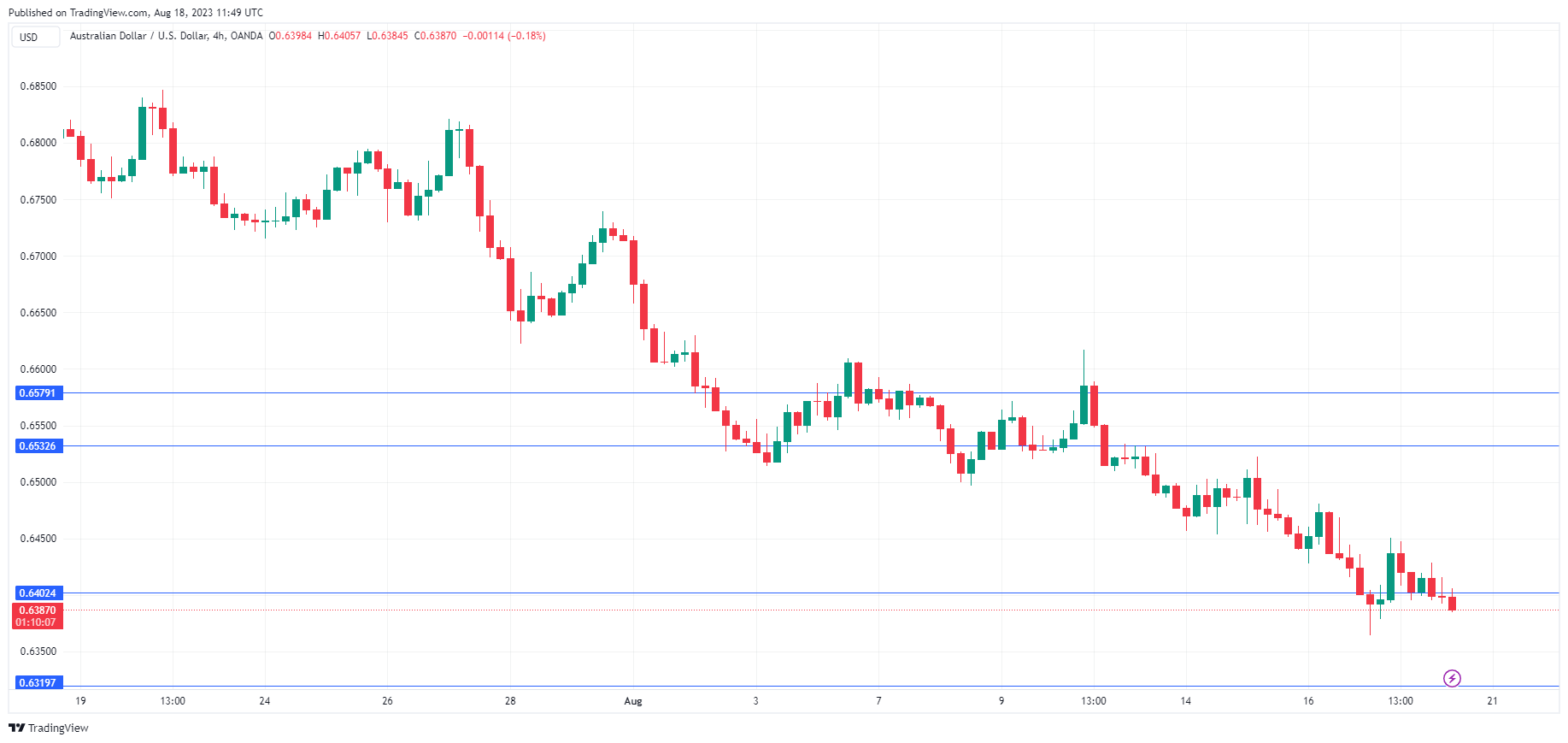

It has been all red for the Australian dollar, as has closed lower for eight straight days and declined 230 basis points during that time. The downswing has continued on Friday, as AUD/USD is trading at 0.6390 in the European session, down 0.20%. There are no Australian or US releases today, so I expect a calm day for AUD/USD.

Evergrande collapse raises contagion fears

Chinese economic releases have looked weak in recent weeks, with exports and imports in decline, a slump in domestic demand, and soft services and manufacturing data. The news from Evergrande, one of the country’s largest property developers, is one more headache that the Chinese economy could do without.

Evergrande filed for bankruptcy in New York on Thursday. The company defaulted on its massive debt in 2021, which triggered a massive property crisis in China and damaged the country’s financial system. The bankruptcy has raised fears that China’s property sector problems could spread to the rest of the economy, which is experiencing deflation and is suffering from weak growth.

There are growing concerns about the stability of the Chinese economy and the Evergrande bankruptcy has raised contagion fears, similar to when the company defaulted on its debt. Australia is particularly sensitive to economic developments in China, which is Australia’s largest trading partner. A slowdown in China has meant less demand for Australian exports, and that has contributed to the Australian dollar’s sharp slide, with the currency plunging a massive 4.93% in August.

In the US, there was unexpected good news from the manufacturing sector on Thursday. Manufacturing has been in the doldrums worldwide, as high inflation and weak demand have taken a heavy toll. The US is no exception, but Philly Fed Manufacturing sparkled in August with a reading of +12, up sharply from -13.5 in July and blowing past the consensus estimate of -10 points.

AUD/USD Technical

- AUD/USD is testing support at 0.6402. This is followed by support at 0.6319

- 0.6449 and 0.6532 are the next resistance lines

Original Post