Australian Dollar Edges Up Ahead of Inflation Report

2023.08.29 08:19

- US releases consumer confidence and job openings later on Tuesday

- Australia releases CPI on Wednesday

The Australian dollar is in positive territory on Tuesday. In the European session, is trading at 0.6437, up 0.12% on the day.

China’s woes raising concerns in Australia

China’s economic slowdown is bad news for the Australian economy, which counts China as its biggest export market. China’s imports have been falling and as a result, commodity prices have dropped, hurting Australia’s exports of iron ore and gold to China.

China continues to record weak economic numbers and this will likely be reflected in lower GDP releases, although economic growth is above 5%. The Australian dollar is sensitive to China’s economic strength and has declined by around 3% in the third quarter.

The Reserve Bank of Australia meets on September 5th and is widely expected to hold rates at 4.10% for a second straight month. There are clear signs of the economy cooling, including inflation and wage growth easing and a slight rise in unemployment. The RBA would like to extend the pause in rate hikes, with an eye on lowering rates sometime in 2024.

All eyes will be on Australia’s July inflation report which will be released on Wednesday. Inflation has been falling, albeit slowly. In June, inflation fell from 5.5% to 5.4% and the consensus estimate for July is 5.2%. If inflation drops to 5.2% or lower, it should cement a RBA pause in September. A higher rate than 5.2% won’t necessarily mean a rate hike, but it would likely lower the odds of a pause, which are currently around 90%.

In the US, it is a busy Tuesday with consumer confidence and employment releases. The Conference Board Consumer Confidence index has been on the rise and soared to 117.0 in July, up from 110.1 in June. The estimate for August is 116.0 points. JOLTS Job Openings is projected to decelerate for a second straight month in July, from 9.58 million to 9.46 million.

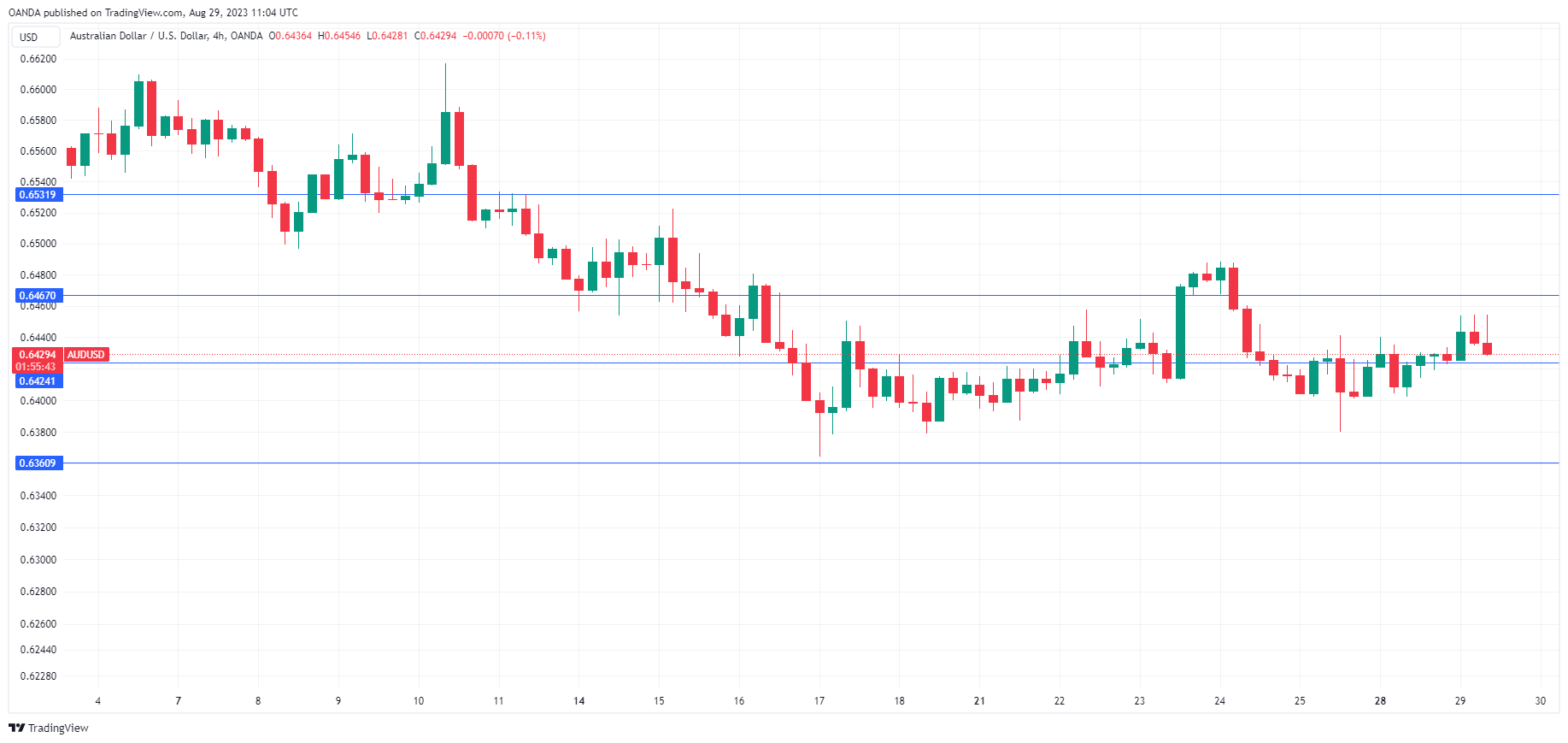

AUD/USD Technical

- AUD/USD tested support at 0.6424 earlier. Below, there is support at 0.6360

- There is resistance at 0.6470 and 0.6531

Original Post